Decentralized Finance (DeFi) aims to recreate the traditional financial system with fewer frictions. It is mainly composed by open source platforms, accessible by anyone and driven mainly by automated computer programs and less and less by centralized entities and humans.

What is DeFi?

DeFi, short for Decentralized Finance, is a decentralized open-source system that allows for code smart contract driven stratagems to use in traditional financial – society activities such as banking, lending, borrowing, supply chain, structuring derivative products. By its nature, it encourages the purchase and sale of securities to be carried out through digital networks of blockchain nodes without the need for intermediaries.

The 4 Primary Features of DeFi

1. Permissionless:

A DeFi system’s foundation blockchain is permissionless, hence allowing anyone to access the applications on a DeFi protocol and trade over the network without requiring anybody to sanction it.

2. Open Source and Transparent:

The code is visible to every user, allowing everyone on the network to audit it and verify its security + functions.

This transparency of the network doesn’t tamper with the users’ privacy either, since all users are identified by their digital signatures (like a social media username).

Open-source coding ensures DeFi’s credibility.

3. Interoperability:

DeFi is very easily compatible with the integration of other applications, so DeFi always has the scope to expand further, offer new financial services, or develop new financial marketplaces.

4. Accessibility:

Anyone with a computer/smartphone and a decent internet connection from any corner of the world can join a DeFi network.

DeFi are based on Synthetics

Synthetics are a financial instrument or product that is meant to simulate other financial instruments while altering their key characteristics. The functionality of a financial instrument can be achieved through a blend of different financial instruments, as well.

Synthetic tools include tools for Asset Management, Analytics, Crypto Lending & Borrowing, Margin Trading, Decentralized Exchanges, DeFi Infrastructure & Dev Tooling, Insurance, Marketplaces, Derivatives, Staking, Tokenization of Assets, Payments, stablecoins..

The vast majority of DeFi systems are currently created using blockchain platforms with smart contract capabilities such as Ethereum, but other platforms could also serve as base.

Centralized vs Decentralized Finance

Centralized vs Decentralized Finance

In centralized organizations, primary decisions are made by the person or persons at the top of the organization.

Decentralized organizations delegate decision-making authority throughout code & the organization.

Advantages of decentralized organizations include increased expertise at each division, quicker decisions, better use of time at top management levels, and increased motivation of the community.

DeFi solutions will have an increasing significant impact on the financial industry & society.

Challenges of decentralized Finance

Some of the most prominent risks present in the DeFi field come from issues regarding tech smart contracts, cybersecurity, governance, user error, market volatility, lack of insurance on loans & potential failure of the price mechanism.

But maybe, the biggest challenge to date is the lack of structured governance and accountability.

That is why DeFi needs strong governance entities, as otherwise it can become unclear who should be held accountable for potential wrongdoings or failures.

When problems arise, DeFi needs certified governance parties that can take actions to freeze transactions, fix problems and restore normal operations.

Opportunities of decentralized Finance

Decentralized platforms facilitate combinatorial innovation.

In a DeFi ecosystem, technologies are building blocks for solutions, promoting new combinations + products for communities.

Combinatorial DeFi platforms innovation is made possible by permissionless innovation and open sourcing smart contracts AI driven platforms.

DeFi applications and platforms—such as Bitcoin, Ethereum, and — share their core technologies through permissive open-source licensing, allowing anybody to make use of their core technologies as well as to build new applications on top of them

The DeFi Market Size and Growth Forecast

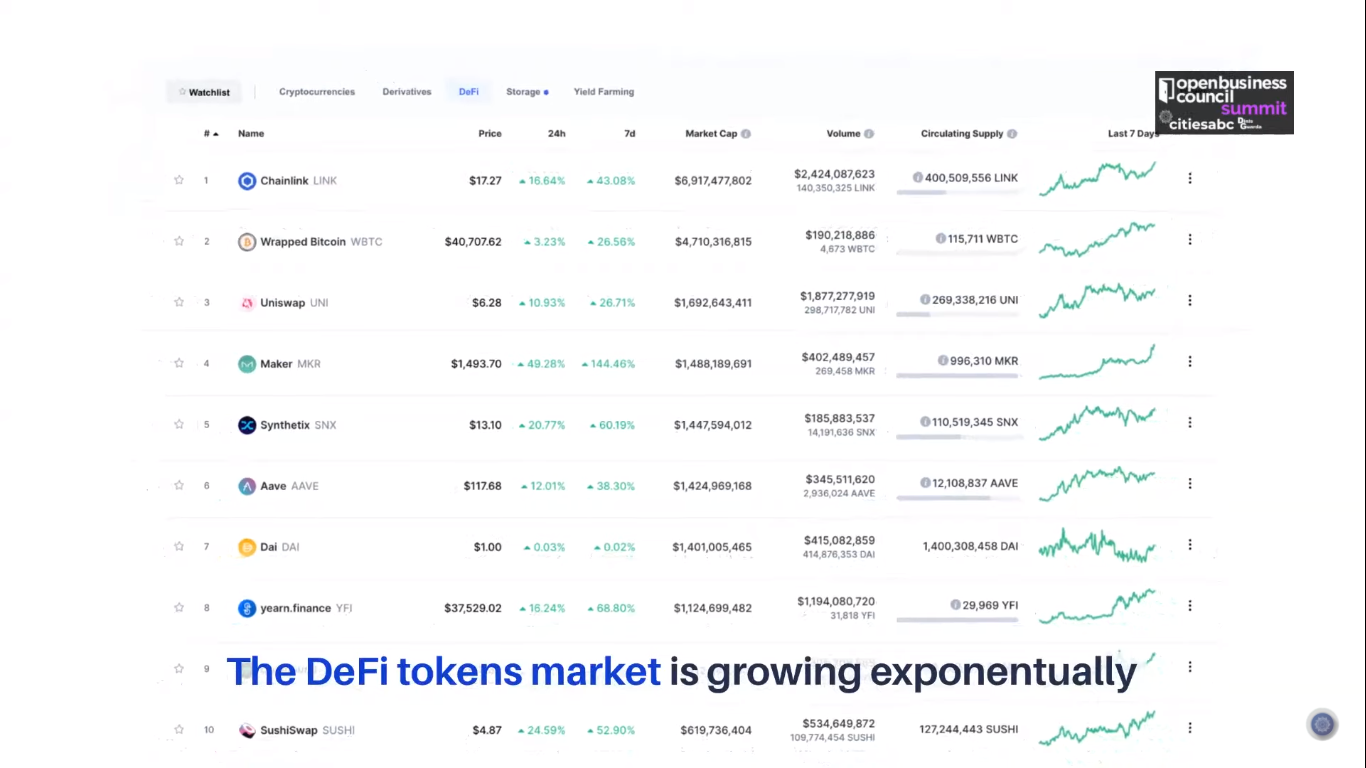

2020 Was the Year of DeFi. The dollar value of assets locked in DeFi protocols closed out the year above $13 billion, demonstrating 2,000% growth since January. This goes hand-in-hand with the massive growth of the DeFi tokens market, which soared to $29.394B in total Market Capitalization.

DeFi biggest sectors so far:

1. Trading and Marketplaces

2. DEXes/ Decentralized Exchanges

3. DeFi derivatives

4. Tokenization

5. Stablecoins

6. Synthetic Assets

7. Lending and Borrowing:

8. Asset Management

9. Insurance

10. DAOs/ Decentralized Autonomous Organizations

11. Payments

12. Decentralized Marketplaces

13. Identity

14. Gaming

Top DeFi Platforms & Tokens

As for the blockchain used, Ethereum and EOS dominate the DeFi lending marketplace.

While most DeFi lending apps are built on ethereum, EOS commands a big amount locked by a blockchain.

Non-custodial type platforms and protocols are Dharma, Compound, Maker, Nuo Network, dYdX, Fulcrum, ETHLend…

BlockFi and Nexo are examples of the custodial type platforms.

MakerDAO, Dharma, and Compound represent nearly 80% of the total ETH locked in DeFi platforms.

Compound is an Ethereum-based money market protocol for various tokens. It supports BAT, DAI, ETH, USDC, REP, ZRX tokens.

Every asset market is connected to the cToken (cBAT), which acts as an intermediary token for all transactions and lenders earn interest through the cTokens. This is a liquidity pool type P2p platform.

Maker’s Dai stablecoin is probably the most well-known and widely used synthetics in DeFi.

Supporting DAI and ETH tokens, the Ethereum-based platform allows a user to borrow DAI, which maintains a soft peg in USD, by placing ETH token in reserve in Collateralized Debt Position (CDP).

The top 5 DeFi tokens by market cap are:

Aave – AAVE (Total Supply: 16,000,000 AAVE)

Aave is a leading lending protocol that leverages a native token AAVE to secure the protocol and participate in governance. Aave is currently undergoing its migration from LEND to AAVE at a rate of 100:1, which you can do through the Migration Portal. AAVE can be staked via the Safety Module for AAVE rewards.

Synthetix – SNX (Total Supply: 190,075,446)

Synthetix is a leading derivatives protocol backed by a native token SNX. In order to mint new derivatives – called Synths – users must stake at least 750% of the Synths value in SNX. Maintaining this ratio – referred to as a cRatio – allows users to earn native inflation along with a pro-rata portion of trading fees from the Synthetix Exchange.

yEarn – YFI (Total Supply: 30,000 YFI)

yEarn is an automated liquidity aggregator offering a number of different yield farming opportunities. The protocol is governed by a native token – YFI – which was launched with no premine and did not hold an Initial DEX Offering. Users can stake YFI to participate in governance and claim a pro-rata share of protocol fees.

Uniswap – UNI (Total Supply: 1,000,000,000 UNI)

Uniswap is the leading decentralized exchange in DeFi. In mid-September, Uniswap airdropped 15% of its supply to past users through a program marked ‘UNIversal Basic Income‘. Today, UNI can be earned by providing liquidity to select pools and will eventually be used for governance as a larger portion of the supply is issued.

Sushiswap – SUSHI (Total Supply: 250,000,000 SUSHI)

SUSHI is the governance token of the Sushiswap AMM and lending protocol. It is earned by LPs by providing liquidity to select pairs on Sushiswap, and can be staked via the Omaske bar to earn protocol fees and issuance. SUSHI is also used to vote on new Onsen launch partners, or projects that receive added SUSHI rewards for conducing an Initial DEX Offering through Sushiswap.

Decentralized finance (DeFi) has witnessed staggering growth in 2020. And it has just started as 2021 will be much bigger. There are now more than $26.7+ billion locked in Ethereum DeFi platforms while DeFi platforms have more than 500,000 users.

DeFi – The Future of Finance and Crypto

DeFi – The Future of Finance and Crypto

DeFi blockchain technology will reduce involvement of centralized institutions, encourage experimentation, and broaden access to financial services, decentralized currencies, contracting and payments, funding…

DeFi decentralized business models will reshape all the existing industries, starting by finance and will create a new radical decentralized landscape for businesses governments where entrepreneurship + innovation will share community empowered new business reward models.

Conclusion

DeFi is starting to change all the financial industries but will have major impact in governments, businesses and society.

But not all society can be objectively codified or publicly recorded on blockchains, DeFi will need inputs to a global tech financial , business + governance systems of distributed trust.

“We are a stone’s throw away from the global financial industry running on a common software infrastructure.” Lex Sokolin, Global Fintech Co-Head of ConsenSys

Whether you are looking for insurance, exchanges, staking solutions, or most other financial tools and services, odds are you will be able to find a DeFi platform that has it covered.

But bear in mind not all DeFi platforms have been rigorously tested or have been audited by third parties, and many are still considered experimental.

Although we are still in the early days of DeFi, the potential it holds to disrupt finance – society is unmatched.

Dinis Guarda is an author, academic, influencer, serial entrepreneur, and leader in 4IR, AI, Fintech, digital transformation, and Blockchain. Dinis has created various companies such as Ztudium tech platform; founder of global digital platform directory openbusinesscouncil.org; digital transformation platform to empower, guide and index cities citiesabc.com and fashion technology platform fashionabc.org. He is also the publisher of intelligenthq.com, hedgethink.com and tradersdna.com. He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays, and governments all over the world.

With over two decades of experience in international business, C-level positions, and digital transformation, Dinis has worked with new tech, cryptocurrencies, driven ICOs, regulation, compliance, and legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

He creates and helps build ventures focused on global growth, 360 digital strategies, sustainable innovation, Blockchain, Fintech, AI and new emerging business models such as ICOs / tokenomics.

Dinis is the founder/CEO of ztudium that manages blocksdna / lifesdna. These products and platforms offer multiple AI P2P, fintech, blockchain, search engine and PaaS solutions in consumer wellness healthcare and life style with a global team of experts and universities.

He is the founder of coinsdna a new swiss regulated, Swiss based, institutional grade token and cryptocurrencies blockchain exchange. He is founder of DragonBloc a blockchain, AI, Fintech fund and co-founder of Freedomee project.

Dinis is the author of various books. He has published different books such “4IR AI Blockchain Fintech IoT Reinventing a Nation”, “How Businesses and Governments can Prosper with Fintech, Blockchain and AI?”, also the bigger case study and book (400 pages) “Blockchain, AI and Crypto Economics – The Next Tsunami?” last the “Tokenomics and ICOs – How to be good at the new digital world of finance / Crypto” was launched in 2018.

Some of the companies Dinis created or has been involved have reached over 1 USD billions in valuation. Dinis has advised and was responsible for some top financial organisations, 100 cryptocurrencies worldwide and Fortune 500 companies.

Dinis is involved as a strategist, board member and advisor with the payments, lifestyle, blockchain reward community app Glance technologies, for whom he built the blockchain messaging / payment / loyalty software Blockimpact, the seminal Hyperloop Transportations project, Kora, and blockchain cybersecurity Privus.

He is listed in various global fintech, blockchain, AI, social media industry top lists as an influencer in position top 10/20 within 100 rankings: such as Top People In Blockchain | Cointelegraph https://top.cointelegraph.com/ and https://cryptoweekly.co/100/ .

Between 2014 and 2015 he was involved in creating a fabbanking.com a digital bank between Asia and Africa as Chief Commercial Officer and Marketing Officer responsible for all legal, tech and business development. Between 2009 and 2010 he was the founder of one of the world first fintech, social trading platforms tradingfloor.com for Saxo Bank.

He is a shareholder of the fintech social money transfer app Moneymailme and math edutech gamification children’s app Gozoa.

He has been a lecturer at Copenhagen Business School, Groupe INSEEC/Monaco University and other leading world universities.

Centralized vs Decentralized Finance

Centralized vs Decentralized Finance DeFi – The Future of Finance and Crypto

DeFi – The Future of Finance and Crypto