The Internet of Things is fast moving from something that is happening in the future to an actual reality. Venture Capitalists are getting on board and starting to invest heavily in Internet of Things solutions and organisations.

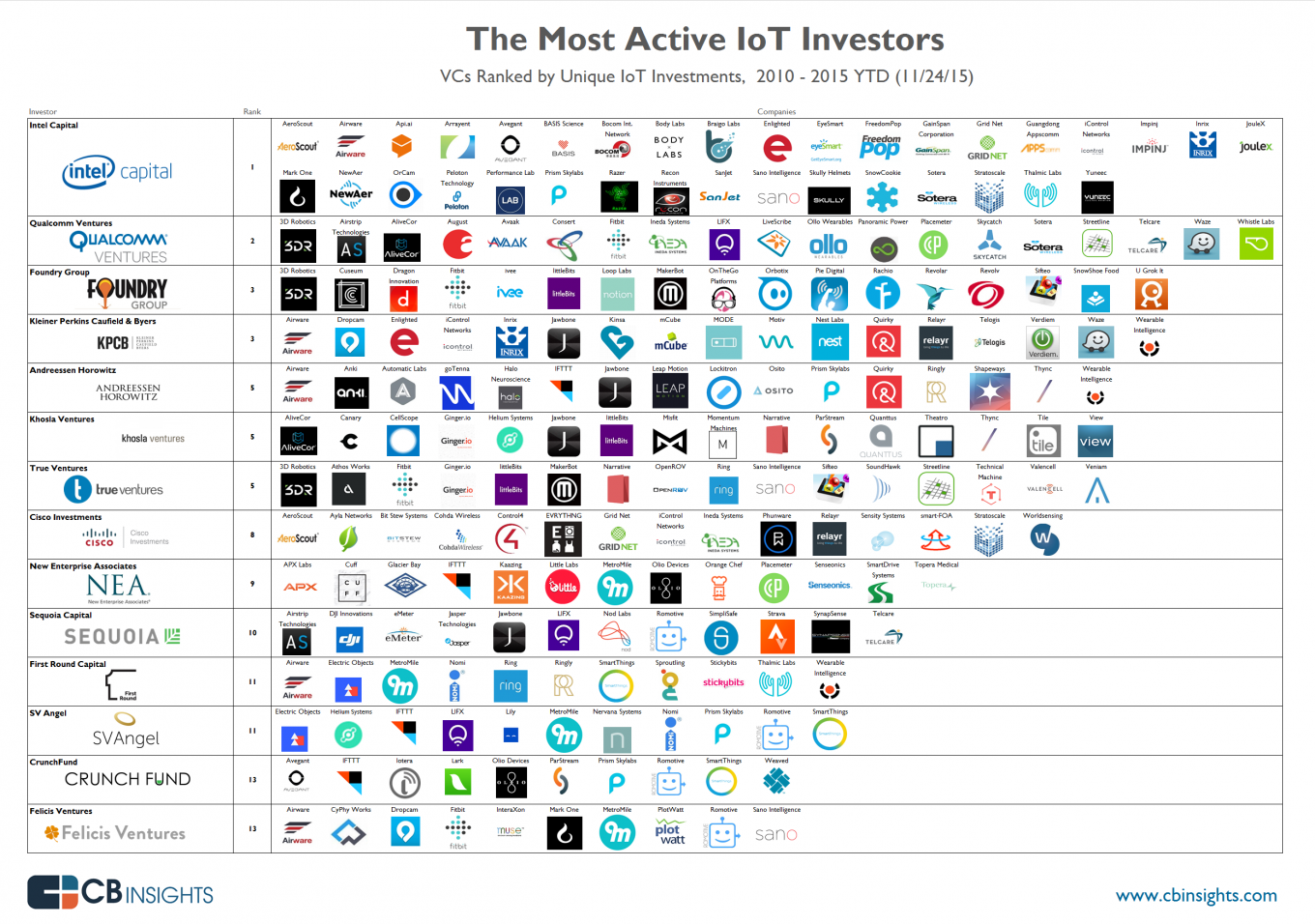

For those wanting to know or understand a bit more about this matter, and particularly for those that want to invest where the smart money is going, or who have an Internet of Things solution that they seek investment for, there is now a tool to help. Specifically, CB Insights (2015) has prepared an infographic which outlines who are the most active venture capitalists in the Internet of Things space, and handily it also shows their investments. As CB Insights reports:

“Many corporate investors and smart money VCs have placed significant bets on the Internet of Things industry, which is expected to see nearly $2 billion of funding through the end of 2014.

Utilising the helpful infographic provided by CB Insights it is possible to see exactly who these VCs are. CB Insights carried out a ranking of those most active in this area and laid out portfolio internet of things companies that these organisations invested in for an easy at a glance view of the situation. Particularly noteworthy in the infographic, it can be seen that Intel Capital has made the most investments in this area between the years 2010 and 2015.

The company has focused particularly heavily in the area of sensors as well as wearable start ups. The sensors are a particularly logical investment since Intel focuses on the creation of chips that are used in operating mobile devices, so this makes particular sense for them from a strategic perspective. Qualcomm Ventures is another small chip producing company that has invested actively in start ups for wearables. It also has invested in sensors, and like Intel Capital, this would appear to be a strategically sound decision.

There were especially noteworthy investments for Intel Capital this year. One of its companies of focus has been BodyLabs. BodyLabs is a manufacturer of 3D body sensing scanners. Intel Capital has also placed funds into Sano Intelligence. Sano Intelligence is a biometric sensor developer. Aside from these investments, Intel Capital has focused on other wearable companies as well as investing in some companies that offer internet of things infrastructure, and that are at the start up stage. Some example companies that it has invested in of this nature include Stratoscale, SigFox and Bocom Intelligent Network Technologies.

Looking closer at Qualcomm Ventures, the second most active investor, one of the interesting investments that it made this year was into Whistle Labs, which manufacturers wearables for canines. It also placed funds into 3D Robotics, a company that makes drones. As well as these investments it placed bets on sensor networks across a range of companies. The companies invested in included Panoramic Power, Streetline and Placemeter. All of these organisations have a focus on the measurement of traffic and energy use in public areas.

Two companies came joint third in terms of the active nature of their investments. These were Kleiner Perkins Caufield and Byers (KPCB) as well as Foundry Group. Foundry Group’s primary area of focus has been hardware. It has invested in a number of companies working on the development of internet of things hardware. Companies that it has invested in include Fitbit which many people will already be familiar with. CB Insights points out that Fitbit went public during the year and was valued at $4.1 billion. The company also invested in LittleBits and MakerBot. MakerBot was bought out in 2013 based on a valuation that had been made of $403 million.

Kleiner Perkins Caufield and Byers meanwhile has placed bets across a range of different categories relating to the internet of things. Some of these include home automation, in which it has invested in Enlighted and Nest. It has also invested in auto, such as in the companies Inrix and Waze. Finally, it placed money into wearable technologies, and the specific companies that it supported in this sphere were Jawbone and Motiv.

This is just some of the helpful and informative information contained in the infographic, and interested parties are recommended to check it out to find out more.

Paula Newton is a business writer, editor and management consultant with extensive experience writing and consulting for both start-ups and long established companies. She has ten years management and leadership experience gained at BSkyB in London and Viva Travel Guides in Quito, Ecuador, giving her a depth of insight into innovation in international business. With an MBA from the University of Hull and many years of experience running her own business consultancy, Paula’s background allows her to connect with a diverse range of clients, including cutting edge technology and web-based start-ups but also multinationals in need of assistance. Paula has played a defining role in shaping organizational strategy for a wide range of different organizations, including for-profit, NGOs and charities. Paula has also served on the Board of Directors for the South American Explorers Club in Quito, Ecuador.