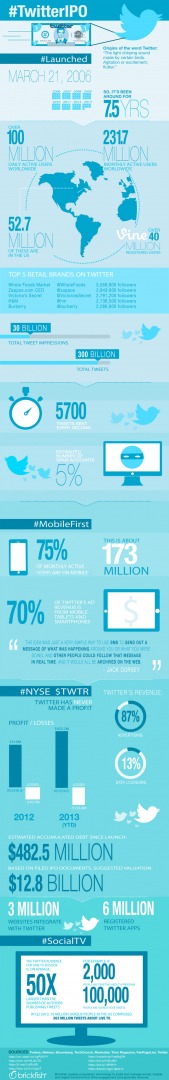

The world’s second largest social network Twitter is preparing to go public, most likely on November 15th. This infographic examines their user growth, impact on social television as well as the latest scoop on their finances. After much speculation Twitter has chosen to list shares on the New York Stock Exchange rather than going with NASDAQ. Reuters reported that the New York Stock Exchange carried out a dry run of Twitter’s highly anticipated debut on the market, in an attempt to avoid the issues that affected Facebook’s public offering on the rival stock exchange NASDAQ.

The test was carried out to see if it systems could cope with the amount of message traffic generated by the IPO and to ensure that any orders placed would generate prompt reports.

Twitter will list under the symbol of TWTR. The NASDAQ will want to change public perception of its ability to handle high profile technological offerings since the Facebook debacle. It’ll be interesting to see what they actually do to change market sentiment after this high profile snub.

NASDAQ was recently forced to pay US$10 million in settlement in relation to the Securities and Exchange Commission charges and agreed in a separate move to compensate up to US$62 million to brokers. Perhaps this is why twitters IPO is much smaller than Facebook’s and is viewed as much more conservative. The market seems happy with its valuation of US$11 billion. Darcy Travlos makes the point in a Forbes article that when it comes to investors, Twitter’s IPO price does not matter.

“What will matter, for most investors, is Twitter’s potential to provide an attractive return after the first trade. Moral of the story? There are two different decision points between buying an IPO allocation and buying an IPO in the aftermarket. Generally, obtaining allocated stock on an IPO is very difficult, unless one is a large institution or a very important client of a firm that is an underwriter on the IPO. Most retail investors do not have the opportunity to buy these stocks at the IPO price. Rather, retail investors face the dilemma whether to buy the stock after it starts trading, not where the IPO gets priced”.

Usually the higher the price set for IPO shares, the more income, companies early-stage investors and sellers can make. For the ordinary man in the street however, the higher the price means there’s very little left on the table for the market dabbler. Time will tell in November, but if the demand is strong and Twitter succeeds in raising more than US$1 billion it will be declared a definite success. For investors however true success will be measured and how the Twitter shares start performing after trading begins.

Savvy investors will probably stick with the marketing tactic, of letting the new stock trade for at least 3 to 6 months before beginning transactions.

At this stage it’s a guessing game and nobody wants a second overhyped social media network IPO.

Inforgraphic source: Brickfish

Hayden Richards is Contributor of IntelligentHQ. He specialises in finance, trading, investment, and technology, with expertise in both buy-side, sell-side. Contributing and advising various global corporations, Hayden is a thought leader, researching on global regulatory subjects, digital, social media strategies and new trends for Businesses, Capital Markets and Financial Services.

Aside from the articles, interviews and content he writes for IntelligentHQ, Hayden is also a content curator for capital markets, analytic platforms and business industry emerging trends. An avid new media explorer Hayden is driven by a passion for business development, innovation, social business, Tech Trading, payments and eCommerce. A native Trinidadian, Hayden is also a veteran, having served with the Royal Air Force Reserves for the past 10 years.

Follow Hayden on Twitter @HaydenARichards, linkedin.com/haydenhrichards and http://www.scoop.it/u/hayden-richards