The SWOT guide to blockchain is a guide in 6 parts, where both the opportunities and challenges of blockchain are considered. Blockchain has the potential to be groundbreaking, offering opportunities and better solutions for a range of situations and industries worldwide. It is easy to get swept up in the euphoria that those that strongly favor this technology inspire. However, it is not without its drawbacks. Analysing its strengths, weaknesses, opportunities, and threats, is important to really understand what blockchain technology has to offer, from an objective perspective, and where it is best placed to help and bring about innovation that truly improves the world. Part 4 of the guide analysis regulation as one of its main challenges… that can be transformed into an opportunity.

Regulation

Regulation is a question that is commonly raised in relation to blockchain technology. It is no surprise that this recent technology has grabbed the attention of governments, given the potential changes it could mean for many industries. While some argue that regulation should be avoided, given that it could stifle innovation, others believe that regulators need to be involved and bought in to blockchain, for its benefits to be fully realised. Blockchain requires a complete redefinition of business processes, since there are no middlemen involved in transactions. With regulators on the side, an acceptable solution can be built from the start, rather than having to try and re-engineer technology to fit legislative requirements later.

When Should Regulators Interfere?

Experts suggest that regulation will depend on how the technology is actually being used. Where blockchain is used within a firm, privately for data storage, it is unlikely to warrant legislative interest. However, there is likely to be interest and legislative input around areas that might suggest the development of monopolies. For example, if competitors are joining together to develop blockchain technology that will give them opportunities to share data or even transactions then this is certainly likely to raise eyebrows from a regulatory perspective.

This is why there is a strong argument for getting regulators involved and on board earlier rather than later. This will help them to better understand how to legislate to allow technological solutions to develop in an effective manner, rather than hampering progress through regulations that are unnecessary. Indeed, in many cases new legislation will not be required – for example, there are already laws in place governing industry competition and monopolies. These just need to be understood from a blockchain perspective.

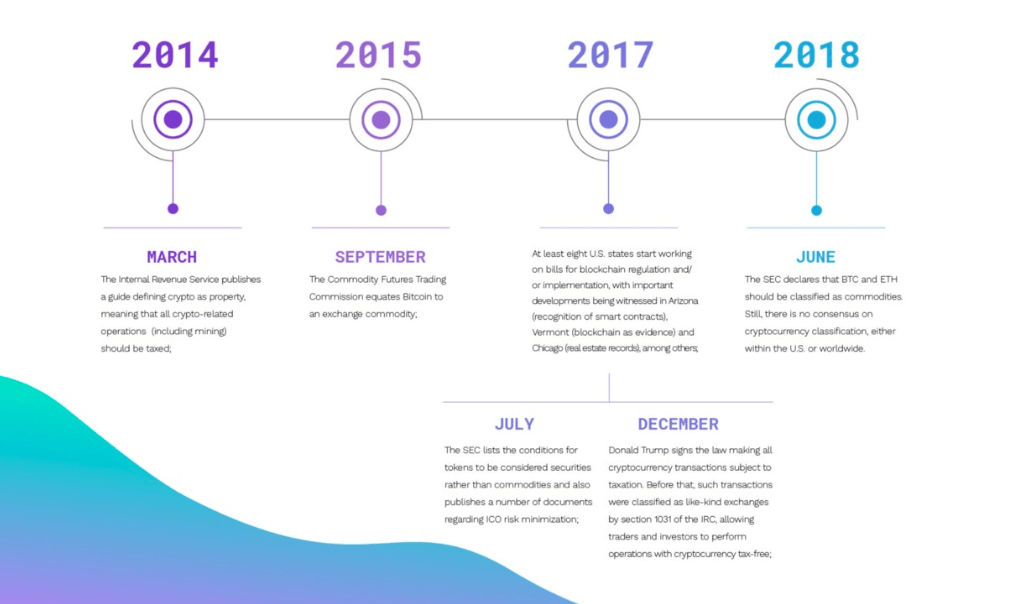

Blockchain Regulation in US

Since the invention of bitcoin, so 11 years ago, the National Security Agency (NSA) of the US has been surveilling Bitcoin users. This was happening as a way to prevent money laundering and counter terrorism financing with ICOs. Fast forward to current times, the US government has equated ICOs (a type of fundraising for cryptocurrencies) to IPO in the majority of cases. In terms of blockchain based projects, the US is also supporting and developing procedures and licensing. Things are changing and happening at such an increased speed, that it is hard to keep up with the most recent evolutions.

Blockchain Regulation in Europe

BLockchain has been approached with overall enthusiasm, in EU countries. EU Governments have been very supportive of innovation, by allocating funds to innovation labs and supporting research even in terms of legislation. This has enabled the flourishing of a very supportive environment for entrepreneurs that encourages them in exploring use cases to test impact and laws, and by giving entrepreneurs confidence that their “approved” applications will be more trusted by their target markets. An example of this is the recent book “Legal aspects of blockchain”. The book is the result of a co-production between UNOPS,the Netherland Governmental Agency, Blockchain Pilots and a consortium of legal experts. It results from a year-long process of co-production, gathering the research of various authors and experts in the thematic areas of financial services, identity, and land registration, the legal aspects of smart contracts, implications of blockchain / DLT on the UN System, ICOs and other hot topics.

Blockchain and GDPR

Analysts suggest that there are also other legislation that needs to be considered from a blockchain perspective. One key example is the GDPR regulations that came into law in May 2018. These require that firms are able to get rid of personal information if the consumer so requires. However, by its very nature, blockchain is immutable. Data that cannot be changed should not be put into blockchain. This raises questions about how to manage blockchain from a regulatory perspective. However, the answer is believed to be in the way that private data is managed. While some suggestions involve requesting workarounds that can apply to GDPR for blockchain, others believe it is simpler to not use these structures for the storage of data that is private. This means that GDPR would be followed without changing the law – which is far preferable.

Examples of Legal Ramifications of Blockchain Records

As this distributed ledger technology gets more and more mainstream, also due to its rigorous encryption techniques, it will have more legal bearing in courts. These, will, in return, develop more practical ways on how to regulate this still incipient technology. Recent examples of blockchain technology and regulation is a recent bill in Vermont that would make records verified through blockchain technology admissible as evidence in court. This bill creates a kind of legal backing for blockchain-based information.In Nevada, another bill has deemed smart contracts and blockchain signatures acceptable records under state law.

As distributed ledgers and systems become more common, their possible use in cases as evidence and discovery becomes more likely. This means lawyers will need to know such records exist as well how to handle that evidence as well as what specific information to request.

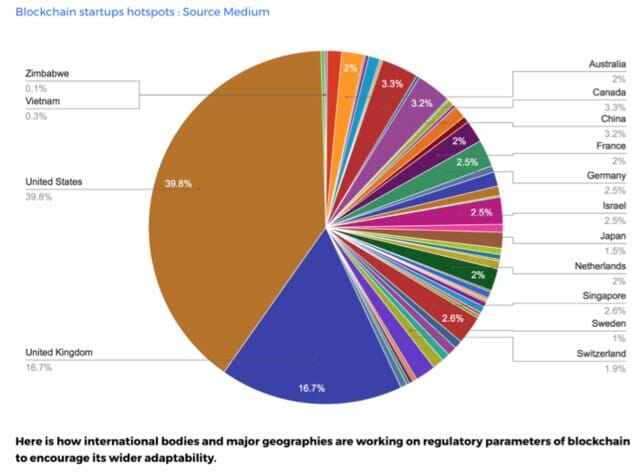

Blockchain Regulation in the World

Blockchain technology regulation is an ongoing process worldwide, so it is important to stay updated with corresponding resources.

Conclusion

In summary, while regulatory questions around blockchain remain, and are likely to do so for the foreseeable future, working within the boundaries of the law as it stands right now is highly recommended, and is plausible. In other cases, challenges are likely to arise later. In particular privacy, monopolies and anti-trust are likely to raise issues when working with blockchain, and working with regulators in advance is likely to be better than undoing work later.

The SWOT Guide to Blockchain Part 1

The SWOT Guide to Blockchain Part 2

The SWOT Guide to Blockchain Part 3

The SWOT Guide to Blockchain Part 4

The SWOT Guide to Blockchain Part 5

The SWOT Guide To Blockchain Part 6

Maria Fonseca is the Editor and Infographic Artist for IntelligentHQ. She is also a thought leader writing about social innovation, sharing economy, social business, and the commons. Aside her work for IntelligentHQ, Maria Fonseca is a visual artist and filmmaker that has exhibited widely in international events such as Manifesta 5, Sao Paulo Biennial, Photo Espana, Moderna Museet in Stockholm, Joshibi University and many others. She concluded her PhD on essayistic filmmaking , taken at University of Westminster in London and is preparing her post doc that will explore the links between creativity and the sharing economy.