Equities are losing their sheen as the pandemic keeps earnings growth in check, and cryptocurrencies are all the rage in today’s investment world. Things were simpler back in 2010 when Bitcoin (BTC) was the undefeated king of the crypto kingdom.

Since then, many rivals have emerged to dethrone BTC. While none have quite surpassed Bitcoin’s market cap so far, some cryptocurrencies like Ethereum (ETH) may soon give BTC a run for the top spot. For the time being, BTC retains the crown.

Everywhere on the internet, people are bragging about the quadruple-digit returns they made trading crypto. Some also lost a good chunk of their wealth, of course. The human mind wonders; it’s only natural to get curious about an investment that is taking the world by storm.

What is cryptocurrency?

Cryptocurrencies are digital assets that can be used for transactions, just like fiat currencies. Think about it this way, a person can buy an iPhone in the U.S. if they have enough Benjamins. If they wanted to buy an iPhone in Japan, they’d need to convert their USD into the Japanese Yen first.

Similarly, they can convert their USD into a cryptocurrency and buy an iPhone from a vendor that accepts cryptocurrency as a payment method. While widespread acceptance of cryptocurrencies as a payment method could take a while, cryptocurrencies have also emerged as an attractive investment vehicle.

The term cryptocurrency is derived from the word cryptography, which means the art of solving or writing codes. Any crypto coin is just a unique code that can’t be duplicated. This makes it simple to track them through the trail of transactions.

Cryptocurrencies are high-risk investments. They can produce millionaires overnight, or leave investors with half the wealth. This is why it’s recommended to trade crypto with caution and get educated before dipping toes in the crypto ocean.

5 Things to Know Before Investing in Cryptocurrencies in 2021

Some of these revelations can be potentially baffling for someone who has no knowledge of cryptocurrencies. Regardless, they are a hundred percent true. They are important factoids and pieces of information that one should know before they start trading or investing in cryptocurrencies.

There are cryptocurrencies other than Bitcoin

Most beginners have one common myth; they think cryptocurrency = Bitcoin. As discussed already, Bitcoin is undoubtedly the king of the crypto kingdom, but that doesn’t mean it’s the only cryptocurrency.

Some popular altcoins, or alternative cryptocurrencies, are Ethereum (ETH), Chainlink (LINK), and Ripple (XRP). Ethereum and Chainlink in particular are interesting bets given their strong fundamentals. There is also another category of cryptocurrencies that has been increasingly attracting investor’s attention, which is stablecoins.

Stablecoins are coins that are pegged to the value of an underlying asset, generally a fiat currency. Tether (USDT) and USD Coin (USDC) are particularly interesting coins in this category. Stablecoins don’t usually generate capital gains, but investors can deposit them with platforms to earn interest. They’re like the fixed income securities of the crypto-verse.

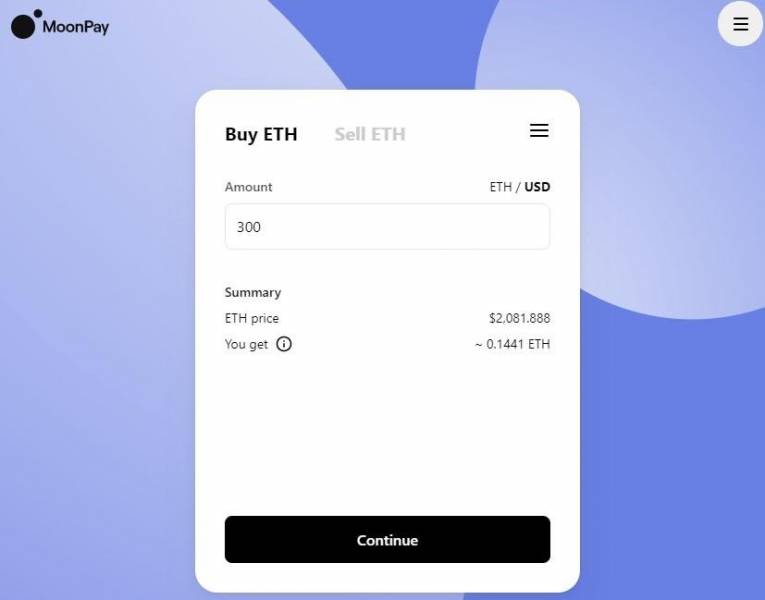

So, how does a person decide on whether they should buy Ethereum, Bitcoin, Chainlink, or Tether? It depends on the investor’s risk appetite and the cryptocurrency’s fundamental strength. As beginners, it’s best to start with stablecoins, just to test the waters. Someone with a higher risk appetite could even start with BTC or ETH, though. They’re all easily available on platforms like MoonPay.

Cryptocurrencies are yet to mature

Cryptocurrencies have been around for over a decade, but they are still in their infancy. The infrastructure needs a lot of ironing before it can become viable for universal use. There is also plenty of grey area when it comes to the general public’s understanding of cryptocurrency. Nobody knows who founded Bitcoin–and the founder is among the world’s richest persons as of today. Plus, a very tiny percentage of the population knows the system and how it operates.

Venturing into the crypto-verse with a blindfold is suicide. Unless a person is confident enough to explain what cryptocurrency is to a 12-year-old, they shouldn’t waste their time or money investing in crypto. It may seem as though everyone and their dog is buying crypto, only 4% of Americans have invested in crypto so far.

No keys, no coins

Cryptocurrencies, though digital, are still bearer assets. Whoever holds the asset is assumed to be the rightful owner, just like cash. If a person loses their cryptocurrency, it’s irrecoverable.

Cryptocurrency coins, as discussed earlier, are just a unique line of code. These codes are known as keys and are stored on wallets. Experts always advise on using cold wallets instead of hot wallets.

Hot wallets are wallets on cryptocurrency exchanges. These wallets are vulnerable to hacks and scams because they are largely unregulated. Decentralized finance platforms often bear the brunt of exploitative activities.

On the contrary, cold wallets offer a lot of safety for keys. Cold wallets are hardware devices, which could be a flash drive or even just a piece of paper. Crypto investors can store the unique string of code on these devices that have no internet access for better security.

However, there is a tradeoff. Investors run the risk of losing this piece of paper or flash drive. In that case, investors lose all of their holdings. Investors could also forget the password to the key that unlocks their crypto, also referred to as the seed phrase.

The dos and don’ts

There are a few underlying principles every crypto investor needs to ingrain in themselves to stay safe.

Discipline: It’s common for investors to get FOMO (fear of missing out), but rest assured, it is a guaranteed way to destroy wealth. Taking trade calls solely based on a gut feeling is a terrible approach. A trading decision must always be backed by strong research.

If an investor holds a coin that’s in an uptrend, it should be sold when their research suggests so, without giving in to the fear of losing out on the remainder of the rally.

Research: Just looking at the price chart and selecting a crypto that’s in the green isn’t research. Look at the cryptocurrency’s fundamentals to assess its capability to provide value. Look for the “why” before investing – why will someone want ETH instead of BTC? Why is one cryptocurrency more volatile than the other?

Only allocate a certain portion to crypto: It’s best to only invest money that investors can afford to lose. Cryptocurrencies swing diabolically, the only thing that can be guaranteed is volatility. Therefore, it’s prudent to allocate a small portion of the portfolio to cryptocurrencies. Putting too much money into cryptocurrencies in the hopes of multiplying wealth could quite easily go wrong.

Build thick skin: There will definitely be times when the price chart turns red. The prices may seem to plummet beyond the point of recovery. Selling the investment out of panic when the prices have bottomed out ensures a huge loss.

If history has taught investors anything, it’s that fundamentally strong assets ultimately recover. If an investor had thoroughly researched before investing and the fundamentals haven’t changed, a plunge in the price shouldn’t cause panic. Granted, it can make investors feel anxious, but they need to develop a thick skin to resist the urge to sell.

Tax consequences

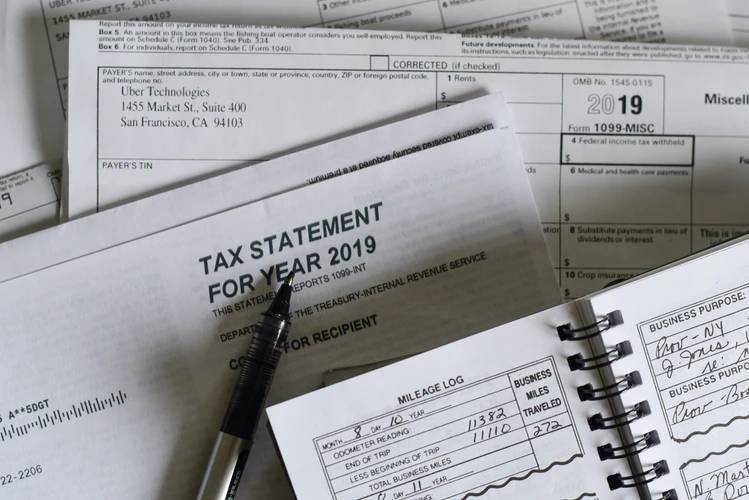

The IRS considers cryptocurrencies as property for tax purposes, not currency. While unrealized capital gains don’t bother uncle Sam, utilizing even a cent out of those gains will bring them knocking at the door.

For instance, an investor invests $10,000 in Bitcoin and the investment value appreciates to $15,000. The investor is fine until they spend any amount out of the $5,000 gain.

The concept of “de minimis exemption” doesn’t apply here, though the industry has been making consistent efforts to change this. What’s more, the IRS has mandated sharing account information for centralized cryptocurrency exchanges.

While the crypto world isn’t as heavily regulated as equities, it still gets plenty of attention from the federal government.

Investors can buy cryptocurrency with cash. Those who run an entirely cash-based business may be tempted to use crypto investments as a way to keep their earnings off the books. However, the government is running a giant deficit and won’t blink an eye before paying such investors a visit.

Go slow and steady

Wealth creation takes time. Especially with cryptocurrency, where several variables are still unknown. Will crypto investing become simpler and safer in the future? Quite possibly, yes. However, from the way things are today, it’s important to tread with caution.

Remember, if something sounds too good to be true, it probably is. Someone who puts in their hard-earned money into crypto hoping to walk out with bags full of cash is daydreaming. Crypto is not an asset that an investor should break their 401(k) for.

However, adding a small crypto exposure to a portfolio could potentially drive up the overall gains over time. Before moving forward with a crypto purchase, though, the investors must understand their risk appetite. If volatility causes an investor to lose sleep, it’s better to not invest in crypto at all.

Author

Arjun Ruparelia – ruparelia.arjun@gmail.com

An accountant turned writer, Arjun writes financial blog posts and research reports for clients across the globe, including Skale. Arjun has five years of financial writing experience across verticals. He is a CMA and CA (Intermediate) by qualification.

Founder Dinis Guarda

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news, and distribution to create an unparalleled, full digital medium and social business networks spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems