In 2013, 68% of millennials believed that the way we access our money would be totally different in five years. So how are the money habits of this disruption-ready generation changing the way we manage money?

This were the findings of a recent report ( June 2019) of cb insights. CB insights is a company offering market research reports about technology trends. They aggregate and analyze massive amounts of data and use machine learning, algorithms and data visualization to help corporations, they state in their website “replace the three Gs (Google searches, gut instinct and guys with MBAs) so they can answer massive strategic questions using probability not punditry.”

According to their recent report, if the media often portrays millennials as preoccupied with the rising prices of festival tickets and avocado toast, their real financial concerns are a bit more practical.

A 2018 survey by Bank of America shows that millennials’ top financial priorities were saving for emergency funds (64%), saving for retirement (49%), and saving to buy a house (33%) — not much different from the concerns their baby boomer parents had 30 years ago.

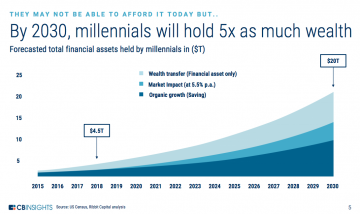

But millennials face significant headwinds in making those financial dreams a reality. This generation is well-known for having to deal with their financial burdens. Having come of age during the Great Recession and its climate of wage stagnation, and being burdened by unprecedented levels of student debt, millennials have been called “the brokest generation.”

However, millennials are proving to be a fiscally conscientious generation, saving more and earlier than previous generations did at their age.

As millennials head deeper into adulthood and make more money, the personal finance space is adapting to their unique money management attitudes in a few key ways:

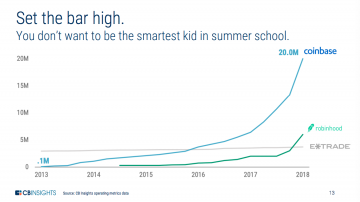

- From in-person to online. Millennials are “the most likely generation to use both online (92%) and mobile channels (79%)” for banking — and finance companies are aligning their services to reflect that preference.

- From big banks to big tech. 73% of millennials say they would be more excited about a new financial offering from a tech company like Google, Amazon, or Apple than from their nationwide bank. This openness to banking alternatives presents opportunities for fintech startups looking to innovate in financial services from the outside.

- From “the way it is” to “the way it could be.” As of 2013, 70% of millennials believed that the way that people purchase things would be totally different in 5 years, and 33% believed that one day they won’t need a bank at all. Being comfortable with the idea of alternative financial systems has opened the door to a variety of innovations, from alternative investment vehicles like cryptocurrency to point-of-sale lending alternatives.

Incumbent financial institutions are feeling the effects of millennials’ disruptive attitudes. Digital-first bank Chime is adding more customers each month than legacy banks such as Wells Fargo or Citibank. One report predicts that the 10 largest banks could lose $344B in deposits to smaller competitors over the next year.

But legacy institutions are fighting back, cherry-picking the best financial innovations that their younger competitors develop — investment robo-advisors, AI-based budgeting, and expense monitoring — and incorporating them into their services.

There have been some high-profile failures, such as JPMorgan’s short-lived mobile bank app Finn. But incumbent banks are also at the forefront of the most promising innovations in personal finance today, such as virtual credit cards.

In this report, we’ll look at how millennial money sensibilities are shaping innovation in personal finance across 5 core areas and how startups & incumbents are responding.

How millennials think about money

To understand where these millennial money behaviors come from, it’s important to understand 2 socio-economic forces that shaped the generation: the Great Recession and the student loan crisis.

Millennials were almost four times as likely as other generations to find themselves unemployed during the recession, and households headed by millennials born in the 1980s actually lost net worth between 2010 and 2016.

Meanwhile, 41% of millennials have student loan debt, compared with 26% for Generation X and 13% for baby boomers. The average millennial student debt load was $10,600 as of 2017 — about 2X more than what was owed by Gen X in 2004.

With their unique financial pressures and their digital-first backgrounds, millennials are looking for new ways to manage their incomes, debt, and future savings. Platforms like ‘Everycent‘ cater precisely to this need, offering digital tools and resources for effective budgeting and financial planning. This aligns well with the millennial inclination towards online solutions, making ‘Everycent‘ a relevant and valuable resource for those looking to optimize their financial management in the digital age. Below, we analyze how millennials are approaching personal finance across:

- Banking: Brick-and-mortar is out; digital and mobile-first are in

- Budgeting & Saving: Millennials go mobile and embrace automation

- Investing: Robo-advisors and micro-investing lower barriers to entry

- Payments: Mobile is replacing cash

- Borrowing: Credit-shy millennials embrace PoS lending

This research was assembled by cbinsights. You can read more about it here.

Founder Dinis Guarda

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news, and distribution to create an unparalleled, full digital medium and social business networks spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems