If you invest or work in finance, you probably think you have enough digits to keep track of. Your firm, charity, or trust probably already has an entity ID number filed with regulators in your country of operation. You probably have enough transaction ID digits to break an old-school typewriter.

Do you really need another 20-digit identifying code, especially when it comes with a regulatory alphabet soup including LEI, GLEIF, FSB, and MiFID II?

The truth is, if your investment or financial trading operations touches the European Union in any way, your firm or organization needs an LEI code. It behooves you to know what it is, how it is used, how it came about, and, most importantly, how to get one.

What is an LEI Code?

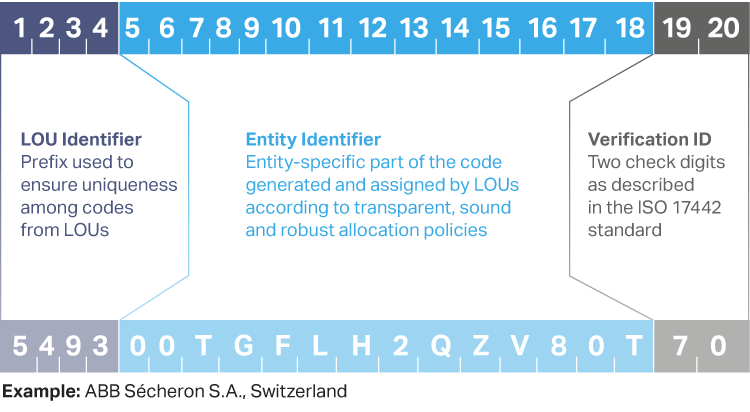

“LEI” stands for Legal Entity Identifier. It is a 20-digit alphanumeric code unique to an entity like a company, trust, or charity.

LEIs must be obtained by entities that want to trade financial instruments (e.g. stocks, bonds, currencies, etc.) using a broker licensed by an EU nation.

The LEI allows the entities to make the trade in compliance with MiFID II, a standard of transactional transparency adopted by the EU and applied to transactions worldwide that involve EU-based organizations.

MiFID II specifically states that market surveillance requires each party to a transaction to be clearly and uniquely identified. It explicitly mandates that each party to a financial transaction have an LEI which is included on every transaction report to identify the entity.

“In order to facilitate market surveillance, client identification should be consistent, unique and robust. Transaction reports should therefore include the full name and date of birth of clients that are natural persons and should identify clients that are legal entities by their LEIs.” (MiFID II)

Who is in Charge of the LEI System?

The LEI system is managed by the Global Legal Entity Identifier Foundation (GLEIF). Established in June of 2014, this not-for-profit organization is tasked with ensuring the quality and integrity of the LEI system.

GLEIF was founded by the FSB with headquarters in Basel, Switzerland. Both GLEIF and the LEI system as a whole continue to enjoy strong support from the FSB, as well as the “Group of 20” or G20. The G20 is a council of finance ministers from major world economic powers, including both “first-world” and developing nations and several EU members.

What nations are in the G20? G20 member nations include:

· Argentina

· Australia

· Brazil

· Canada

· China

· France

· Germany

· India

· Indonesia

· Italy

· Japan

· Mexico

· Russia

· Saudi Arabia

· South Africa

· South Korea

· Turkey

· The UK

· The US

LEI ROC

The entity tasked with the oversight of GLEIF is called the LEI Regulatory Oversight Committee (LEI ROC). Also headquartered in Basel, Switzerland, the LEI ROC consists of more than 70 authorities from public-sector organizations.

The ROC consists of a Chairperson, three Vice-Chairs, an Executive Committee, a Committee on Evaluations and Standards, and a Secretariat.

Who Issues LEI Codes?

While GLEIF is responsible for the integrity and supervision of the LEI system, individual LEIs are handed out by Legal Operating Units (LOU). These smaller satellite organizations actually issue the LEIs, accountable to GLEIF and the LEI ROC. If your organization needs an LEI, you will approach an LOU (or partner of an LOU) to get one.

LOUs issue the LEI, register it, and make it available to the public and to regulators free of charge.

GetLEI is a division of EnVers Group SEI, an industry leader with over 15 years in business, trusted by over 81,000 customers and 7,100 partners worldwide. EnVers Group has partnered with RapidLEI, a GLEIF-approved LOU and industry leader in providing fast and compliant LEI registration, allowing entities to quickly adhere to MiFID II.

What is MiFID II?

“MiFID” stands for the Markets in Financial Instruments Directive. If you noticed the sequel-esque “II” Roman numeral, it might help to note that the original MiFID was issued by the Financial Stability Board and Central Bank Governors in November of 2007.

Financial Stability Board (FSB): Established in 1999 by Central Bank Governors and the Group of Seven (G7) Finance Ministers, the FSB promotes transparency and international cooperation in the supervision and regulation of financial markets, in an attempt to foster global economic stability.

The FSB also carries a mandate to monitor and offer policy advice on market developments, best practices, and regulatory standards. They perform strategic reviews, implement standards boards, and set supervisory guidelines. FSB collaborates on “early warning exercises” with the International Monetary Fund (IMF). They also promote adherence to standards and commitments across jurisdictions.

The G7 consists of the following countries: Canada, France, Italy, Germany, Japan, the UK, and the US. FSB headquarters is in Basel, Switzerland.

As you can guess, anyone in the business of regulating financial markets in 2007 took a beating a year later when the world economy crashed. The 2008 global financial crisis exposed glaring weaknesses in the first MiFID.

A legislative proposal for an updated MiFID was adopted in 2011 by the European Commission (the executive branch of the EU). MiFID II made its debut on 3 January 2018.

MiFID II improved on its predecessor in a number of ways. In addition to requiring the use and disclosure of LEIs for every entity that is a party to a financial trade, MiFID II did the following:

• It expanded the scope of regulation to many more classes of asset. The first MiFID focused narrowly on equities (stocks), whereas the global financial crisis came about in large part due to derivatives trading. MiFID II applies to derivatives, fixed-income investment vehicles, currencies, commodities, futures, options, debt instruments, and other tradable securities.

• It increased the mandate for transparency in high-volume trades. Prior transactions could take place in “dark pools” where investors could legally decline to identify themselves or their firms. MiFID II limits a firm’s “dark pool” trading to 8% of the entity’s transaction volume.

• It increases reporting requirements. Brokers must provide over 50 more pieces of data than before, including details on price and value. Brokers must store all their conversations, including records of telephone calls.

• It limits financial inducements paid to firms for services. For example, banks cannot bundle research and transactional costs into one fee. This allows parties to more clearly understand the cost of services like research, as well as promote better research.

• It encourages electronic trading. E-trades are easier to record and track, especially as blockchain technology makes secure ledgers and smart contracts available.

What Information Does an LEI Code Include?

On a basic level, an LEI code is just a unique identifying number that MiFID II requires you to disclose on financial transactional documents.

When you drill down, however, the twenty digits of your LEI code communicate even more detailed information to regulators who might look at it. Encoded in your LEI number are:

· The registered address of the entity.

· The country of formation of the entity.

· The date of assignment of the LEI.

· The date the LEI was last updated (if different).

· The expiration date of the LEI, if applicable.

Who Needs an LEI Code?

On a basic level, any party to a financial transaction that falls under the jurisdiction of an EU regulatory body must have an LEI code on file and available to disclose on transactional documents.

This includes:

· Bankers and their firms.

· Traders and their firms.

· Fund managers and their firms.

· Exchange officials and their firms.

· Brokers and their firms.

· Institutional investors.

· Retail investors.

Parties to the transaction don’t have to live or operate in the EU—if an EU-based entity wants to do business with an entity based outside of the EU, each entity needs its own LEI, including the entity that does not headquarter in the EU.

In fact, the largest number of LEIs—almost one-quarter of the total—are issued to entities based in the United States. The worldwide distribution of LEI codes are as follows:

· US – 24.9%

· Italy – 9.6%

· Germany – 9.4%

· France – 6.3%

· UK – 6.0%

· Luxembourg – 4.5%

· Canada – 4.3%

· Spain – 3.9%

· Netherlands – 3.9%

· Cayman Islands – 2.6%

· Sweden – 2.2%

· Ireland – 2.0%

· Belgium – 1.8%

· Poland – 1.7%

· Denmark – 1.6%

· Austria – 1.6%

· Australia – 1.1%

· Japan – 1.1%

· Other countries – 11.5%

How Do I Get My LEI Code?

If you expect to be a party to a trade with an EU entity or a trade otherwise governed by MiFID II, reach out to an LOU to obtain your LEI.

GetLEI provides LOU services under the umbrella of EnVers Group SIA. Based in Riga, Latvia, EnVers Group is a trusted name in compliance with more than 15 years’ experience, providing quality service to over 81,000 clients across 1.3 million transactions.

To launch GetLEI, EnVers partnered with RapidLEI, a cutting-edge LOU that offers the fastest, most secure LEI registration on the market, enabling your entity to comply with MiFID II when you need it the most.

Reach out to GetLEI today so you can close your transactions on time, safely, and without error or interruption.

This is an article provided by our partners network. It does not reflect the views or opinions of our editorial team and management.

Contributed content

Founder Dinis Guarda

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news, and distribution to create an unparalleled, full digital medium and social business networks spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems