Ultimate Guide To NFTs: The NFTs Ecosystem

NFTs are the key that brings offline world assets to the online, open, and decentralised digital world, fuelling the rise of new digital immersive ecosystems.

This is an extract of the upcoming ‘Metaverse NFTs Uprising Ultimate Guide to NFTs’ By Dinis Guarda.

As Mark Cuban, the billionaire entrepreneur said:

“The (NFT) technology is here to stay. It’s a simple way to own things digitally. The royalties paid to the original creator in perpetuity is what is so exciting.”

Non-fungible tokens, or NFTs, are virtual representations of real-world assets. They can often be viewed as the first iteration of Web 3.0 in an increasingly virtual world: the Metaverse, where we all actively operate. NFTs are the key that brings offline world assets to the online, open, and decentralised digital world, fuelling the rise of new digital immersive ecosystems.

NFTs have the potential to bring blockchain technology and all other decentralised ideologies into the mainstream. Early examples of NFTs are more than just the media soundbites around NFT trading, art speculation, or NBA sports collectives. There is something deeper, transformative, and radical going on. NFTs open the floodgates to new possibilities of creating, storing, selling, buying, and collecting value.

‘Metaverse NFTs Uprising Ultimate Guide to NFTs’ offers an in-depth view of how this innovative technology works and how it is disrupting the creative industries, the business world, and the digital foundations of our entire society.

NFTs: the basics

A non-fungible token (NFT) is a unique and non-interchangeable unit of data stored on a digital ledger (blockchain). Although NFTs use the same blockchain technology as cryptocurrencies, what distinguishes them is their lack of interchangeability (fungibility). Each NFT has a unique blockchain address. This characteristic enables NFTs to act as a digital twin for any unique digital or physical asset to provide public proof of ownership.

The world economy has been evolving toward increased digitisation, creating digital twins of everything around us. A digital twin is simply a digital representation, a unique identity, of whatever exists. However, we did not have a way to certify and monetise our digital world as we did with paper technology until recently.

NFTs provide an essential building block for the creation of the digital world. They offer a ubiquitous means to securely share ownership, access, and use of a unique set of data. As such, NFTs are then a key enabler of digital transformation and a much-needed invention, enabling us, for the first time, to certify an ever-expanding digital ecosystem on which we are increasingly dependent.

The NFTs ecosystem

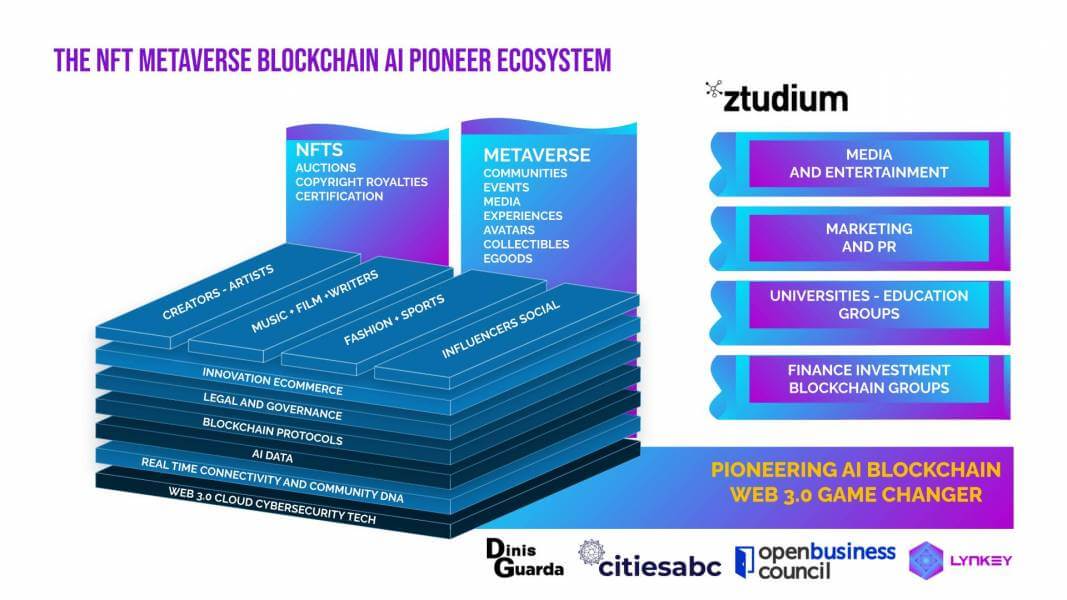

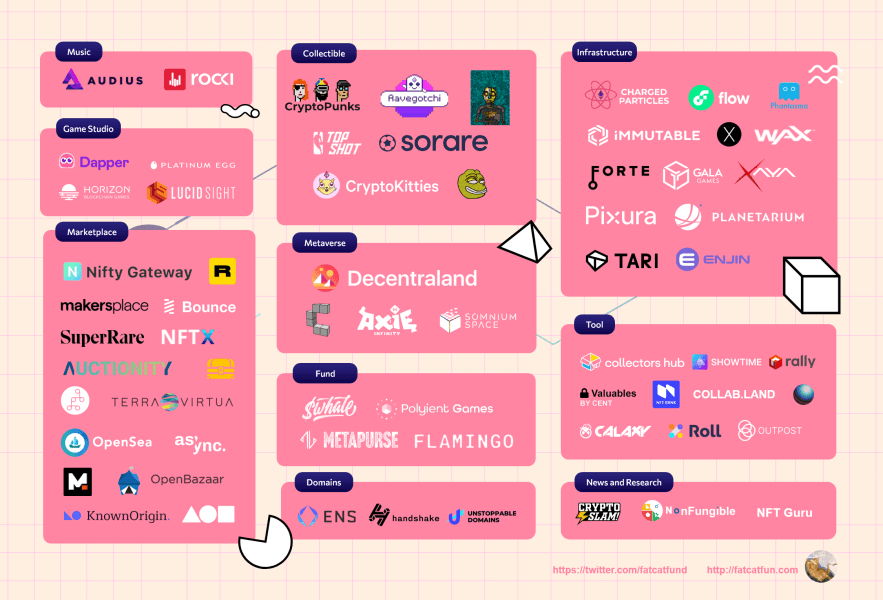

What makes the NFT space so attractive is its rich diversity of players, each exploring new technologies and market opportunities, and fulfilling various needs with different approaches.

The NFT space is new and vibrant. The boundaries and content of this new territory are expanding rapidly – this is frontier land in a gold rush! Each day new opportunities are identified and explored, and new services implemented. If its scope is amorphous, so too is its nature. It is a mistake to think of NFTs as simply a market. Their potential impact is profound across so many areas, and they bring together so many often cross-cutting elements.

A better paradigm is to see NFTs as an ecosystem of related marketplaces, market sectors, applications, actors, and interests.

The NFT ecosystem encompasses a tremendously broad spectrum of fields, including Art and Collectibles, Gaming, DeFi, Domains, Metaverse, News and Research projects. Some participants are technological innovators; others are research projects. Some are start-up entrepreneurs; others established businesses embarking on a digital transformation journey whilst trying to transpose old-world business models with physical infrastructure and goods into a new virtual environment with digital products and services.

Marketplaces

There are many marketplaces to buy and sell NFTs. Depending on which marketplace you choose, you’ll be able to purchase different types of assets, such as art or collectables. Many websites have secondary marketplaces with various NFTs, but each platform operates slightly differently. Examples:

• Opensea – The first, leading and largest marketplace for crypto collectables and NFTs. It is the one-stop-shop for all kinds of digital items. Opensea supports a variety of NFTs, is uncurated and is open to all types of creators. One of the value-added features of this platform is that it allows for gas-free minting. Minting:

• Async Art – A new revolutionary art movement built on the Ethereum blockchain. Launched in February 2020, there has already been over $5M in volume on the platform. Their users create, collect, and trade programmable art comprising a Masterwork and independently owned and controlled layers. The latter enables their users to become a part of the art themselves.

• BakerySwap – An automated market maker and the first curated NFT marketplace on the Binance Smart Chain (BSC). It is one of several protocols attempting to.

The NFTs Ecosystem – Mapping the growing NFT marketplaces – Fat Cat Fun

NFT Uses

There are an increasing number of groups and communities of interest using NFTs. From initial use in Decentralised Finance and cryptocurrency and then Gaming, an increasing number of sectors are now adopting NFTs. Below are just some examples:

• Decentralised Finance (DeFi)

Most of the infrastructure enabling the monetisation of NFTs builds on foundations established by Decentralised Finance (DeFi), a sector that has flourished over the past two years.

DeFi is a new and innovative sector that challenges traditional financial structures, forms, and centrally managed and controlled institutions. Using solutions built on blockchain, DeFi supports the same spectrum of functions and services, including cryptocurrency and fund management, investments and loans, and invoicing, without needing centralised financial intermediaries such as brokerages, exchanges, or banks.

• Arts and Creative Industries

NFTs originated in the arts and are becoming a vital part of the art industry. The emergence and adoption of NFTs have been in response to two critical challenges associated with digital artworks: authenticity and uniqueness.

Auction sales for NFT artworks have become astronomic, with millions spent on individual NFTs. To date, the Art industry alone has done over $150m in sales volume, with individual artists selling art as NFTs for 6-7 figures.

What is also changing is the form of the artwork itself, with artists choosing and allowing the artwork’s new owners to determine whether a work represented by an NFT is exclusively physical, digital or both. Christie’s auction of “EVERYDAYS: THE FIRST 5000 DAYS“ (sold online for $69,346,250) as the first ‘NFT only’ piece by Beeple, is a case in point.

• Gaming

The Gaming industry saw some of the first applications of NFTs to personalise and monetise items that can be acquired and applied to a player’s gaming experience. A pioneer NFT project was CryptoKitties, in which players adopt and trade virtual cartoon cats,

Nowadays, all significant game items – optional extras and customisable items – such as skins, guns, armour, pets, and characters can be bought and sold as NFTs. In some cases, users may unlock or purchase rare items that can subsequently be resold for significant sums to collectors.

Not only does this create financial value for the game provider, where (programmable) NFTs represent gaming elements, they can be bought and sold, enabling the player to get a return on their creative as well as financial investment in the game. Suddenly Gaming becomes a potential revenue stream for players!

• Virtual Real Estate

Market developments and aspirations in Gaming naturally lead to a much broader prospect, the virtual property sector.

What makes virtual real estate valuation is its context for, and functionality to support, the development of concepts and themes. This is attractive to companies, such as games providers, and individuals, such as players or participants in specific communities.

Virtual properties are already becoming valuable, with some valued at eight or nine-figure sums, in June 2021, when a patch of virtual land in the blockchain-based online world Decentraland sold for more than $900,000.

Virtual buildings are also in demand. A property block sold for $4.3 million in the Sandbox, one of the leading metaverse games.

• Sports and Sporting Collectibles

One very recognisable area where NFTs have been adopted is the sports sector, specifically in connection with sports collectables, which can be either physical or virtual.

Digital media vastly expands the possibilities for owning sports content and memorabilia, enabling ownership of unique stills, video, and audio content, such as scoring a goal, with additional content such as commentary provided by the player/s involved.

Sports organisations such as the NBA have been quick to replicate other implementations of virtual collectables.

A prime example is NBA Top Shot NFTs which offer basketball fans the opportunity to buy and sell NFT collectables of moments in the NBA league’s history. Developed in collaboration between the NBA players and several notable entrepreneurs, these have been hugely popular and achieved over $100 million in sales volume.

Conclusion :The NFTs Ecosystem

NFTs have been adopted in multiple industries, and their use is now widespread and popular. It is not just about doing the same things differently, NFTs enable new and hitherto unimagined transactions.

NFTs create an ever-tighter association between creators and their creations. Whilst many industry examples have very specific forms, such as artworks, collectables, or gaming features, the principles enabled by NFTs, the encapsulation and authentication of content, extent far more broadly and abstractly, with the potential to revolutionise very many forms of human interactions. The possibilities are endless.

This is an extract of the upcoming ‘Metaverse NFTs Uprising Ultimate Guide to NFTs’ By Dinis Guarda.

Dinis Guarda is an author, academic, influencer, serial entrepreneur, and leader in 4IR, AI, Fintech, digital transformation, and Blockchain. Dinis has created various companies such as Ztudium tech platform; founder of global digital platform directory openbusinesscouncil.org; digital transformation platform to empower, guide and index cities citiesabc.com and fashion technology platform fashionabc.org. He is also the publisher of intelligenthq.com, hedgethink.com and tradersdna.com. He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays, and governments all over the world.

With over two decades of experience in international business, C-level positions, and digital transformation, Dinis has worked with new tech, cryptocurrencies, driven ICOs, regulation, compliance, and legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

He creates and helps build ventures focused on global growth, 360 digital strategies, sustainable innovation, Blockchain, Fintech, AI and new emerging business models such as ICOs / tokenomics.

Dinis is the founder/CEO of ztudium that manages blocksdna / lifesdna. These products and platforms offer multiple AI P2P, fintech, blockchain, search engine and PaaS solutions in consumer wellness healthcare and life style with a global team of experts and universities.

He is the founder of coinsdna a new swiss regulated, Swiss based, institutional grade token and cryptocurrencies blockchain exchange. He is founder of DragonBloc a blockchain, AI, Fintech fund and co-founder of Freedomee project.

Dinis is the author of various books. He has published different books such “4IR AI Blockchain Fintech IoT Reinventing a Nation”, “How Businesses and Governments can Prosper with Fintech, Blockchain and AI?”, also the bigger case study and book (400 pages) “Blockchain, AI and Crypto Economics – The Next Tsunami?” last the “Tokenomics and ICOs – How to be good at the new digital world of finance / Crypto” was launched in 2018.

Some of the companies Dinis created or has been involved have reached over 1 USD billions in valuation. Dinis has advised and was responsible for some top financial organisations, 100 cryptocurrencies worldwide and Fortune 500 companies.

Dinis is involved as a strategist, board member and advisor with the payments, lifestyle, blockchain reward community app Glance technologies, for whom he built the blockchain messaging / payment / loyalty software Blockimpact, the seminal Hyperloop Transportations project, Kora, and blockchain cybersecurity Privus.

He is listed in various global fintech, blockchain, AI, social media industry top lists as an influencer in position top 10/20 within 100 rankings: such as Top People In Blockchain | Cointelegraph https://top.cointelegraph.com/ and https://cryptoweekly.co/100/ .

Between 2014 and 2015 he was involved in creating a fabbanking.com a digital bank between Asia and Africa as Chief Commercial Officer and Marketing Officer responsible for all legal, tech and business development. Between 2009 and 2010 he was the founder of one of the world first fintech, social trading platforms tradingfloor.com for Saxo Bank.

He is a shareholder of the fintech social money transfer app Moneymailme and math edutech gamification children’s app Gozoa.

He has been a lecturer at Copenhagen Business School, Groupe INSEEC/Monaco University and other leading world universities.