The Financial industry Disruption by Social Media

The Financial Services, trading, investment and other highly regulated industries, have been highly disrupted by the path into digital and social media spaces. This way is not an easy one and it is one which banks, trading houses, stockbrokers, wealth management organisations, hedge funds and other financial organisation must tread with extreme care. There are a lot things in the moving target of the fast changing times we are living in the finance world that it seems as in a sophisticated poker game. This new landscape displays a growth of technological new disruptive responsive technologies, security and special the direct interaction with users, clients, traders.

All these new challenges, bring to these industries advanced challenges and of course opportunities that although don’t fit as neatly into social media, as sectors like entertainment, FMCG and lifestyle brands, have however a fundamental innovative and potential even more disruptive importance. However this new advanced way needs a hard effort that has to be prepared in liaison with boards, executive management teams, internal corporate communications, legal / compliance departments of of course marketing and communications.

Social media and finance is a 360 degree disruptive new process that has to be seen as whole picture that affects the whole of any organisation.

The keyword to start is Social Media Business and Finance SHIFT.

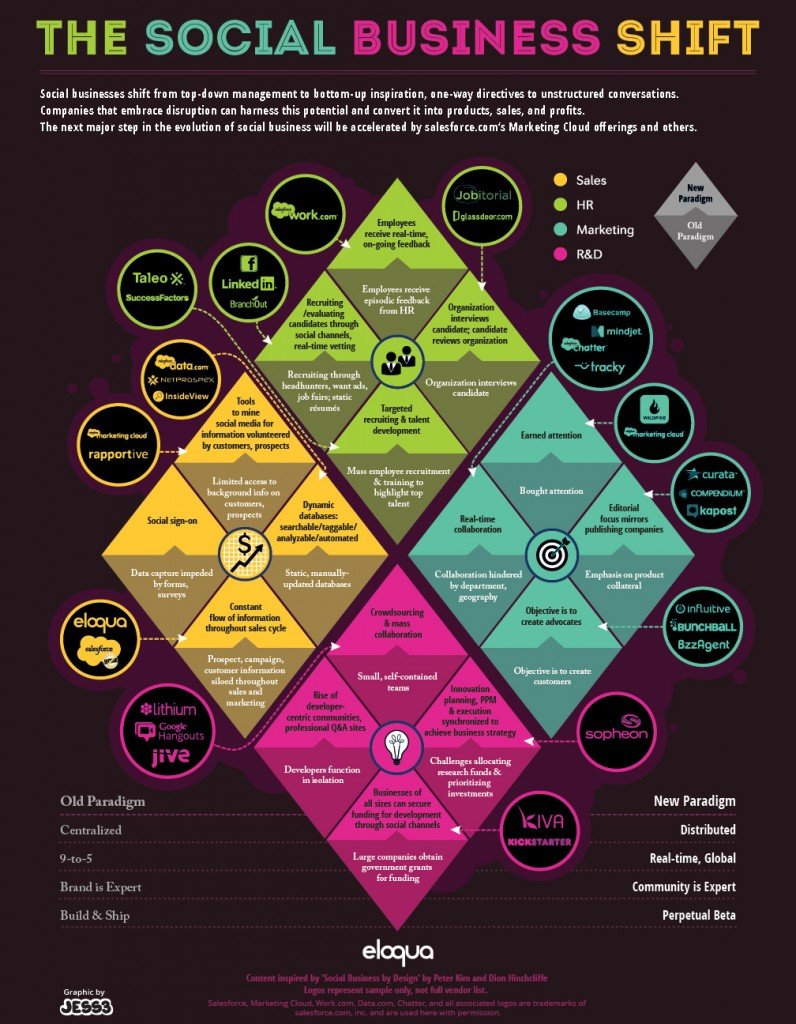

To understand social media and finance one needs to make an effort to understand the dynamics that this medium brought to business in general. Social media has been shifting the way business as usual is processed. The bellow infographic by Eloqua and Jess3 is a solid example that can support better some of the general DNA ideas important to understand in order to get in the mindset necessary for social media. These ideas are for business but apply to Finance and trading as a whole. The keyword to bear in mind is SHIFT.

Eloqua and Jess3 Social Media Business Shift infographicDespite all this, the financial industry is conscious that it has to change. Moreover have been working conscious of its challenges and have established some of their social presence. The next steps are now looking to move ahead and develop beyond just acquiring their brand’s name on LinkedIn, Facebook, Google+ and special Twitter. The big question is how to create a strategy and a powerful aligned effort where compliance, legal, product development, security departments, communications, marketing, content can engage and move forward in the right direction with their consumers in financial services? The major challenge is how to respond to customer, traders, users queries, needs in an efficient yet compliant way? How to lead discussions towards products and services on offer to bolster the best business, financial performance?

As Twitter created in March 2006 by Jack Dorsey, turns 7, Facebook founded in February 2004 by Mark Zuckerberg with his college roommates and fellow Harvard University students Eduardo Saverin, Andrew McCollum, Dustin Moskovitz and Chris Hughes turns nine and LinkedIn Founded in December 2002 and launched on May 5, 2003, by Reid Hoffman and founding team members from PayPal and Socialnet.com (Allen Blue, Eric Ly, Jean-Luc Vaillant, Lee Hower, Konstantin Guericke, Stephen Beitzel, David Eves, Ian McNish, Yan Pujante, and Chris Saccheri) turns 10, social media platforms are maturing and creating new process and opportunities together with its obvious challenges. The Finance industry is facing more challenges in the last couple of years that in the last 100 and as they say the devil is on details!

While there are a few main things the finance industry needs to realise regarding social media such as information security, record keeping, supervising business communications and different type of content / sources requirements, managing platforms, localisation of FSA regulatory different procedures, generally the rules applied to social media shouldn’t be too hard to follow as we are talking about platforms that facilitate financial and trading services and activities and not new laws or activities.

Joe Price, a senior vice president of corporate financing and advertising regulation for FINRA, and a panelist at LinkedIn’s Finance Connect conference in New York has been highlighting:

“I don’t think the rules of the road are overly complex. There are pretty straight forward principles to apply.”

Price also acknowledges the social media rules are not rocket science and hard and fast. What he defends is the wisdom of any professional right way of doing things. Social media platforms and its related tools and activities were purposefully designed to social interconnection, facilitate users, to be flexible and easy to use, special now with the emergence of user experience design. Social media was developed as a general list of properties designed to keep up with a rapidly changing technological and social environment. So as the financial industry starts to to look seriously at the area of social media actionable has to be flexible and down to earth.

A professional in finance or an adviser having to “like” a page to participate in a conversation, Twitting something or engaging in LinkedIn doesn’t necessarily mean that the adviser “likes”, or signs about all the content, ideas, messages on there. So it is rather important to have a strong ethical down to earth approach to the subjects of social media and its nuances, granular models. As usual common sense applies and the rule is keep the industry standpoint principles in mind.

In a new regulatory / technological / big data ecosystem use social media, but know how to use it in the right way!

With the rise of new regulatory and compliance needs financial and trading professional have also seen the emergence of software companies and technology providers that can help automate the process for financial organisations in their social media and tech operations and thus making it easier. This opened the increase of data storage, the famous big data that any financial organisation has to manage at the moment. As one of the critical elements of social media is to manage data and information first and fore-all with it comes the need to understand the principles and rules to be applied to this data. So, with all of this new ways there’s no doubt that social media adds to the corporate, marketing, business intelligence, human resources and legal, compliance departments a huge new amount of work load, different ways of looking at things and necessary resources.

At the same time, however, social media presents an enormous opportunity for financial professionals. As this new work load grows, social media savvy and expert finance, legal / compliance, marketing and communication professionals have a new opportunity to advance their careers and create a new sub industry capable of opening a new growth and trust in an industry going through a massive credibility crisis. Lisa Shalett, head of brand marketing and digital strategy for Goldman Sachs (formerly the chief operating officer of global compliance, legal and Internal Audit) affirms:

“I’d see this as a golden opportunity that in a career, maybe if you are lucky, comes along once.“

Become an expert in social media, it’s a must and the critical gimme right now. For marketing, BI, compliance and legal, it is the sacred graal, any professonal in this area needs to understand the social layers, its strategy and the way users use social media and interact with them. Moreover they need to be able to contextualise it within each of their specific market and legal frames.

However the new important message for any professional in finance is to think not just of the risks involved in using social media but all the new doors opened by it. Legal and compliance isn’t the real obstacle but the right alignment of efforts within organisations.

As all brands are now media and content publishers, the real difficulty is in figuring out the best process how to modify that content into sharable and use visual user interface items that are appropriate for the audience, customers, users on a given social platform, community. More important to engage the right audience target with the right use of social media.

This article with continue with a second part soon.

Dinis Guarda is an author, academic, influencer, serial entrepreneur, and leader in 4IR, AI, Fintech, digital transformation, and Blockchain. Dinis has created various companies such as Ztudium tech platform; founder of global digital platform directory openbusinesscouncil.org; digital transformation platform to empower, guide and index cities citiesabc.com and fashion technology platform fashionabc.org. He is also the publisher of intelligenthq.com, hedgethink.com and tradersdna.com. He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays, and governments all over the world.

With over two decades of experience in international business, C-level positions, and digital transformation, Dinis has worked with new tech, cryptocurrencies, driven ICOs, regulation, compliance, and legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

He creates and helps build ventures focused on global growth, 360 digital strategies, sustainable innovation, Blockchain, Fintech, AI and new emerging business models such as ICOs / tokenomics.

Dinis is the founder/CEO of ztudium that manages blocksdna / lifesdna. These products and platforms offer multiple AI P2P, fintech, blockchain, search engine and PaaS solutions in consumer wellness healthcare and life style with a global team of experts and universities.

He is the founder of coinsdna a new swiss regulated, Swiss based, institutional grade token and cryptocurrencies blockchain exchange. He is founder of DragonBloc a blockchain, AI, Fintech fund and co-founder of Freedomee project.

Dinis is the author of various books. He has published different books such “4IR AI Blockchain Fintech IoT Reinventing a Nation”, “How Businesses and Governments can Prosper with Fintech, Blockchain and AI?”, also the bigger case study and book (400 pages) “Blockchain, AI and Crypto Economics – The Next Tsunami?” last the “Tokenomics and ICOs – How to be good at the new digital world of finance / Crypto” was launched in 2018.

Some of the companies Dinis created or has been involved have reached over 1 USD billions in valuation. Dinis has advised and was responsible for some top financial organisations, 100 cryptocurrencies worldwide and Fortune 500 companies.

Dinis is involved as a strategist, board member and advisor with the payments, lifestyle, blockchain reward community app Glance technologies, for whom he built the blockchain messaging / payment / loyalty software Blockimpact, the seminal Hyperloop Transportations project, Kora, and blockchain cybersecurity Privus.

He is listed in various global fintech, blockchain, AI, social media industry top lists as an influencer in position top 10/20 within 100 rankings: such as Top People In Blockchain | Cointelegraph https://top.cointelegraph.com/ and https://cryptoweekly.co/100/ .

Between 2014 and 2015 he was involved in creating a fabbanking.com a digital bank between Asia and Africa as Chief Commercial Officer and Marketing Officer responsible for all legal, tech and business development. Between 2009 and 2010 he was the founder of one of the world first fintech, social trading platforms tradingfloor.com for Saxo Bank.

He is a shareholder of the fintech social money transfer app Moneymailme and math edutech gamification children’s app Gozoa.

He has been a lecturer at Copenhagen Business School, Groupe INSEEC/Monaco University and other leading world universities.