Professor Yu Xiong, along with fellow colleagues Shangrong Jiang, Yuze Li, Quanying Lu, Yongmiao Hong, Dabo Guan, & Shouyang Wang has researched and published a new article on Nature about the growing energy consumption and associated carbon emission of Bitcoin mining in China. They discovered that bitcoin mining and blockchain operations could potentially undermine global sustainable efforts.

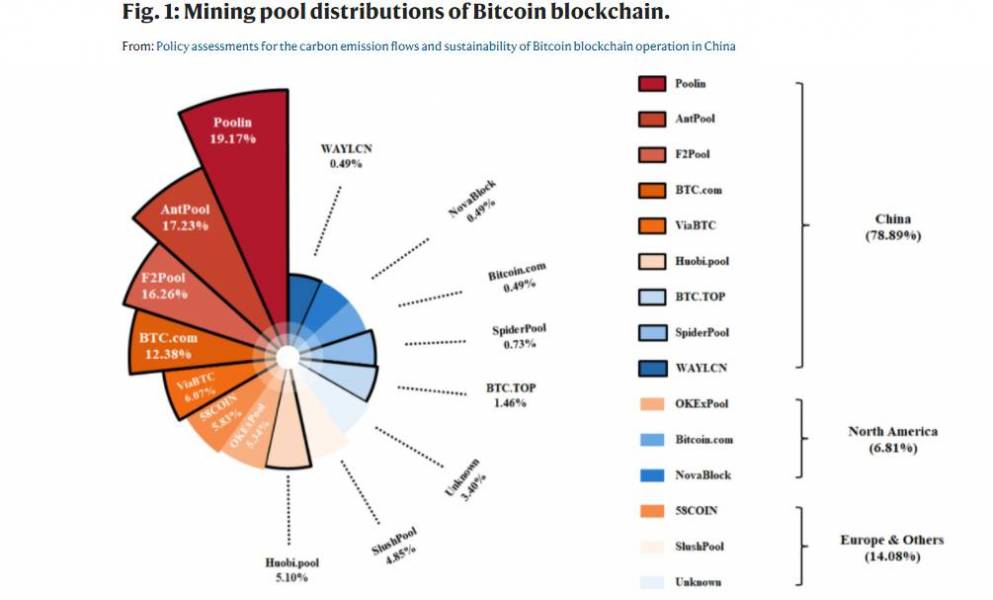

The researchers focused their work on investigating carbon emission flows of Bitcoin blockchain operation in China with a simulation-based Bitcoin blockchain carbon emission model, and they found that without any policy interventions, the annual energy consumption of the Bitcoin blockchain in China is expected to peak in 2024 at 296.59 Twh and generate 130.50 million metric tons of carbon emission correspondingly. Internationally, this emission output would exceed the total annualized greenhouse gas emission output of the Czech Republic and Qatar. Domestically, it ranks in the top 10 among 182 cities and 42 industrial sectors in China.

In this work, they showed that moving away from the current punitive carbon tax policy to a site regulation policy which induces changes in the energy consumption structure of the mining activities is more effective in limiting carbon emission of Bitcoin blockchain operation.

The full research paper can be found on Nature.

Here is the introduction of the research paper:

As Bitcoin attracted considerable amount of attention in recent years, its underlying core mechanism, namely blockchain technology, has also quickly gained popularity. Due to its key characteristics such as decentralization, auditability, and anonymity, blockchain is widely regarded as one of the most promising and attractive technologies for a variety of industries, such as supply chain finance, production operations management, logistics management, and the Internet of Things (IoT). Despite its promises and attractiveness, its first application in the actual operation of the Bitcoin network indicates that there exists a non-negligible energy and carbon emission drawback with the current consensus algorithm. Therefore, there is an urgent need to address this issue. In this paper, we quantify the current and future carbon emission patterns of Bitcoin blockchain operation in China under different carbon policies. In recent years, the system dynamics (SD) based model is widely introduced for carbon emission flow estimation of a specific area or industry. In comparison to its counterparts, SD modeling has two main advantages in carbon emission flow assessment: first, by combining the feedback loops of stock and flow parameters, SD is able to capture and reproduce the endogenous dynamics of complex system elements, which enables the simulation and estimation of specific industry operations. In addition, since the SD-based model is focused on disequilibrium dynamics of the complex system, intended policies can be adjusted for scenario policy effectiveness evaluation. Consequently, based on system dynamics modeling, we develop the Bitcoin blockchain carbon emission model (BBCE) to assess the carbon emission flows of the Bitcoin network operation in China under different scenarios.

This paper uses the theory of carbon footprint to create a theoretical model for Bitcoin blockchain carbon emission assessment and policy evaluation. First, we establish the system boundary and feedback loops for the Bitcoin blockchain carbon emission system, which serve as the theoretical framework to investigate the carbon emission mechanism of the Bitcoin blockchain. The BBCE model consists of three interacting subsystems: Bitcoin blockchain mining and transaction subsystem, Bitcoin blockchain energy consumption subsystem, and Bitcoin blockchain carbon emission subsystem. Specifically, transactions packaged in the block are confirmed when the block is formally broadcasted to the Bitcoin blockchain. To increase the probability of mining a new block and getting rewarded, mining hardware will be updated continuously and invested by network participants for a higher hash rate, which would cause the overall hash rate of the whole network to rise. The network mining power is determined by two factors: first, the network hash rate (hashes computed per second) positively accounts for the mining power increase in the Bitcoin blockchain when high hash rate miners are mining; second, power usage efficiency (PUE) is introduced to illustrate the energy consumption efficiency of Bitcoin blockchain as suggested by Stoll. The network energy cost of the Bitcoin mining process is determined by the network energy consumption and average electricity price, which further influences the dynamic behavior of Bitcoin miners. The BBCE model collects the carbon footprint of Bitcoin miners in both coal-based energy and hydro-based energy regions to formulate the overall carbon emission flows of the whole Bitcoin industry in China. The level variable GDP consists of Bitcoin miner’s profit rate and total cost, which reflects the accumulated productivity of the Bitcoin blockchain. It also serves as an auxiliary factor to generate the carbon emission per GDP in our model, which provides guidance for policy makers in implementing the punitive carbon taxation on the Bitcoin mining industry. Bitcoin blockchain reward halving occurs every four years, which means that the reward of broadcasting a new block in Bitcoin blockchain will be zero in 2140. As a result, the Bitcoin market price increases periodically due to the halving mechanism of Bitcoin blockchain. Finally, by combining both carbon cost and energy cost, the total cost of the Bitcoin mining process provides a negative feedback for miner’s profit rate and their investment strategies. Miners will gradually stop mining in China or relocate to elsewhere when the mining profit turns negative in our BBCE simulation. The comprehensive theoretical relationship of BBCE parameters is demonstrated in Supplementary Fig. 1.

We find that the annualized energy consumption of the Bitcoin industry in China will peak in 2024 at 296.59 Twh based on the Benchmark simulation of BBCE modeling. This exceeds the total energy consumption level of Italy and Saudi Arabia and ranks 12th among all countries in 2016. Correspondingly, the carbon emission flows of the Bitcoin operation would peak at 130.50 million metric tons per year in 2024. Internationally, this emission output surpasses the total greenhouse gas emission output of the Czech Republic and Qatar in 2016 reported by cia.gov under the Benchmark scenario without any policy intervention. Domestically, the emission output of the Bitcoin mining industry would rank in the top 10 among 182 prefecture-level cities and 42 major industrial sectors in China, accounting for approximately 5.41% of the emissions of the electricity generation in China according to the China Emission Accounts & Datasets (www.ceads.net). In addition, the maximized carbon emission per GDP of the Bitcoin industry would reach 10.77 kg/USD based on BBCE modeling. Through scenario analysis, we find that some commonly implemented carbon emission policies, such as carbon taxation, are relatively ineffective for the Bitcoin industry. On the contrary, site regulation policies for Bitcoin miners which induce changes in the energy consumption structure of the mining activities are able to provide effective negative feedbacks for the carbon emission of Bitcoin blockchain operation.

Founder Dinis Guarda

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news, and distribution to create an unparalleled, full digital medium and social business networks spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems