If you are to inherit or if you want to make your will it is important that you learn about inheritance tax (IHT), as it is possible, by planning accordingly, to avoid paying unnecessary IHT.

Because of the rising prices of property, particularly in large cities, Inheritance tax changed in the 2015 budget, to allow people to pass on more to children or grandchildren without being taxed. There are various reliefs and exemptions available that can help you reducing your IHT liability. Since most of us don’t own a property worth GBP 350,000 the reliefs will be enough to solve the problem.

This little guide introduces the reader to some concepts and offers some tips for reducing your estate’s exposure to IHT. For the more complex areas of IHT planning, it is important to seek professional advice before taking action. You should talk to your financial adviser or if you don’t have one, you should find some help. Alexander, an accountancy and consulting firm, can help you with your plans for your estate and see if IHT planning can help your beneficiaries when the time comes.

What is IHT?

Inheritance Tax is a tax on the estate (the property, money and possessions) of someone who’s died. IHT is charged on your estate at 40%.

What is “nil rate band”

Nil rate band (NRB) is the amount which a person can leave on death with IHT being charged at zero (i.e. no tax is payable on it at all). Everyone who his a resident in the UK has a ‘nil rate band’. The current NRB was changed. The current threshold is £325,000, but from April 2017 a new, higher threshold including a “family home allowance”, will begin to be phased in.

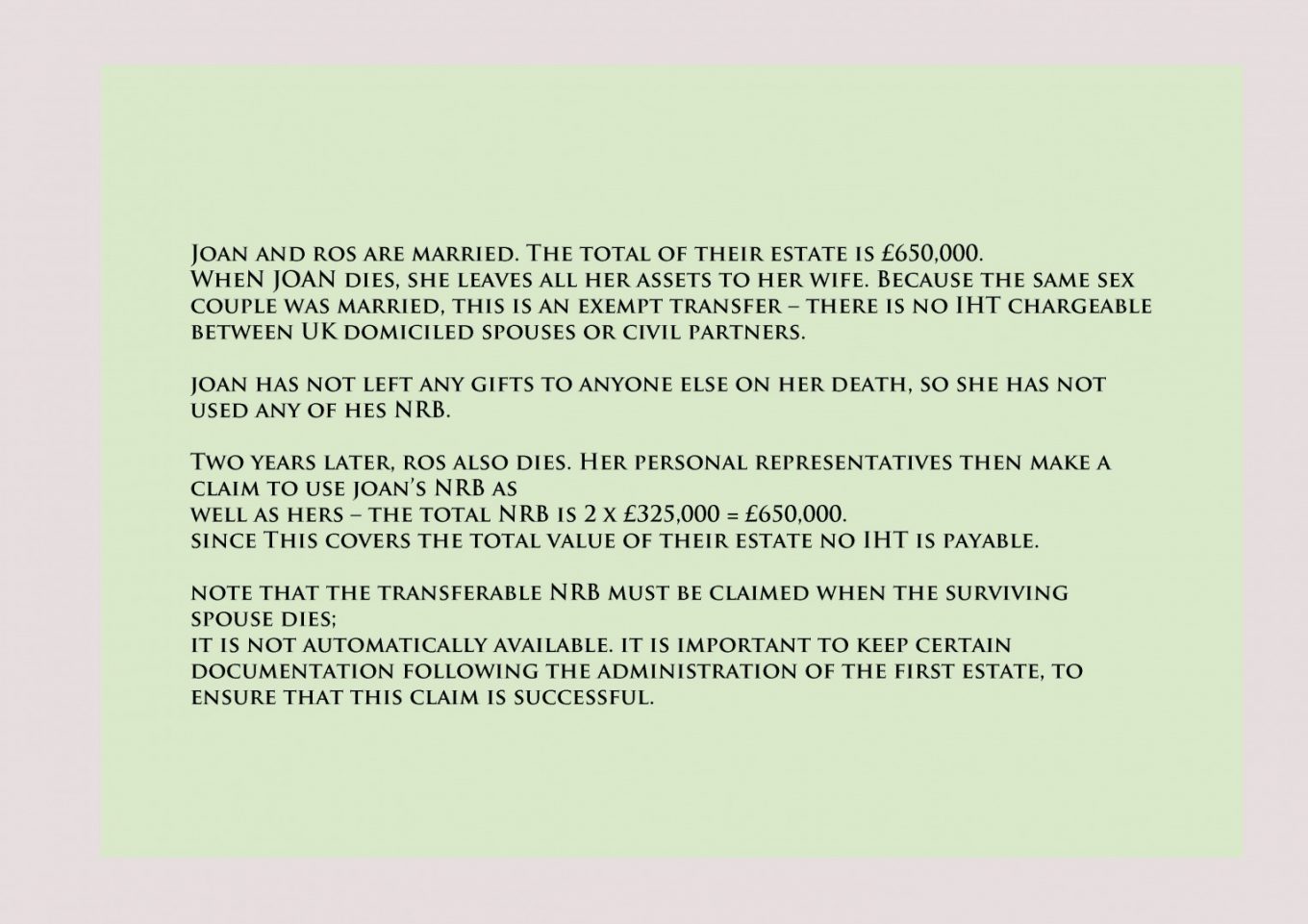

The Transferable Nil Rate Band

In previous years, unless an individual used their NRB upon death, it was lost. This often used to be the case where, for example, a husband died and left all his assets to his widow. When transferring his assets to the widow, even though this would be exempt from IHT, the husband would be wasting the NRB.

Since 2015 it is possible to transfer NRB. ‘Transferable NRBs’ must be claimed though when the surviving spouse dies as it is not automatically available. In the example above, due to the transferable NRB, if claimed, the widow will also inherit any unused portion of her husband’s NRB. This will then allow her to leave more to her children without them having to pay IHT.

Exemptions

Some exemptions to IHT are gifts made during someone’s lifetime. These include interspousal gifts, small gifts, annual exemption, wedding gifts, payments or gifts from normal expenditure, charitable gifts. Be careful to understand what it is meant by gift.

According to the HMRC, a gift can be:

- anything that has a value, eg money, property, possessions

- a loss in value when something’s transferred, eg if you sell your house to your child for less than it’s worth, the difference in value counts as a gift

On small gifts you make out of your normal income, for example Christmas or birthday presents, there is none IHT to be paid. These are known as ‘exempted gifts’.There’s also no Inheritance Tax to pay on gifts between spouses or civil partners. You can give them as much as you like during your lifetime – as long as they live in the UK permanently.

Other gifts count towards the value of your estate. There may be Inheritance Tax to pay if you’ve given away more than £325,000, but only if you die within 7 years.

Charitable gifts

You can make gifts to certain organisations free from IHT implications. Examples of charitable organizations are qualifying charities established in the EU or another permitted country, some institutions, for example, the National Trust and certain political parties.

If you make a charitable gift through your will you will be able to reduce the rate of tax that applies to your taxable estate to 36%, provided that you meet certain qualifying criteria.

Conclusion

In this little guide, we covered some essentials concepts and rules you need to know about inheritance tax. For more complex details it is advisable to seek professional help.

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news and distribution to create an unparalleled, full digital medium and social business network spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems.