In the fast paced world of high frequency trading, asset management and equity analysis, more companies are tapping into real-time social media data streams to help make investment decisions. According to social data providers, Gnip, in Social Media and Markets: the new frontier, gauging sentiment amongst social networks and getting important breaking information have become key means of using leading indicator data from social media to create alpha and predict the direction of the market. Gnip notes that hedge funds, in particular, have been leaders in innovating the ways in which leading indicator data from social media sources are being used to help them create alpha for their investors as access to data streams becomes more widespread.

Research from Indiana University, Pace University and TUM School of Management in Munich, have already demonstrated the potential predictive capabilities of social data as well as the ability of social networks to spread breaking news at a fraction of the pace of traditional media. When the death of Apple CEO Steve Jobs broke in 2011, the news rapidly spread through the social networks, particularly, Twitter. Within half an hour, 50,000 people were tweeting about Jobs every minute. Interest in the story dominated Twitter trends throughout the day, occupying nearly 25% of all Tweets. Considering that on average, Twitter users generate more than 250 million new Tweets each day, it is easy to understand why using leading indicator data from social media sources has become critical for recognizing and responding to trends as they happen.

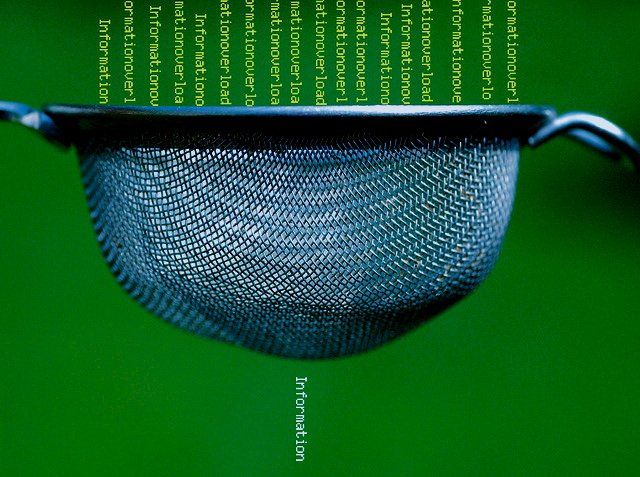

For investment professionals, tapping into social media data can offer a “collective pulse of observations, wisdom and emotional reactions for asset managers, equity analysts and traders to analyze and quantify.” As Gnip points out, “The ability to understand the forces shaping the market – allowing one to predict direction – has become an increasingly elusive skill,” in such an environment swamped by the exponential explosion of social media.

Adoption of social media data. Source Gnip, Inc.Gnip recommends considering three key areas when choosing a social media data provider, “where the company sources its data, their infrastructure and their understanding of the breadth of social media sources and how they relate to a fund’s intended use case.” Different firms may provide data in a variety of formats. The latency and reliability of the firm’s data are also important factors to consider. Data collected by crawlers might not be as reliable as data collected through publisher agreements or public API feeds. The differing data collection methods have benefits and drawbacks depending upon whether the potential volume of data or the long-term reliability of the data are most integral to the investment strategy process.

There are also any number of quantifiable metrics that can act as a veritable “crowd-sourced megaphone,” amplifying trends that can influence markets. Sentiment analysis, or examining the mood of the marketplace using social data, is measured by investment funds using a variety of complex algorithms and social network monitoring tools, such as Dataminr. Low-latency on platforms like Twitter and Facebook means that real-time sentiment can be measured for specific brands, equities or products. Gnip explains, “This data can be used by investment professionals to determine the relative weight or broad market interest in a particular story. By capturing a realtime snapshot of what the market considers important– and what it doesn’t – asset managers and traders are able to add an important factor to their existing algorithms in the quest to create alpha.”

The ease of access and ubiquity of social networks have required investment professionals to adopt social media into traditional research and review strategies. Even as social data can function as a barometer of the “pulse of humanity,” as Gnip says, “The propensity of users to like, share and retweet content from other users gives those consuming social media data an extremely easy mechanism to measure what content is most important to the world – and to compare that content against other content in real time.” With more use and innovation by investment professionals, tapping into the predictive power of social data can continue towards greater sophistication, providing the needed edge in developing trading strategies and in making sound investment decisions.

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news and distribution to create an unparalleled, full digital medium and social business network spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems.