While finances aren’t everything, they’re certainly an integral aspect of conducting sustainable business. That’s why it’s important to know the ins and outs of reading and understanding a profit and loss sheet. Whether you’re an entrepreneur on your first venture, or your experience speaks for itself at this point: the ability to read and analyze a profit and loss sheet is always an advantage.

While finances aren’t everything, they’re certainly an integral aspect of conducting sustainable business. That’s why it’s important to know the ins and outs of reading and understanding a profit and loss sheet. Whether you’re an entrepreneur on your first venture, or your experience speaks for itself at this point: the ability to read and analyze a profit and loss sheet is always an advantage.

Using Google Sheets Profit and Loss template is one of the best methods to learn how to interpret and perform a profit and loss analysis.

1. Know When Too Much is Too Much

Everyone needs time to recharge and relax. Knowing when you’re at the brink of exhaustion is integral to remaining productive and effective at work. The same applies to reading and analyzing a profit and loss sheet. If you don’t have the mental capacity, energy, or bandwidth when you sit down with this financial data, you may as well not sit down with it at all.

“A great productivity tip is to take notice of when you’re at the HALT, and take some time to cool down before getting back to work. Take some time off, call a friend, take a nap, see a movie or eat something refreshing. The key is to realize that what you’re feeling is normal and to be okay with it. Once you feel better, you can get back to work.”

-Tyler Read, Founder and Senior Editor, Personal Trainer Pioneer

2. Sales First

While it may seem like a rather obvious place to start, sales are one of the leading indicators on performance. Keeping a good record of sales from month-to-month will give you a larger picture. Additionally, this information can provide insight into sales strategies that work or don’t work. Beyond sales strategy itself, though, it can also indicate to business owners and decision-makers if there are any seasonal trends to take into consideration.

“When I first started looking at the sales line year-over-year, I realized there were certain trends that continued regardless of the sales tactics I employed. For instance, the last few months of the year, let’s say September through the beginning of January, there’s always a spike in ad-space sales, pay-per-click-sales, everything in the digital marketing space, really.”

-Lina Miranda, VP Marketing, AdQuick

3. Sources of Income

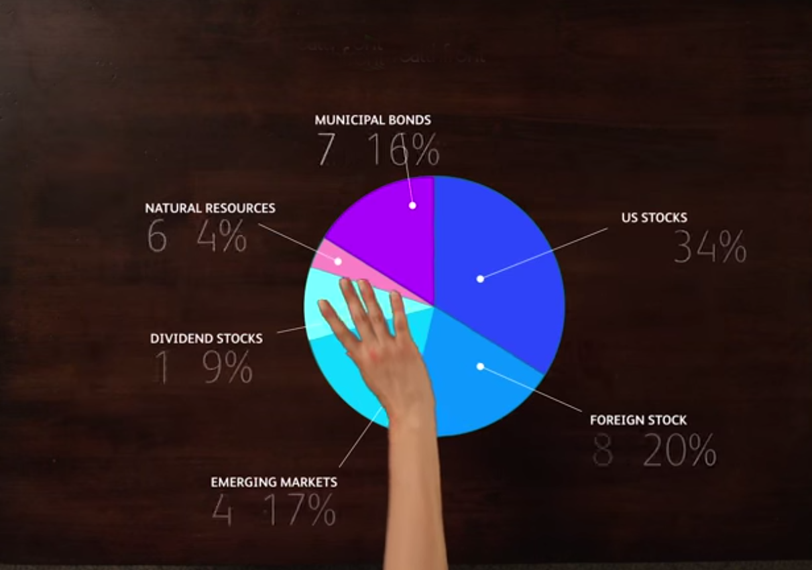

After taking a look at the sales figures themselves, it’s important to delve into the granular detail behind those numbers. For instance, it’s vital to understand the various sources of revenue that actually create your overall sales figure. This will help paint a picture of how the spectrum of products or services you might offer are performing compared to one another. Furthermore, it can even help in understanding the majority demographics that are making up your current consumer base – providing insight on potential areas of improvement.

“Breaking down my sales figure by product line was a game-changer for me. Now, I’m able to market best-seller lists on the homepage of our website, and it even helped me cut under-performing products. Overall, understanding the driving forces behind the sales figure totally reframed how I looked at our profit and loss statements.

-Fred Gerantabee, Chief Experience Officer, Readers.com

4. Cost of Goods Sold

Another vital segment of the profit and loss sheet that needs consideration is the cost of goods sold, or CSG. This is just as important as sales, if not more so. Additionally, the two should be directly correlated to some degree. For instance, as sales increase over time, the cost of goods sold should also increase proportionately. This happens for a variety of reasons from the cost of operations to the cost of resources, and even cost of workers. The larger the scale the business becomes, the more people it requires to function.

“Good employees. Yeah, those are probably the most valuable asset of any organization, or certainly this one, at least. It is a bit of an employee’s market right now because of that. If you’re good at what you do and people know it, that matters. Companies that want the best of the best are typically willing to pay for it.”

-Jae Pak, Founder, Jae Pak MD Medical

5. Selling, General, and Administrative Expenses

There are expenses beyond the raw resources and the salaries of the workers, though. These other costs need to be considered in the profit and loss statement as well. These are expenses that include softwares the business may need to run, marketing campaigns, equipment costs, and even things like rent and utilities of a property.

“I think one of the biggest pieces of our budget comes down to marketing each and every year. It’s important. We know we don’t have as much to spend in this way as it is, so making strategic choices in where to put our marketing money is always integral to seeing a good sales figure.”

-Trey Ferro, CEO, Spot Pet Insurance

6. Examine the Margins

The devil is in the details, as they say. This is absolutely true when it comes to the profit and loss sheet. The more granular a level that you’re able to break down this financial sheet into, the better it will be for your business. This can seem a little tedious, but the data discovered can be tremendously beneficial. The gross profit margin, operating margin, net profit margin, all of these margins can lead to extraordinary insights into your operations.

“The various margins we run on our product lines always helps me figure out where to go next, what to take off the shelf, and how helps me strategize moving forward. It’s certainly helped me paint our marketing path successfully.”

-Amanda E. Johnson, Chief Marketing Officer, Nailboo

7. Keep Track of Gains

Gains are one-time monetary infusions that need to be tracked rather meticulously. Gains are important because they can mark significant events in the history of a company, or indicate the buy-in of a new partner, for instance. There are a lot of variances of monetary-infusions, or gains, and confusing these instances with regular sales activity can become a weed that needs significant untangling.

“Funding is of course important, and sometimes it doesn’t necessarily come from sales. Especially with products that take a long time to research and develop. This is often the case in the instance of scientific products, specifically. R&D (research and development) budgets continue to grow, and sometimes never yield anything. Thankfully, that wasn’t the case for us, but it certainly happens.

-Shaun Price, Head of Customer Acquisition, MitoQ

8. Don’t Let Losses Overwhelm You

Losses are a natural part of business. Sometimes it’s a single week, sometimes it’s a single month, and other times it’s a whole quarter or even longer than that. The important thing is to be resilient, and learn from the losses if you can, rather than sinking into a feeling of helplessness or getting down on yourself. There are important lessons in the weeks and months that losses occur.

“You can’t win them all, that’s for sure. But you can certainly learn from mistakes, and make improvements moving forward. I think that was one of the first things I learned when I set out to found this company. You definitely can’t put too much weight on the ‘losses’ and the ‘failures’ because if you keep trucking along, and pay attention to where the mistakes were, it’s only a matter of time before the losses turn to gains.

-Michael Hennessy, Founder and CEO, Diathrive

Approaching The Profit and Loss Sheet

There are a multitude of ways to approach the profit and loss sheet. This is important to consider when examining and analyzing your own. One of the most beneficial ways to use this information is in planning and strategy, however. The profit and loss sheet analysis can help make decisions on products moving forward, and help decision-makers plan their strategy accordingly.

“A P&L statement can make it much easier to make decisions for your company’s future expenses. Knowing your current financial status and how your future income might be impacted can help you prioritize what decisions need to be made for the health of your business.”

Another common practice is to use the profit and loss sheet as a tool to gain the interest of potential investors. These statements can be very beneficial in proving the validity of an up and coming business hoping to expand further.

“These records provide information about a company’s ability or inability to generate profit by increasing revenue, reducing costs, or both.”

The profit and loss sheet is an important financial tool that businesses and organizations of all sizes can utilize to understand which tactics have worked and which have not, strategize for the future, and to gain the attention of potential investors.

Founder Dinis Guarda

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news, and distribution to create an unparalleled, full digital medium and social business networks spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems