Positive Investment is the new generation of socially responsible investing. Positive Investment can also be called Impact Investment. It involves making investments in activities and companies believed to have a positive social impact

Ethex is a company that is focused on bringing about positive investing. According to Ethex the company enables investors to do this in a way that is simple and secure. Positive investing is explained by Ethex to be:

“Putting your money directly into businesses whose mission and impacts you support and that also offer a financial return.”

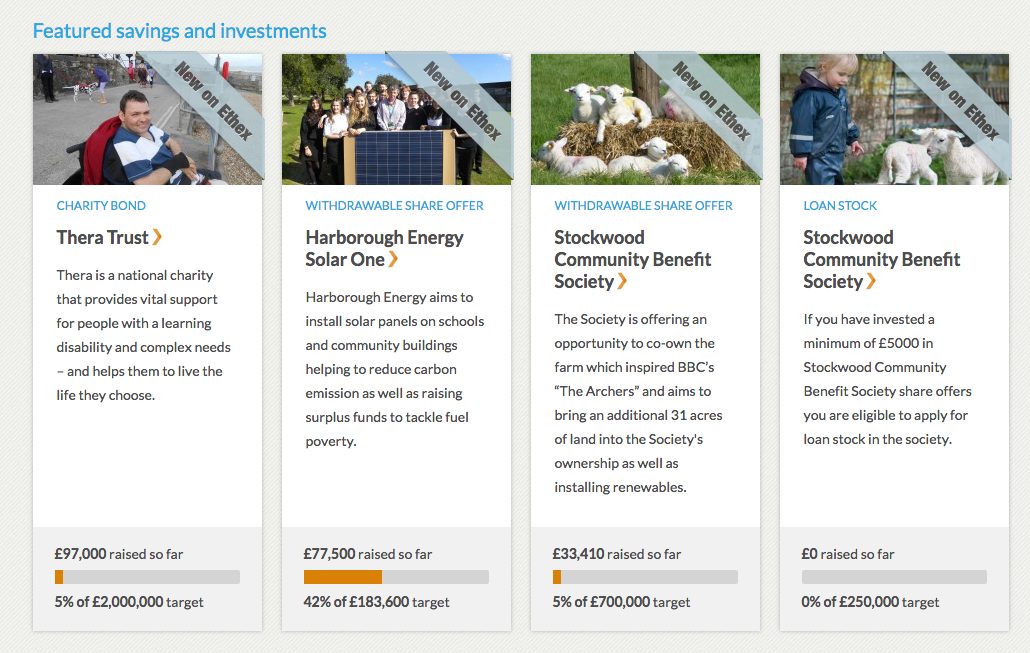

The company was founded in 2012. The way it works is that investors are able to browse different investments by type to choose investments that will be suitable for them. It is then possible to look in more detail at the social and financial profiles of the businesses to be able to understand them better. Ethex provides detailed information about the investments that allows investors to be able to invest. The company also offers a portfolio service that can be helpful in tracking the performance of positive investments and the status of orders. There is also a handy “investment alerts” service that provides information about what Ethex is up to and updates on some of the possible investments.

There are various different possible investment types available via Ethex. These include charity bonds, business bonds and debentures, equity investments, funds, stocks and share ISAs. There are savings accounts and savings bonds, cash ISAs, children’s savings accounts and children’s ISAs too. Looking at business bonds and debentures first, these are considered longer term investments where money is lent to an ethical organisation for a set amount of time which can be between one and 20 years or more.

This helps the business to fund or expand activities. Debentures are not secured, and it requires the belief that the business will be able to pay the money back, while bonds may or may not be secured. For the investor there is interest and the money is returned with interest at the end of the loan. There are a range of bonds available on the platform that in many cases run for five years and offer 3-7% interest, which is a lot higher than is possible to get on a bank savings account.

Equity investments are also available on the site. Equity investments include withdrawable shares, transferable or ordinary shares and depository receipts. The withdrawable shares are issued by cooperatives. You get interest but the money is more at risk than it is with regular savings. Ordinary shares usually lead to investors getting paid dividends if the company turns a profit. Depository receipts are offered by international social investment organisations and are like shares but without voting rights. Options for investment currently available on the website range from companies that did not pay a dividend last year to those paying as much as a 7% dividend, so it makes sense to choose wisely.

Funds are also available on the site, though there is only one to invest in at the current time. Investing in a fund allows the person to have the fund manager invest in a variety of investments so that your risk is spread overall. The fund currently available for investment on the platform is the Triodos Sustainable Pioneer Fund. This offered an 11.5% return in 2014, and to date has invested in more than 60 innovative companies. You have to have £1,000 to be able to invest. The companies invested in are considered to be corporate social responsibility pioneers and those working in sustainable energy and medical and environmental technology.

Many of the other products available on the platform are also offered through Triodos Bank. However, Ecology Building Society which offers a savings account with a 1% interest rate and a minimum investment of £25.Bristol Credit Union also offers a member share account. This paid a 1% dividend every year for the past four, and the minimum investment is just £1.Charity Bank offers a community account and this pays between 0.7% and 1.5% interest, but you have to be able to invest £1,000 to get access to this account. For those without that level of money to put into savings, Charity Bank also offers a savings account paying 0.5% to 1% interest, with a minimum investment of only £10. Charity Bank also offers an ethical cash ISA which pays a return of 1%, though you need to be able to invest £250 to get access to it.

Paula Newton is a business writer, editor and management consultant with extensive experience writing and consulting for both start-ups and long established companies. She has ten years management and leadership experience gained at BSkyB in London and Viva Travel Guides in Quito, Ecuador, giving her a depth of insight into innovation in international business. With an MBA from the University of Hull and many years of experience running her own business consultancy, Paula’s background allows her to connect with a diverse range of clients, including cutting edge technology and web-based start-ups but also multinationals in need of assistance. Paula has played a defining role in shaping organizational strategy for a wide range of different organizations, including for-profit, NGOs and charities. Paula has also served on the Board of Directors for the South American Explorers Club in Quito, Ecuador.