Financial Technology FinTech Report benefits and challenges to the UK

There is no doubt of the global power of Financial Technology (FinTech). This hybrid term describes the application of digital technology to financial services and has been disrupting the way financial organisations work, execute, relate with their customers and how they act 360.

POST the British Parliament’s in-house source of independent, balanced and accessible analysis of public policy issues related to science and technology has been doing an excellent work of reporting research in relation to major topics in Science and Technology within the website parliament.uk/.

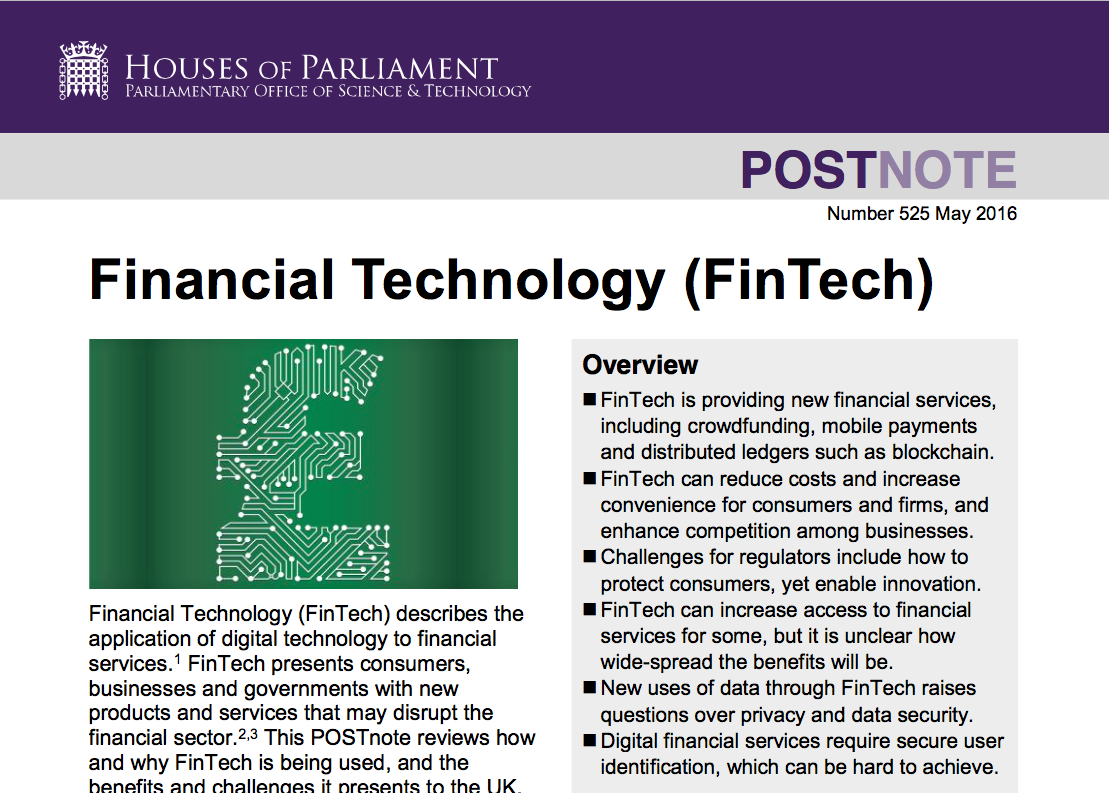

POST – The Parliamentary Office of Science and Technology released a powerful and synthetic report on Fintech activity in the UK on May 24, 2016, done by Authors: Lydia Harriss; Samuel Bayliss. This exceptional report manages as few to summary what is going on in the sector and reviews how and why FinTech is being used, and the benefits and challenges it presents to the UK economy and financial organisation.

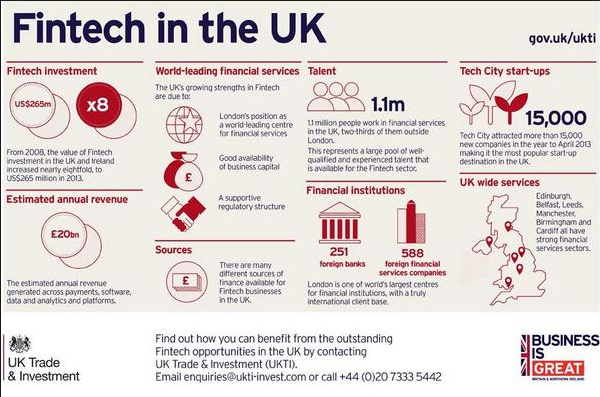

FinTech in UK is changing the types of financial services available, who can access them, and how. The British Government has been one of the global leading innovators in this sector and sees FinTech as an opportunity to create jobs and economic growth. The report estimates suggest that in 2015, the UK FinTech was worth roughly £6.6bn in annual revenue and employed directly around 61,000 people.

Number 525 May 2016

Financial Technology (FinTech) by the Houses of Parliament

This briefing POST report focuses on four emerging and critical areas of FinTech:

- Alternative finance – such as peer-to-peer lending, which enables consumers and companies to obtain loans without using a bank.

- Data analytics – which can be applied to an individual’s financial data to give them low-cost automated financial advice.

- New payments methods – such as apps, which allow transactions to be made with a smartphone.

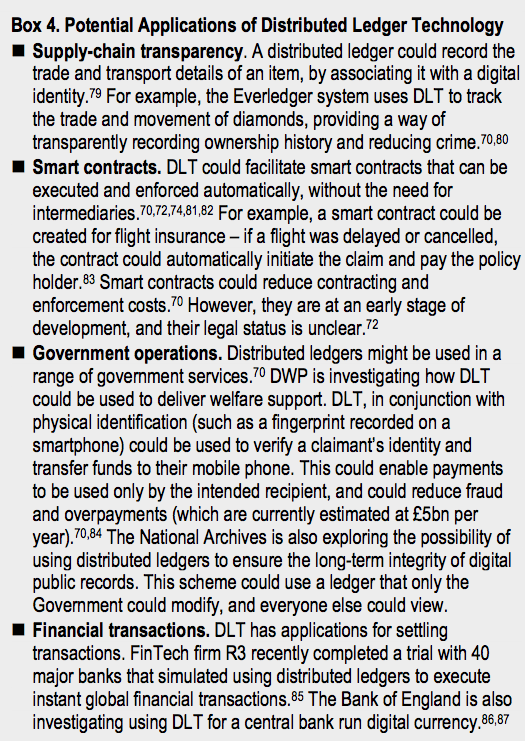

- Distributed ledger technology (e.g. blockchain) – which enables new ways of recording and executing transactions.

FinTech is presenting consumers, businesses, and governments with new products and services. It has the potential to be used as a tool to help regulate businesses, and could help to increase access to financial services for some.

Some other excellent highlights of this report are the display how FinTech is changing the types of financial services available, who can access them, and how. For example:

-

- alternative finance such as peer-to-peer lending allows consumers or firms to obtain loans without using a bank

- data analytics can be applied to an individual’s financial data to give them low-cost automated financial advice

- new payment methods, such as apps, allow transactions to be made with a smartphone

- distributed ledger technology (e.g. blockchain) enables new ways of recording and executing transactions.

The British Government wants the UK to be the world’s leading FinTech center. It sees FinTech as an opportunity to create jobs and economic growth. The estimates suggest that in 2015, UK FinTech:

- was worth roughly £6.6bn in annual revenue;

- employed around 61,000 people;

- attracted approximately £524m of investment.

However, FinTech also presents its challenges. Digital financial services require a secure way for different parties to prove their identity online, which is important for establishing the trust needed to perform transactions and mitigate against identity crime (such as fraud). In addition, FinTech may be difficult to access for the digitally excluded – i.e. people who do not have the skills or technology to use digital services.

The report overview identifies the following areas related with Fintech in the UK market:

- FinTech is providing new financial services, including crowdfunding, mobile payments and distributed ledgers such as blockchain.

- FinTech can reduce costs and increase convenience for consumers and firms, and enhance competition among businesses.

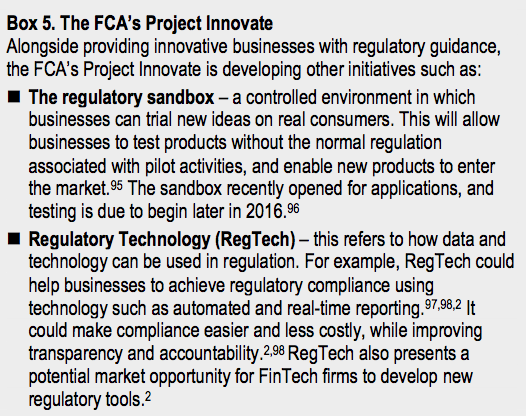

- Challenges for regulators include how to protect consumers, yet enable innovation.

FinTech can increase access to financial services for some, but it is unclear how widespread the benefits will be. - New uses of data through FinTech raises questions over privacy and data security.

- Digital financial services require secure user identification, which can be hard to achieve.

Interesting the summary about distributed ledgers – Blockchain

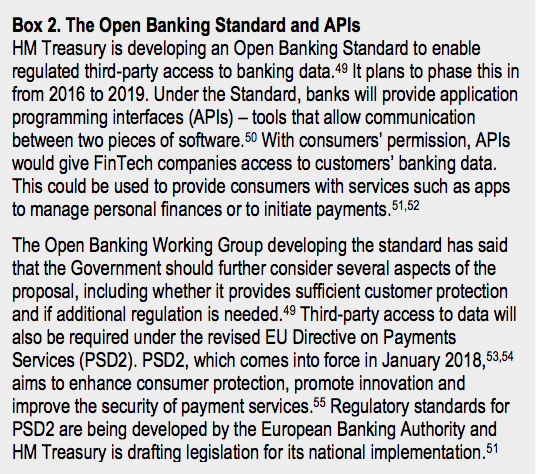

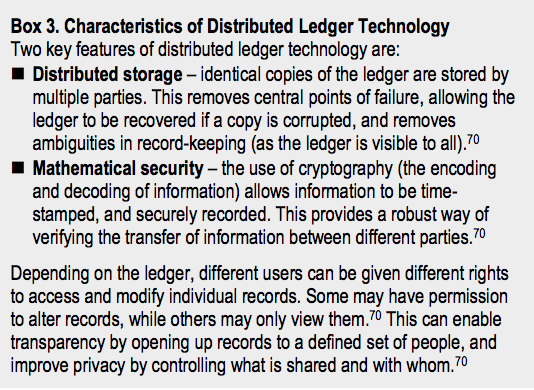

“Distributed ledgers are digital records that can be shared among many different locations or users, without needing to have a central intermediary.70,71 The characteristics of distributed ledgers vary, but all involve distributed and secure information sharing (Box 3).72 DLT was originally developed for digital currencies73 (the blockchain ledger, which underpins Bitcoin), and these currencies remain the main use of the technology (POSTnote 475). However, DLT could be used more broadly (Box 4),74 and outside of FinTech,70 since it provides a way of creating securely shared records for essentially any asset or transaction. An estimate suggests that globally, DLT firms attracted around $490m (£350m) in early-stage investment in 2015.75 DLT research is receiving support from public funding bodies.76,77”

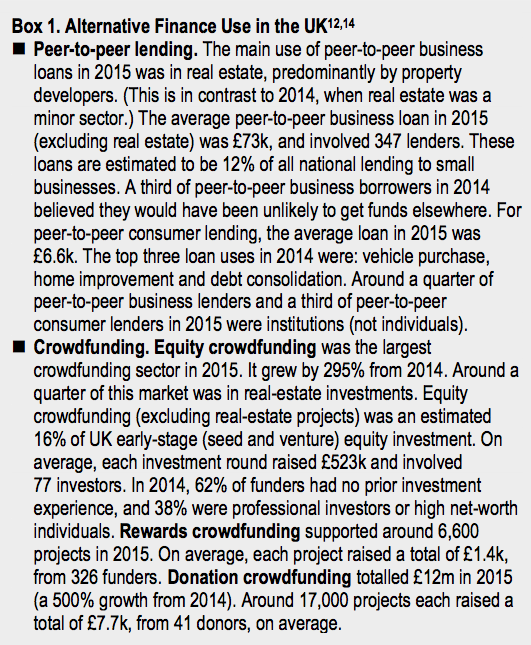

Some of the box highlights in this report that synthesises perfectly what is going in the Financial industry Fintech areas:

Other excellent insights POST provides in balanced and accessible overviews of research from across the biological, physical and social sciences, and engineering and technology. POST place the findings of this research in a policy context for Parliamentary use. You can find the research and reports in the bellow links:

Dinis Guarda is an author, academic, influencer, serial entrepreneur, and leader in 4IR, AI, Fintech, digital transformation, and Blockchain. Dinis has created various companies such as Ztudium tech platform; founder of global digital platform directory openbusinesscouncil.org; digital transformation platform to empower, guide and index cities citiesabc.com and fashion technology platform fashionabc.org. He is also the publisher of intelligenthq.com, hedgethink.com and tradersdna.com. He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays, and governments all over the world.

With over two decades of experience in international business, C-level positions, and digital transformation, Dinis has worked with new tech, cryptocurrencies, driven ICOs, regulation, compliance, and legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

He creates and helps build ventures focused on global growth, 360 digital strategies, sustainable innovation, Blockchain, Fintech, AI and new emerging business models such as ICOs / tokenomics.

Dinis is the founder/CEO of ztudium that manages blocksdna / lifesdna. These products and platforms offer multiple AI P2P, fintech, blockchain, search engine and PaaS solutions in consumer wellness healthcare and life style with a global team of experts and universities.

He is the founder of coinsdna a new swiss regulated, Swiss based, institutional grade token and cryptocurrencies blockchain exchange. He is founder of DragonBloc a blockchain, AI, Fintech fund and co-founder of Freedomee project.

Dinis is the author of various books. He has published different books such “4IR AI Blockchain Fintech IoT Reinventing a Nation”, “How Businesses and Governments can Prosper with Fintech, Blockchain and AI?”, also the bigger case study and book (400 pages) “Blockchain, AI and Crypto Economics – The Next Tsunami?” last the “Tokenomics and ICOs – How to be good at the new digital world of finance / Crypto” was launched in 2018.

Some of the companies Dinis created or has been involved have reached over 1 USD billions in valuation. Dinis has advised and was responsible for some top financial organisations, 100 cryptocurrencies worldwide and Fortune 500 companies.

Dinis is involved as a strategist, board member and advisor with the payments, lifestyle, blockchain reward community app Glance technologies, for whom he built the blockchain messaging / payment / loyalty software Blockimpact, the seminal Hyperloop Transportations project, Kora, and blockchain cybersecurity Privus.

He is listed in various global fintech, blockchain, AI, social media industry top lists as an influencer in position top 10/20 within 100 rankings: such as Top People In Blockchain | Cointelegraph https://top.cointelegraph.com/ and https://cryptoweekly.co/100/ .

Between 2014 and 2015 he was involved in creating a fabbanking.com a digital bank between Asia and Africa as Chief Commercial Officer and Marketing Officer responsible for all legal, tech and business development. Between 2009 and 2010 he was the founder of one of the world first fintech, social trading platforms tradingfloor.com for Saxo Bank.

He is a shareholder of the fintech social money transfer app Moneymailme and math edutech gamification children’s app Gozoa.

He has been a lecturer at Copenhagen Business School, Groupe INSEEC/Monaco University and other leading world universities.