LIBRA is a brainchild of Facebook and by association the developed world is cautious about whether LIBRA will be a force for the good. People in the West can’t forget Cambridge Analytica, fake News, propagandas, and what Chris Hughes, Sean Parker or Chamath Palihapitiya said.

Governance in a Swiss association is legally non-existent. Dianne Schepers, a legal executive, explained to me that foundations (frequently used by blockchain startups) are supervised by the Swiss Federal Supervisory Board for Foundations (ESA) and are required to be registered in the commercial registry and provide an annual report. Associations, however, are not subject to any of these requirements.

So, we need to be clear that for now, it is only in good faith that the LIBRA association will execute on what is described in their white paper. Which is what prompted me to look closer to who bought a seat at the table. This raised yellow and red flags for one third of the members.

Each founding member is expected or has already ‘coughed up’ $10million. The 7 financial sector members are established companies which should be seen as the magic power of the LIBRA association as they will be able to use the LIBRA coin in their established networks.

- Visa

- Mastercard

- Paypal

- Stripe

- PayU

- Mercado Pago

- Calibra – Facebook link

The 4 members from the Blockchain space: BisonTails, Anchorage and crypto companies Coinbase and Xapo also raised questions in my mind.

BisonTails is as new as it gets startup, setup in Oct 2018 in the US to focus in blockchain interoperability and has only $5.3mil in seed funding. Anchorage is a US start-up launched in 2017 focused on digital asset custody for institutional investors with a Series A funding completed (total funding $17mil). Where did Bison Trails find the $10million membership fee to participate in the LIBRA association? Why did Anchorage decide to spend 60% of its total funding up to date, on its LIBRA membership?

Coinbase and Xapo are well established in the crypto space. Xapo is actually the only Swiss entity with a seat at the table.

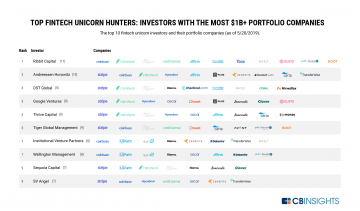

Another matter that made me want to watch closely the governance of the LIBRA association is the heavy involvement of an equal number from the VC world. This heavy participation of VCs raised questions about incentives and conflicts of interest.

The 4 VC members include – Andreessen Horowitz, Union Square Ventures, Ribbit Capital, and Thrive Capital – from the VC world and are also as heavyweights as it gets.

Andreessen Horowitz is an investor in Bison Trails (one out of seven) and a lead investor in Anchorage. Thrive is family to the Facebook family through Instagram. USV is family to Coinbase, and on and on.

The 3 members from the e-commerce space -Booking Holdings, eBay, and Farfetch, are another source of power for LIBRA to become a stable coin that scales. However, I only know Farfetch as an online luxury fashion e-commerce business and I am not clear how this ties into financial inclusion and the underbanked.

More outreach to established markets with the two online hailing businesses – Lyft, Uber; Spotify, the music unicorn; and the two telecoms – Vodafone and Iliad.

Another flag raised with the inclusion of Iliad, a troubled French telecom whose stock price has been in steady bearish trap over the past 2yrs (-47% yoy). Is this just another billionaire whose legacy depends on the success of LIBRA? The founder and still major shareholder of Iliad is billionaire Xavier Niel, who loves challenging the corporate establishment and is the founder of the StationF, one of the biggest startup campus.

For the 5 members that are non-profit organizations, I can only but ask how they ‘coughed up’ the $10mil. Could it have been arranged as a loan or some other side trade arrangement? Three flags go up (albeit light colored) for Kiva, Mercy Corps and Women’s World Banking.

The remaining two non-profits – Creative Destruction Labs and Breakthrough Initiatives – seem odd in the LIBRA family. How did a university tech incubator rise $10mil? The Why is probably that they aim to become a venture studio that builds part of the ecosystem needed to make the LIBRA stable coin scale. But Why does an extravesical think tank with Mark Zuckerberg on the board, participate in LIBRA?

Is a 66.66% attack on the LIBRA network possible?

Verum Capital in Your Guide to Libra summarizes clearly the governance structure promised in the LIBRA white paper:

“The 28 founding members will each cast a vote to elect 5-19 board members who will oversee operations and can be reelected on an annual basis. The board will appoint one of its members as managing director for a three-year term. The managing director, in turn, will be responsible for hiring an executive team.”

The white paper also states:

“All decisions are brought to the Council, and major policy or technical decisions require the consent of two-thirds of the votes.”

Why did these powerful members choose a Swiss Association for their setup? To me this aligns with the culture of “Move fast and break things”. An Association has no transparency requirements and no governance supervision.

Should we fear a 66.66% attack on the LIBRA network? Why did they choose a huge PR campaign, a white paper, and an Association setup instead of a more transparent setup with an established supervision over governance and the highest reporting standards? This would have been their white glove treatment to all those concerned with their ethics and motives.

This article has been adapted from Can Facebook pull off a 69% attack on the LIBRA netwrok

Dr. Efi Pylarinou is the No.1 Global Woman Influencer in Finance & the Data conversation by Refinitiv 2019 & 2020. A seasoned Wall Street professional & a recognized technology thought leader on innovation topics in AI, Big Data, and Impact on the ecology and the economy.

Efi Pylarinou is a speaker, a moderator, and a creative content producer serving the needs of Big Tech companies, Financial services corporates, Accelerators, Growth Fintechs. As an influencer, she works in the intersection of business development, marketing, and PR and supports campaigns and earning media initiatives. She is also a consultant on incubating and launching industry specific projects that require multiple stakeholders. She is also involved in knowledge focused partnerships.

She is the cofounder and author of Daily Fintech. She has over 184,000+ followers on Linkedin and 10,500 on Twitter.

She is the author of Wiley Fixed income books with Frank Fabozzi and a contributing author of the the 2019 4IR AI Blockchain Fintech IOT book and the 2018 WealthTech book by Wiley.