What are some of the most incredible innovations happening out there in the field of healthcare ? Is Artificial Intelligence disrupting the sector in a beneficial way? It seems so! Following the success of minimally invasive surgery (MIS) for a number of indications and surgical specialties, medical device companies are increasingly turning to surgical robotics as the next big innovation to solve the limitations still present in MIS procedures. In this context, leading data and analytics company GlobalData, believes that the surgical robotics market will become more crowded and grow to support a wider variety of surgical procedures.

The systems for robotic-assisted surgical procedures are experiencing increased interest globally. They exist for an array of indications from a variety of general surgery procedures to orthopedic knee replacement procedures.

The competitive landscape for surgical robotics is vast with both large MNCs and small startups venturing into the space. Among these, Intuitive Surgical occupies the top position in the global surgical robotics market since the FDA approval of the company’s first generation da Vinci system in 2000.

Following Intuitive Surgical’s success, global competitors including Medtronic, Johnson & Johnson, and Stryker have either partnered with or acquired surgical robotics companies to help accelerate robotic innovation and gain market share.

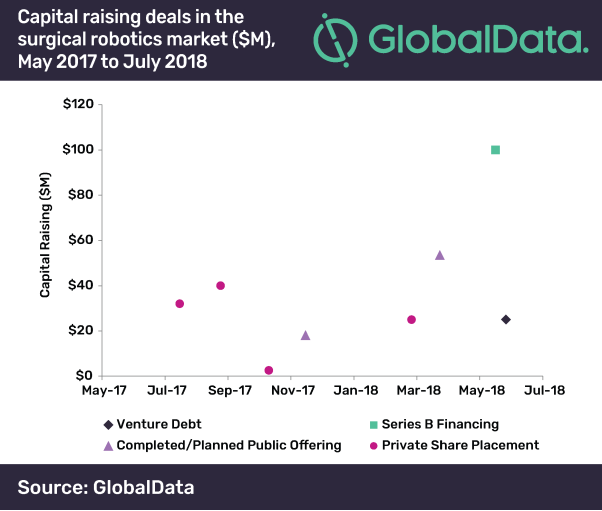

Jennifer Ryan, Medical Devices Analyst at GlobalData, says: “While robotic-assisted surgery aims to provide increased precision and control to a complicated procedure, they are generally very expensive to procure. On the other hand, the majority of companies at the forefront of surgical robotics systems are startups (small players), which are reliant on funding and capital raisings for continued advancement.”

Over the past year, several surgical robotics players including Titan Medical, Medrobotics and Accuray have announced capital raisings through public offerings or private share placements. The largest deals have assisted CMR Surgical, Corindus Vascular Robotics and Mazor Robotics.

In September 2017, Mazor Robotics completed the third tranche of private share placement for $40m, for a total of $72m. The offering also brings Medtronic’s total investment in Mazor to $125m. According to GlobalData, surgical robotics companies raised a total of $296.1m between July 2017 and July 2018.

As the market’s growth potential continues to rise, larger multinational players are expected to invest in the surgical robotics space through acquisitions and partnerships in the coming years.

Ryan concludes: “Improvements in surgical procedures through the use of robotics will increase the patient population eligible for treatment and reduce complications and negative outcomes. As partnerships and funding continue to support innovation in the surgical robotics market, the competitive landscape will become more crowded and the market will continue to grow to support a wider variety of surgical procedures and patients.”

This is an article provided by our partners’ network. It might not necessarily reflect the views or opinions of our editorial team and management.

Founder Dinis Guarda

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news, and distribution to create an unparalleled, full digital medium and social business networks spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems