Paysend will help more than 8 million foreign workers, migrants and international students in Canada by making money transfers simple, quick and at a low fixed fee

Paysend, the UK-based fintech business, has secured a licence to operate in Canada, expanding its worldwide footprint for its global money transfers service. Paysend will launch the service to Canadian consumers early in 2020.

Obtaining the money service business (MSB) license in Canada is Paysend’s first step in establishing its presence in North America. The license allows Paysend to offer its signature Global Transfers service in Canada.

Canada is one of the largest global money transfer markets in the world. Migrants and foreign workers in Canada transfer over $24bn (US dollars) home each year, according to the World Bank Report. The top five countries receiving money transfers from Canada are China ($4.1bn), India ($2.9bn), Philippines ($2.4bn) France ($1.3bn) and Italy ($1.1bn).

Canadians also receive $1.3bn in money transfers, according to the World Bank. The five markets sending the most to Canada are the US ($879m), the UK ($92m), Australia ($47m), Italy ($27m), and France ($25m).

Canada has the highest proportion of immigrants within the G7 (being the seventh largest economy worldwide) at 21.5% or 8.1m migrants compared to a 37.6m population.

Ronald Millar, CEO at Paysend, said: “Canada is home to a large number of immigrants, most of whom regularly send money to their families back home. Very often these transactions are life changing for those that send or receive them. We want to support these people by making what was once laborious, slow and expensive, simple, quick and with a minimal cost.

“Moving into Canada is a significant step for Paysend global expansion plan, establishing a firm foothold in North America which is a massive opportunity.”

Launched just two years ago, Paysend’s card-to-card global money transfer service now has over 1.2 million users around the world. Its unique proprietary technology enables secure, safe and simple money transfers, globally.

Paysend’s growth stems from the emergence of increasingly mobile segments of the work force and the continued increase in international migrants. These are people who live and work in one country while often financially providing for, or relying on, other family members in another country.

World Bank figures show that there are now 270m people worldwide who live outside their home country, sending an estimated $689bn home. This is almost ten times as much as it was in 1990 and it’s already a major part of the receiving countries’ economies.

Timur Shomansurov, Canada country manager at Paysend, said: “I’m excited that soon Canadians will be able to access a money transfer service that prioritises convenience, accessibility and low fees. Paysend is raising the bar and is setting a new standard for the whole industry. This will ultimately lead to improved customer experience, lower fees and higher customer satisfaction for everyone sending money abroad.”

“Our unique Global Transfers service enables customers to move money in an instant anywhere in the world. With fixed and transparent fees, our service ensures that more of our customers’ money is enjoyed by those they care about.”

Paysend charges the same transfer rate, regardless of whether it is buying or selling a currency. This means the cost to customers is just 3 CAD for transaction fee.

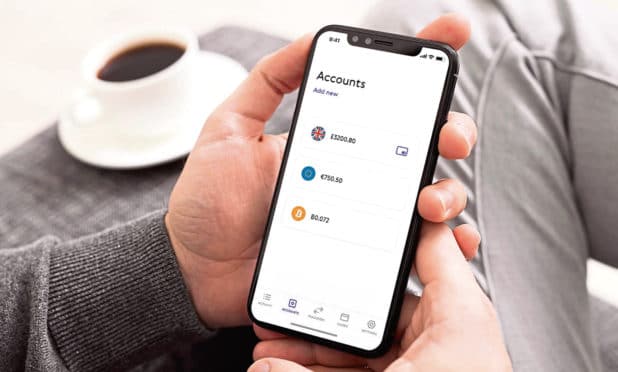

Instant, freemium and borderless, Paysend’s Global Transfer customers can simply transfer money card to card, to a bank account, a mobile wallet or simply using a phone number.

About Paysend

Paysend is a global Fintech company founded in 2017 in UK and regulated by FCA. The company is currently serving clients in 45 countries in multiple currencies. Paysend provides instant cross border and local payment services in a simple and smart way. The company’s unique money transfer and proxy card technologies already serve over 1.2 million customers worldwide. Paysend is money for the future.

Paysend partnered with number of banks, international and local payment systems including major international card networks – Visa, Mastercard and China Union Pay.

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news and distribution to create an unparalleled, full digital medium and social business network spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems.