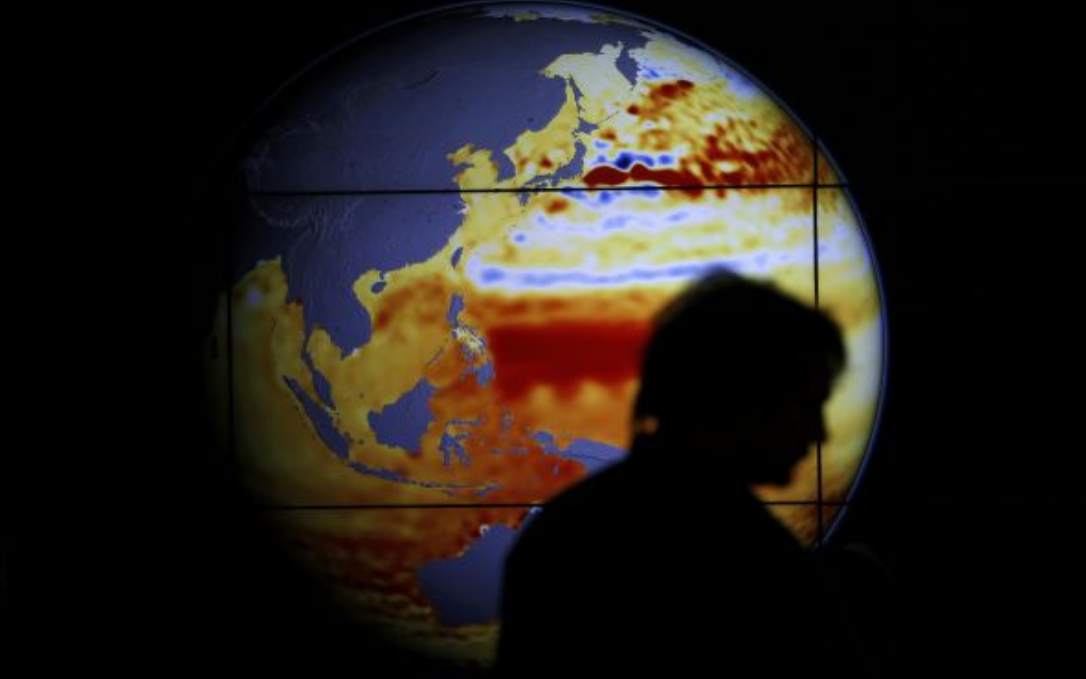

As the COP22 global climate meeting approaches, lessons from past policy failures should guide future policy-making efforts, according to a new book by climate expert Richard Rosenzweig. Reducing the risk of climate change will be achieved by bottom-up, workable policies, not overly ambitious, top-down programs, argues Richard Rosenzweig, a former senior government official and carbon management company executive.

Richard H. Rosenzweig is an internationally recognized expert on energy and environmental policy and markets and has been a leading voice on climate policy and carbon markets for more than two decades. He was chief of staff to the U.S. Secretary of Energy when the U.S. developed its first responses to climate change in the 1990s, and he later was chief operating officer of Natsource, one of the world’s largest private sector asset management firms specializing in the global carbon markets. Today he is an author, university professor and consultant focused on policies that can mitigate climate related risks and the role of government and private enterprise in addressing these challenges.

In his new book, Global Climate Change Policy and Carbon Markets: Transition to a New Era,” Rosenzweig assesses the failure of climate policy over the past 25 years to slow global greenhouse-gas emissions and to create workable carbon markets and recommends a more modest, targeted approach to guide future policy-making.

Informed by his unique perspective as both a senior government official and a top private sector executive in the carbon markets, Rosenzweig’s book provides an in-depth examination of the climate policies enacted after the 1997 Kyoto Protocol, including a first-time comprehensive analysis of the global carbon markets, offering a candid assessment of their performance. He says:

“The global carbon markets did not live up to their promise,” Rosenzweig said. “Their inability to mobilize the large scale investment needed to address climate change was caused by poor design and administration, interactions with other policies and the inability of governments to respond to changes in market conditions. Markets will continue to play a role in the new era of policy-making, but not to the exclusion of other approaches.”

According to Rosenzweig, first-generation climate policies failed because they were top-down, overly ambitious and complex. More modest, targeted policies – singles and doubles, small ball, to use a baseball analogy – will be more successful in fighting climate change in the new era of policy-making. This approach is required given the public’s lack of trust in the government’s ability to do big things.

Hailed for its insight and candor, the book is especially timely as global policy-makers prepare to gather at COP22 in Marrakesh in early November to continue discussions on the implementation of the landmark 2015 Paris climate accord.

“Private companies, governments at all levels and nonprofit organizations all have a vital role to play in the fight against climate change,” Rosenzweig said. “Governments need to set clear goals and establish consistent, enduring policy frameworks that encourage the private sector to make the investments necessary to achieve emission reduction goals. We must learn from past efforts, measure progress to see what works and continue to act.”

To learn more, please visit: www.richrosenzweig.com. Information on “Global Climate Change Policy and Carbon Markets: Transition to a New Era,” can be found here.

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news and distribution to create an unparalleled, full digital medium and social business network spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems.