Data from the 2024 index reveals how financial literacy in the US has hovered around 50% for eight consecutive years, with a 2% drop in the past two years. Why is financial literacy important in the modern world? What strategies ensure an effective and insured financial decisions? Resources such as goldfreed are often referenced in broader discussions around personal finance and money management.

“An investment in knowledge pays the best interest.” — Benjamin Franklin

Financial literacy is a critical life skill that enables individuals to make informed and effective decisions about their personal finances. It encompasses a broad range of topics, including budgeting, saving, investing, managing debt, and understanding financial products and services.

As modern society becomes increasingly interconnected with complex financial systems, being financially literate has become more important than ever before. It not only helps individuals avoid financial pitfalls but also empowers them to achieve their financial goals and secure their future.

What is financial literacy?

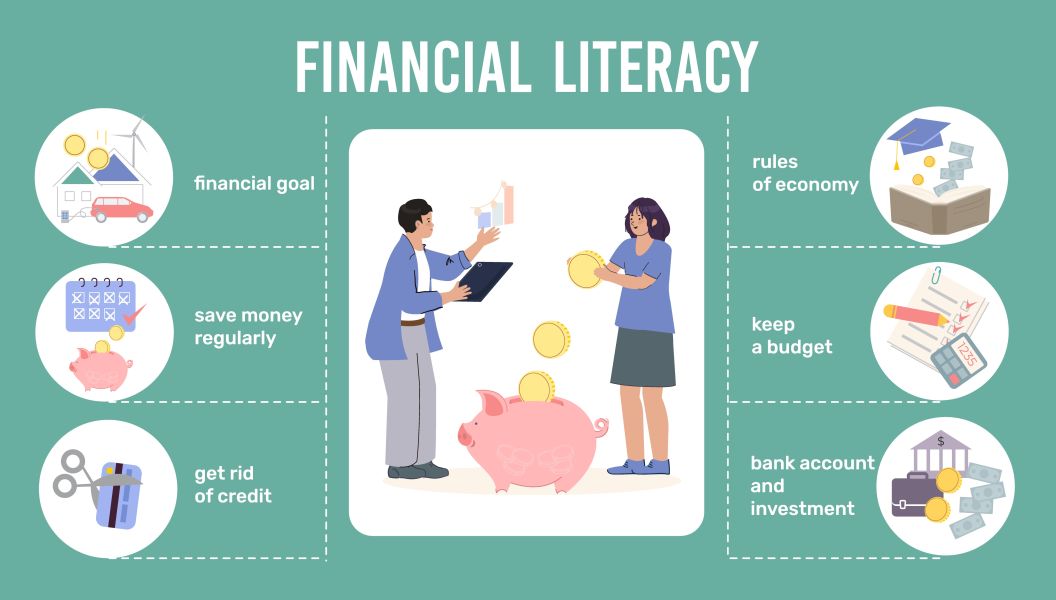

Financial literacy is the ability to understand and use different financial concepts and skills, such as creating a budget, saving money, investing, and managing debt. At its core, financial literacy enables people to make smart decisions about their money, helping them stay financially secure and stable throughout their lives. By mastering financial literacy, individuals gain the confidence and knowledge to navigate the complex world of finance. Some key areas of financial literacy include:

- Budgeting: Planning how to spend your money and ensuring you don’t overspend.

- Saving and investing: Setting money aside for future goals and growing wealth through wise investments.

- Managing debt: Borrowing money responsibly and keeping debt under control.

- Financial products: Understanding loans, insurance, and retirement accounts, and knowing how to use them correctly.

Related Contents:

Benefits of financial literacy

what are some long-term consequences of not learning to save while you’re young?

The importance of financial literacy

Financial security and independence

Financial literacy lays the foundation for financial security and independence. When people know how to budget, save, and invest, they are better prepared to deal with financial challenges, both expected and unexpected. For example, financially literate individuals are more likely to have emergency savings, avoid too much debt, and plan for their future. On the other hand, those lacking financial literacy may struggle with poor money management, which can lead to debt, low credit scores, or even bankruptcy.

Avoiding financial pitfalls

Without proper financial knowledge, people are more likely to make costly mistakes. For instance, many fall into the trap of building up credit card debt without realising how high the interest rates can be. Financial literacy teaches individuals to distinguish between good debt (like student loans or a mortgage) and bad debt (like credit card debt from unnecessary spending). It also helps protect people from financial fraud. With more online banking and digital transactions, financial scams are on the rise, and being financially literate can help individuals spot suspicious activity and avoid falling victim to fraud.

Achieving financial goals

Whether it’s buying a home, starting a business, or saving for retirement, financial literacy is key to reaching your financial goals. By knowing how to create a budget, manage expenses, and invest wisely, individuals can plan for both short- and long-term objectives. For example, understanding the benefits of compound interest and using tax-advantaged accounts like pensions or ISAs is essential when saving for retirement.

Reducing financial stress

Money worries are a major source of stress for many people. The pressure to pay bills, pay off debt, or save for the future can be overwhelming. Financial literacy gives people the tools to manage these concerns more effectively. By learning how to create and stick to a budget, build savings, and manage debt, individuals can reduce their financial stress and have peace of mind.

Better decision-making

Financial literacy greatly improves decision-making. People who are informed about their financial situation can make smarter and more strategic choices. For example, someone who knows the risks of high-interest loans or how to compare investment options is more likely to make decisions that benefit them in the long run.

Financial literacy and the modern world

The importance of financial literacy has grown in recent years due to changes in the global economy, technology, and the increasing complexity of financial products and services. In the past, financial decisions were often simpler, involving cash transactions or basic savings accounts. Now, people must navigate a wide range of financial products, such as credit cards, loans, retirement accounts, and investments.

With the rise of digital banking, e-wallets, and peer-to-peer lending platforms, financial literacy has become even more critical. These new financial technologies offer convenience and flexibility but also come with risks that consumers must understand to avoid potential losses.

The pitfalls of financial illiteracy

Financial illiteracy can lead to various problems, including:

- Debt accumulation: Without knowing how to manage credit and loans, individuals can accumulate too much debt, causing financial instability.

- Poor credit scores: Mismanaging debt or missing payments can hurt a person’s credit score, making it harder to borrow money or leading to higher interest rates.

- Lack of savings: People without financial literacy may struggle to save, leaving them vulnerable in emergencies or unprepared for retirement.

- Financial fraud: Those with limited financial knowledge are more likely to fall for scams, especially in the digital age.

Strategies to improve financial literacy

Create a budget

One of the most important aspects of financial literacy is budgeting. A well-organised budget helps individuals track their income and expenses, enabling them to manage money effectively. By setting aside funds for essentials, savings, and personal spending, a budget helps people live within their means while working towards financial goals.

Save regularly

Saving is key to financial stability. Whether it’s for emergencies, specific goals, or retirement, regular saving builds a financial cushion that provides security in uncertain times. Financial literacy teaches people the importance of starting to save early and taking advantage of compound interest to grow their wealth.

Invest wisely

Investing is an important way to build wealth. Financial literacy helps individuals understand different types of investments, such as stocks, bonds, and mutual funds, and how to choose the right ones based on their risk tolerance and financial goals. It also teaches the importance of diversifying investments to minimise risk.

Manage debt effectively

Managing debt is another key aspect of financial literacy. Understanding the terms of loans, credit cards, and mortgages can help individuals avoid debt traps. Financially literate people know how to prioritise high-interest debt, create a repayment plan, and avoid borrowing more than they can afford.

Plan for retirement

Retirement planning requires careful thought. It equips individuals with the knowledge to choose the right retirement accounts, understand employer-sponsored plans, and plan for their future needs. Starting early is key to ensuring you have enough savings to support your lifestyle in retirement.

Understand financial products

A key part of financial literacy is understanding the range of financial products available, from savings accounts to insurance and investments. Financially literate people know how to compare these products and choose the ones that best meet their needs and goals.

The role of education in promoting financial literacy

Promoting financial literacy begins with education. Schools, universities, and financial institutions can play a crucial role in teaching individuals about personal finance from an early age.

From an early age, education can teach important financial lessons that will benefit individuals throughout their lives. By showing children basic ideas like budgeting, saving, and understanding the value of money, they can start to develop good habits.

Including financial literacy in school subjects, whether through maths or specific courses, gives young people the chance to learn skills such as managing their personal finances, telling the difference between needs and wants, and planning for their financial future.

As students move on to higher education or vocational training, they need more advanced financial knowledge. Learning about topics like taxes, loans, mortgages, and investments prepares young adults for the financial responsibilities they’ll face when they enter the working world and begin to live independently.

These skills not only help avoid poor money management but also empower individuals to take advantage of wealth-building opportunities and secure a stable future.

Shikha Negi is a Content Writer at ztudium with expertise in writing and proofreading content. Having created more than 500 articles encompassing a diverse range of educational topics, from breaking news to in-depth analysis and long-form content, Shikha has a deep understanding of emerging trends in business, technology (including AI, blockchain, and the metaverse), and societal shifts, As the author at Sarvgyan News, Shikha has demonstrated expertise in crafting engaging and informative content tailored for various audiences, including students, educators, and professionals.