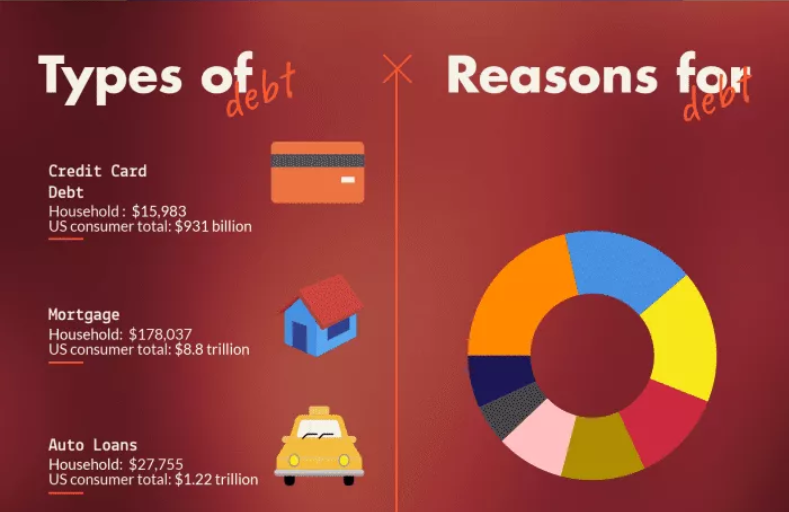

According to a new survey from CreditCards.com, over half (47%) of U.S. adults, or approximately 120 million individuals, have credit card debt, up from 43 percent recorded in early March.

Meanwhile, governments are imposing stay-at-home orders, which have caused millions of companies to close their doors. As a direct result of the present Covid-19 epidemic, 23 percent of credit card borrowers have increased their credit card debt.

The epidemic has had the greatest impact on millennial credit cardholders, with 1 in 3 (34 percent) falling further into debt.

According to Ted Rossman, an analyst at CreditCards, millennials are more likely than prior generations to face financial difficulty for two reasons. As a result of a rapid and unexpected increase in unemployment, 30 million individuals have been compelled to file for unemployment benefits. Along with millions of young Americans just scraping by, this has driven many people to use credit cards to pay for essentials. Since the unemployment rate was so high, individuals were compelled to use their credit cards, unlike during the 2008 and Dot Com collapse recessions.

Fewer than one-third of millennials (ages 23 to 38) say they have enough money saved to last at least three months in the event of an emergency, according to Schwab’s 2019 Modern Wealth Report 36 percent of respondents told Schwab that they had no money set aside for an unexpected expenditure, according to the survey results.

Rossman said millennials’ capacity to save is hindered by sluggish pay growth and growing expenses of living. After inflation, typical hourly salaries have scarcely changed in 50 years, while certain significant costs such as housing and tuition have increased enormously,” he says.

According to research by the nonpartisan think tank New America, millennials earn roughly 20 percent less than baby boomers at the same time of life. As millennials join the labor market, they’ve already seen two recessions.

According to research by the nonpartisan think tank New America, millennials earn roughly 20 percent less than baby boomers at the same time of life. As millennials join the labor market, they’ve already seen two recessions.

As a result of these factors and the Great Recession, millennials have had a harder difficulty building up assets than Generations X and Boomer,” stated Rossman.

According to CreditCards.com research, paying more than the minimum (60 percent), balance transfers (13 percent), and paying only the minimum are the most frequent strategies for paying off debt (13 percent ). Thirteen percent of Americans pay nothing (9 percent) or have no plan at all (4 percent ).

Because of this, Rossman believes that new solutions should be considered.

‘Two months earlier, I would have advised someone to take out a personal loan or a transferrable balance.’ Banks have ceased making personal loans and credit card firms have stopped giving interest-free balance transfers,” he added.

Rossman observed that banks are giving discounts on credit card payments.

We believe that people should communicate directly with their credit card providers. You can ask for a respite or to miss a payment at any bank,” he added.

When it comes to debt repayment, Rossman advises against utilizing unemployment or stimulus cheques.

As a precautionary measure, you’ll want to keep some cash on hand. Don’t use it all up! Instead, ask your credit card company for lines of credit.”

Eligible taxpayers can get up to $1,200 for singles and up to $2,400 for couples under the CARES Act Children who qualify for the program might receive up to $500 in financial assistance.

As a result of the reopening of several states, the economy is expected to gradually recover. Make a list of your debts and start putting out a budget or game plan for how you’ll pay it off.

Eventually, Rossman says, limitations will start to loosen, allowing for balance transfers and/or personal loans. As soon as things get back to normal, these avenues will be open again.

Markets and Debts

Another factor contributing to debt markets and the production of excessive debt is the fundamentally private character of most debt contracts, as well as the manner that banks operate and offer credit in modern liberalized financial markets. Rather than transferring money from savers to investors, banks generate new money in most cases. As explained in a recent Bank of England publication, commercial banks produce the majority of the money in the economy through making loans. Fractional reserve banking assumes that central banks regulate private bank money supply through reserves, that is, the percentage of deposits needed to generate new loans, which is in direct opposition to what is actually happening. According to the Bank of England, money production is restricted primarily by interest rates, which are set by the central bank itself. In any case, the production of new money is connected with the formation of new debt in the economy.

Banks’ ability to issue new credit is hampered by two primary factors: their high level of leverage and the long and complicated chains of transactions they originate in the capital markets, a phenomenon known as the securitized banking model. CMU’s fundamental pillar of securitization appears to be centered around the aforementioned deals.

With the use of high leverage financial companies, like banks, see a big profit. However, it is worth noting that the leverage size isn’t quite adequately regulated. Because of that, there are many circumstances when people get into debt. Nevertheless, it’s obvious that for example, leverage in Forex trading allows traders to increase their income, or vice versa, lose more money and the same goes for people who use leverage in other aspects, policy-makers have for too long ignored the detrimental effects that this can have on the financial system as a whole. The expansion of credit supply raises debt and leverage, which may be advantageous for the individual business (as it leads to a faster and cheaper asset growth), but will inevitably result in excesses of credit and finally asset bubbles. A policy approach should take note of the fact that asset price bubbles distort the allocation of capital in the economy, and also affect the distribution of income within the economy.

As early as the 1980s, financial institutions began engaging in shadow banking operations, both on the asset and liability side, expanding interconnections with unregulated companies and products. Firms in the shadow banking system perform many of the same services as banks, but they are not subject to the same regulatory framework as banks. As a result of reserve requirements, banks are required to set aside a certain amount (or a certain percentage) of cash reserves that they receive as deposits and deposits with the central bank. FRB and money multipliers, which are described in textbooks as methods to restrict the quantity of money generated by banks, rely on this principle.

Why Do People Get Into Debt?

When was the last time you thought about how and why individuals fall into debt? Why do we experience financial difficulties at some point in our lives? Having debt may have devastating repercussions; it can ruin a relationship, cause us to lose our possessions and all we have worked so hard to build, and it can cause mental pain, unlike any other situation we have ever encountered before!

Why, therefore, would anyone assume the risk of incurring debt in the first place? Some factors are due to our decisions, while others are due to unforeseen events.

So we can detect the warning signals and try to escape the debt cycle, it’s vital to understand how we might become overwhelmed by debt.

If you’re going to comprehend debt, you’ll need to know how the debt cycle works. As soon as we begin to spend more than we earn, a debt cycle begins. Some of the reasons behind this might range from simple ignorance to a desperate need.

Not to be forgotten is the fact that a lot of our non-discretionary costs are influenced by our lifestyle and choices, such as our living area, our house, our automobiles, etc.

Soon after entering the debt cycle, we find out that our original plan to pay off the modest debt we acquired is not feasible, and we find ourselves borrowing up to the credit limit on our first credit card. A second credit card or credit facility is then obtained. Balance transfers at zero percent interest typically encourage this behavior, as it is believed that debt will be paid off much faster at zero percent interest.

Whenever our expenses exceed our income, we must borrow to maintain our lifestyle. That’s partly because it’s so easy to borrow money and because we have a range of options that make using credit to pay for routine expenses a breeze. So that they may survive until the next payday, many people use their credit cards for little items that they expect to pay off when their next salary comes in. It’s the only way to pay off the increased debt because of our fixed or non-discretionary expenses. Not to be forgotten is the fact that a lot of our non-discretionary costs are influenced by our lifestyle and choices, such as our living area, our house, our automobiles, etc.

Soon after entering the debt cycle, we find out that our original plan to pay off the modest debt we acquired is not feasible, and we find ourselves borrowing up to the credit limit on our first credit card. A second credit card or credit facility is then obtained. Balance transfers at zero percent interest typically encourage this behavior, as it is believed that debt will be paid off much faster at zero percent interest. A common misconception is that a credit card’s initial 0% interest rate only applies to the transferred amount, and any new purchases are charged at the normal credit card rate. This means the introductory rate period is rapidly over and little progress has been made in paying off the debt. Now you’re being charged the full interest rate on both the current balance and the additional debt you’ve incurred.

The reasons people incur debt are numerous.

When it comes to interest, it might be difficult to determine how much it costs. Inadequate budgeting often leads to debt. You can’t keep track of your spending without a budget. This is the greatest approach to understand where you can minimize needless costs and prevent debt. We’ll all be held accountable at some point.

This increased concern for social circles and how they are viewed by friends and family might influence how we spend money or incur debt in order to preserve a false image of their financial status…

People take on debt in order to live and provide for their families’ fundamental necessities, such as food and shelter. Rarely are people in debt just for the sake of need; instead, one or more of the other causes are involved.

Expenses might quickly surpass income in the event of a reduced income. As long as it’s seen as an inconvenience that will pass, no lifestyle adjustments should be undertaken (often driven by pride). You must take immediate action to ensure that you understand the implications of your income shift so that you can establish a budget and plan to accommodate it. Some people hope that the reduced income is only temporary and that the adjustments to lifestyle and expenditure are made as soon as possible, without utilizing credit to support a lifestyle during this period, since it may be highly harmful.

More than half of Canadian marriages end in divorce, which can be caused or exacerbated by personal financial issues, such as debt.

Using the rise of online gaming, it has become increasingly popular and easy to fund with credit cards. You may easily become addicted to gambling if you think about “the big victory” or the concept that you’ll just win back what you lost and then quit.

We must be prepared for unexpected costs in order to prevent unnecessary debt. In the event of an emergency, you won’t have to rely on easy-to-access, short-term, and high-interest credit. If you’re unlucky enough to get sick or lose your job or go through a breakup you won’t have to worry about going into debt.

It is quite easy and frequent for us to get into debt in any of the circumstances listed above. It will be a lot simpler to deal with these situations if you acquire strong money management and budgeting abilities before they happen. Every time we spend over our means, we diminish our wealth and put ourselves in financial danger. Through financial discipline, you may substantially minimize your chances of getting into a vicious circle of borrowing.

Founder Dinis Guarda

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news, and distribution to create an unparalleled, full digital medium and social business networks spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems