Revolutions in Banking Technology, continue to accelerate at a rapid pace. There is already a lot going on the mobile space, as mobile devices are the conduit to access channeled services, but perhaps in recognition of this fact, financial tech boffins are turning their attention to facial recognition technology. Take British Company Facebanx for example, the company has developed a new online facial recognition solution that will enable banks, payment processors, insurance and ID verification companies to dramatically reduce fraud and ID theft.

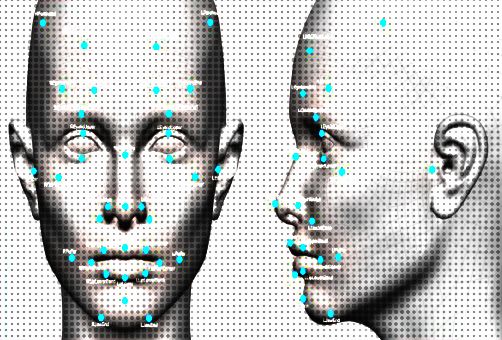

Facebanx works by users simply adding their face to their account via the camera on their laptop, mobile phone or tablet and then the software compares the facial image against a database of faces to flag up possible fraud. Each face is recorded via a video stream and the technology compares multiple images taken throughout the recording to confirm that the person is real and not a photo.

The timing of all of this is interesting. A recent Cisco survey has said ‘Customers around the world are becoming increasingly comfortable carrying out major “high touch” interactions with their banks through virtual channels’. Of 1514 people from 10 countries quizzed by the IT giant, around two thirds say that they want access to banking services whenever they need them, that they want competent advisors, and that they want efficient communications.

In order to get these things, respondents are willing to use digital channels – 71% are comfortable with the increasing use of virtual communications in addition to in-person financial conversations. Because consumers are willing to trust and use digital channels, advances in facial recognition should provide reassurance. Hardware providers like Samsung may not be too far off as strategic partners either. Samsung provides not only smart phones but smart TVs as well. The built-in camera on the ES8000 is equipped with facial recognition technology that can automatically log you on to your Smart Hub and VoIP service Skype without needing a password or ID. With the right partnership I can see financial applications working seemlessly accross mobile to large screen devices.

Jorgen Ericsson, VP, global financial services practice, Cisco Internet Business Solutions Group, says: “Retail banks that succeed in providing a seamless customer experience across all channels to market- branch, mobile, online, contact centre- will be the winners of the future. Superior customer experience will be the only long term sustainable differentiator. Matthew Silverstone, CEO of Facebanx, said: “Our product has been specifically designed to combat fraud and provides a unique solution for processors to share data to combat multiple acts of fraud. We are currently in discussions with a number of processing companies, banks and merchants about adding our software to their CRM.”

Looking at the Facebanx example, how does it all work in practice?

The Facebanx system asks a customer to take a picture of their face using a webcam, smartphone or tablet device with a camera when they sign up for a new bank account, insurance plan, online wallet or other sensitive service. This face is then registered in the facebanx database so that the same face can’t be assigned to a different account, or a different face used to access the original account.

Face capture is taken from a live video recording, which uses all manner of detail in the recording to ensure that it’s not just a still image being held up to the camera. I am not sure if it will work under ‘duress’ situations but it is a live steam…

Does all of this make you comfortable? Bruce Schneier, chief security technology officer at BT, summed a question regarding mobile transactions: “Yes, there are going to be security issues and they will have to shake out. The question is, if something happens will the bank make it up to you?” Apparently it will. The rules regarding liability in mobile banking are the same as they are for other methods of banking, said Jim Van Dyke, president of Javelin Strategy & Research.

Image credit: FaceBanx

Hayden Richards is Contributor of IntelligentHQ. He specialises in finance, trading, investment, and technology, with expertise in both buy-side, sell-side. Contributing and advising various global corporations, Hayden is a thought leader, researching on global regulatory subjects, digital, social media strategies and new trends for Businesses, Capital Markets and Financial Services.

Aside from the articles, interviews and content he writes for IntelligentHQ, Hayden is also a content curator for capital markets, analytic platforms and business industry emerging trends. An avid new media explorer Hayden is driven by a passion for business development, innovation, social business, Tech Trading, payments and eCommerce. A native Trinidadian, Hayden is also a veteran, having served with the Royal Air Force Reserves for the past 10 years.

Follow Hayden on Twitter @HaydenARichards, linkedin.com/haydenhrichards and http://www.scoop.it/u/hayden-richards