An article in two parts reflecting on the transformational power of blockchain and AI joined together. The first part covers blockchain, whereas the second addresses AI and then what can be expected from the conjugation of both.

Introduction

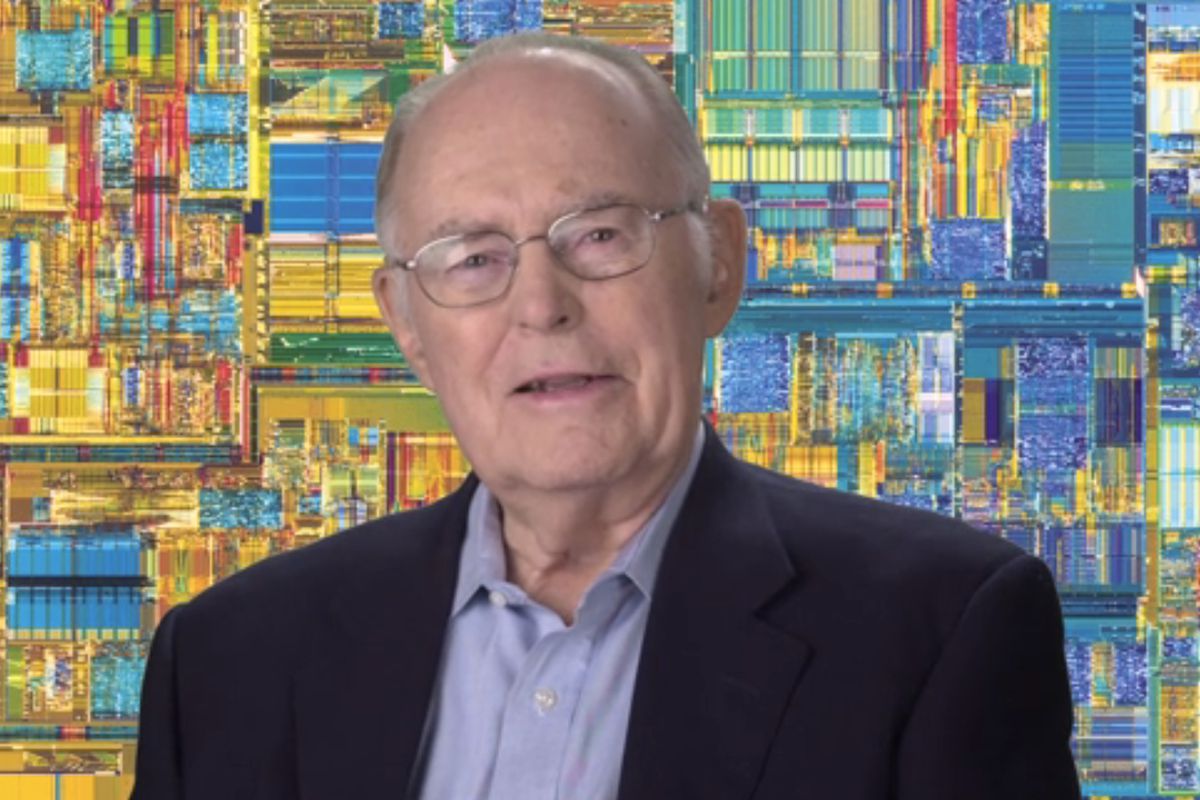

A world driven by digital devices and invisible technology is taking over our lives at an increased speed. In 1965, Gordon Moore, an engineer and the co-founder of chip giant Intel, noticed that the number of transistors per square inch on integrated circuits had doubled every year since their invention. Moore published his findings in a paper posted in Electronics magazines. Little did he know how what he was predicting had the status of a law, what is now famously called Moore’s law.

The concept behind the Law, is that manufacturers find increasingly innovative ways to squeeze more switches into a given space. Moore’s law is the reason why we have now, in our pockets, little computers (our phones) with the power of the supercomputers that filled rooms and rooms of Universities, just a few decades ago. What it predicts, can be extended of course to all areas of tech, particularly in its relation from hardware to software, to algorithms and somehow to genetics. Take the example of new innovations such as 3D NAND, the very idea of stacking sets of transistors on top of each other to create “3D processors”.

Evidently Moore’s law is an observation and projection of a historical trend, and not a physical or natural law. It has even been doubted, and to some, Moore’s law is a sign of bad news, due to its controversial implication that exponential growth trends will eventually lead to a technological singularity. The amount of computing power, data, processing operations we can now squeeze into the smallest of our daily devices is powerful and remarkable compared with what was achievable, say, a year ago and of course, multiple times, a decade ago. This is made possible simply because of a revolution of chip makers, increasing advancements in software developments, integrated systems of nanotechnology, global connected cloud computing databases, algorithms that are able to increase the number of transistors on a chip, and many more tech developments, as research continue to advance at fast pace.

Since 1965, our technological evolution has been speeding up, and that has incurred in shifts in our perception of the world, and societal organisation.

One can say that Moore’s law, was what drove us to a present world driven by digital devices and invisible technologies, the ones behind the devices. These are structuring our lives now in ways as never seen before. Most of our time, whether it is doing business, studying or entertaining ourselves, is spent in front of screens and devices, and behind our modern tools there is an holistic invisible technology, what we could call internet driven tech or IOT (internet of things). The screens that rule our lives, have produced a society where connection happens around social media, online videos, algorithms, mobile technology, data crunching, gamification. Our world is thus being shaped by the internet and its developments. But the internet is fast evolving, and a new change is happening as we depend more and more from big data and algorithms to process our activities, our transactions and payments, our studies, our entertainment.

Contributing to part of those invisible technologies behind our eyes are very recent transformational technologies such as blockchain, smart contract identity and machine learning AI tech. In the next few years, we will see more of these transformational technologies. These, will modify everything we do, our very own dna, health, society models, in unimaginable ways.

Regardless of what transformations will these technologies bring to the world (whether we like it or not, these are the very same technologies everyone is using and at the same time questioning) – the fundamental question is not how to deploy wisely these technologies, but how they can solve daily and fundamental problems, such as work automation, improved wellbeing, and how they will unfold in novel business solutions, in such a way that they are impactful, useful, and beneficial to the world.

A key factor to the evolution of these new transformational technologies, is that they gain the trust of users and public opinion.

Blockchain – Distributed Ledger plus AI technologies are without any doubt the biggest disruption in the history of society and tech. Blockchain and AI establishes and brings a new landscape where:

-

- Blockchain Is The New Default Database

- There is a Shift to New Computing Architectures driven by DLT

- AI is The New Matrix and increasingly the UX and UI driver of the new digital world

- Smart Contracts will slowly replace, integrate all areas of identity, financial transactions and supply chain worldwide online and offline

- We are in The Twilight of a new radical Digital DNA full scope Age

Blockchain + AI: Expanding Deeply Any Horizons of What Can be Done

“I think people need to understand that deep learning is making a lot of things, behind-the-scenes, much better. Deep learning is already working in Google search, and in image search; it allows you to image search a term like “hug.””Geoffrey Hinton

“The swarm is headed towards us.” Satoshi Nakamoto, when WikiLeaks started accepting Bitcoin donation.

“The classic example used to demonstrate smart contracts in the form of code executing automatically is a vending machine. Unlike a person, a vending machine behaves algorithmically; the same instruction set will be followed every time in every case. When you deposit money and make a selection, the item is released. There is no possibility of the machine not feeling like complying with the contract today, or only partially complying (as long as it is not broken). A smart contract similarly cannot help but execute the specified code. As Lessig reminds us, “code is law” in the sense that the code will execute no matter what. This could be good or bad depending on the situation; either way, it is a new kind of situation in society that will require a heavy accommodation period if blockchain-based smart contracts are to become widespread.”

Melanie Swan, Blockchain: Blueprint for a New Economy

We are heading towards a new world driven by two unique technologies, blockchain and AI. Let’s look at each of them separately.

Connecting the World With Blockchain Databases

Blockchain can be so many things, that it is sometimes complicated to define it. Maybe a possible way out is by enumerating a set of its different possible applications, such as smart contracts powering payments and financial transactions, supply change, governmental activities, identity and healthcare data processing.

The following seven characteristics are the ones who can best define blockchain:

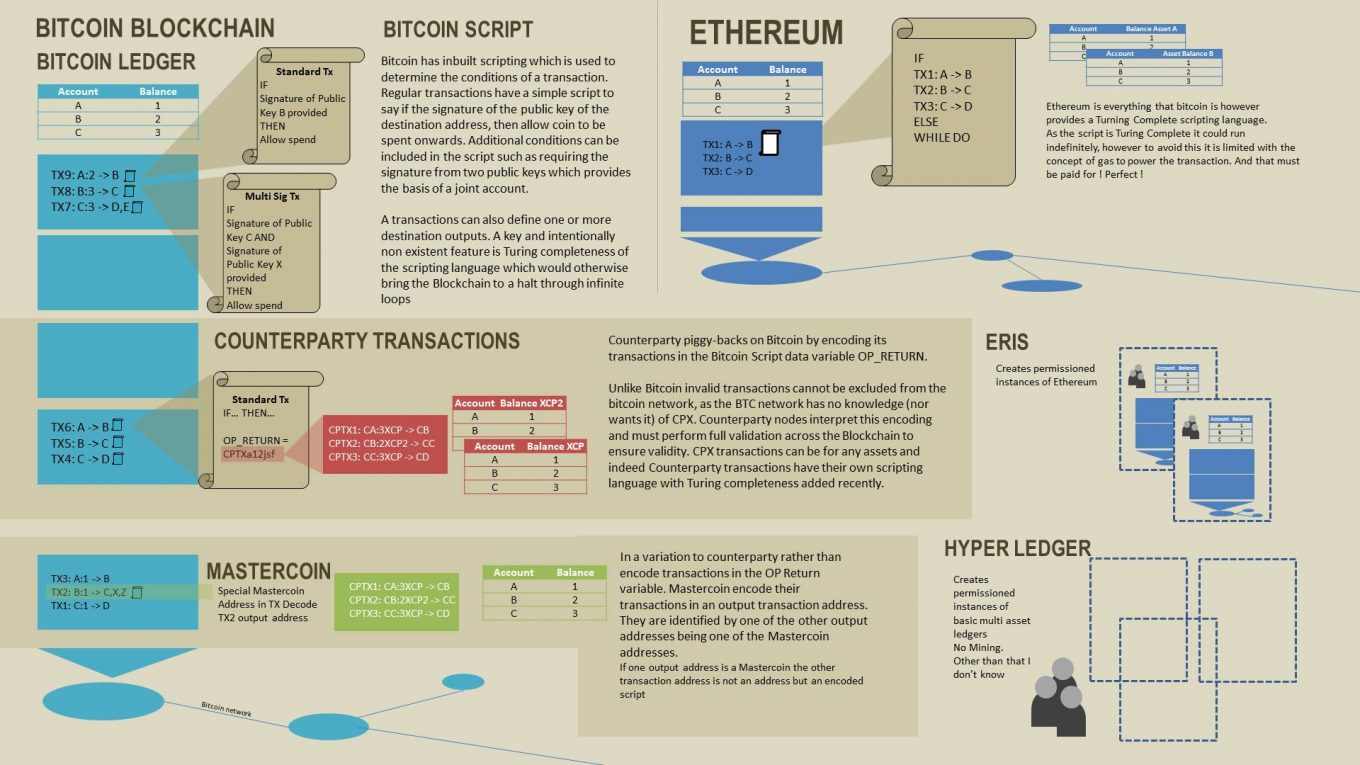

- The distributed myth behind Blockchain ideology:decentralised ledger tech

- The consensus protocol: resulting from Blockchain bitcoin origins – mining

- Blockchain and smart contracts

- Blockchain and identity

- Blockchain and decentralised data bases

- Blockchain cryptoeconomics or tokeneconomics

- Blockchain crypto trading

One can say that the main core characteristic about blockchain that explains its versatility and revolutionary power is the one of it being a distributed database. Blockchain is also called DLT, which is exactly a name that is an acronym for Distributed Ledger Technology.

Distributed Databases

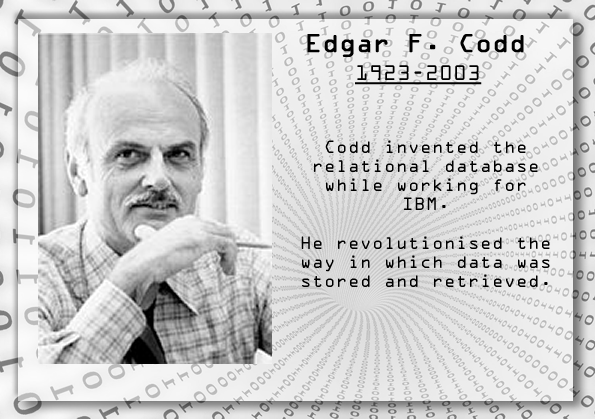

What is so special and powerful about databases? Databases have existed since humanity, and their evolution testifies the long process in society’s organisational capacity. As it becomes more complex, new ways to organize data need to be developed. History has some examples about this that can teach us the power of what seems like small inventions. That is the case of the relational database.

In 1970, a researcher at IBM named Edgar F. Codd came up with a new way to store and retrieve data called the relational database. His revolutionary invention, consisted of a database that organized data into one or more tables (or “relations”) of columns and rows, with a unique key identifying each row. When it came out, Codd’s invention was considered, quite obscure and theoretical , with no practical applicability. In a matter of years, relational databases would go on to have a major widespread impact forming the basic technological infrastructure for the entire industry and its full adoption by the industry, which included companies like Oracle and SAP.

Fast forward to 2018, we have a similar phenomena, this time much more holistic, happening with blockchain. As explained previously Blockchain is database, but of a new kind, as it is a distributed database, made secure through encryption. Most of us are still trying to understand the usability and potential of this distributed ledger technologies. Probably the most important aspect will be blockchain’s ability to create trust through its audit function. That, in turn, will give rise to new business models and, most probably, profoundly alter the relationship between companies and consumers/users. A trust protocol rewards trustworthy behavior and punishes deception. That endows the consumer and user with a power that is new. As Bhrmie Balaram, a senior researcher for the RSA writes, in a paper advocating the use of blockchain in sharing economy projects, “users have power over technology.”

Layer 2 Solutions Are Making Blockchain User Friendly

Technology is a living thing, always transforming itself to better adapt to new possibilities. So, another important characteristic of the blockchain resides in the history of its inception as bitcoin. Bitcoin is a coin that produces an immutable database of blocks linked to each other, and its invention has the importance of the creation of the world wide web. Its immutability and network effect, and the way its evolving, again, reflects the development of the internet.

If we investigate the story of technological innovation we can identify crucial moments and how the speed of technological innovation has increased, particularly during the second half of the XXth century. The most important recent innovation is the World Wide Web in the 1990s, which revolutionized the world in just a few decades. At its inception, the internet was nothing else but a network of computers used by academics, but in a few decades it became a global phenomena that would transform the world, due to further technological innovations, improving it. One of such innovations was the HTTP. HTTP stands for Hypertext Transfer Protocol. It was invented by Tim Berners-Lee, as a technology to be put on top of the base-layer Transmission Control and Internet protocols (TCP/IP). The http laid the ground for further needed smaller inventions, such as Marc Andreessen’s Mosaic Netscape browser in 1994. As time moved on, more and more innovations happened, and a whole array of web-based applications were invented ( just think of blogger or wordpress).

Will blockchain Finally Go Mainstream?

Moving forward to present days, we can see how something similar is happening now with the development of a sort of HTTP in the blockchain, called Layer 2 blockchain solutions. Neha Narula, director of the MIT Media Lab’s Digital Currency Initiative describes the Layer 2 by stating that “computation is moved off-chain, either to enable privacy or to save computing resources.”

The key attribute of layer 2 solutions is that these operate “on top” of existing blockchains. Rather than having the script of a particular program executed by every computer in the blockchain network (which is the basis of what blockchain stands for), layer 2 solutions “is implemented simply by two or more computers involved in the transaction.”

In order for this to happen in a safe way, new security and trust solutions must be invented, since much of the computing activity in individual transactions or smart contracts will be taken “off chain.” Important breakthroughs will happen with blockchain tech, when easing the heavy, multi-party computation that blockchains carry. For that to happen, it is important to ensure that transaction histories are at some point anchored by “on-chain” consensus algorithms.

The advantage, according to Narula, is that “you get similar security protections as with on-chain transactions because the blockchain acts as the anchor of trust.”

Lightning Network

Whereas Tim Berners-Lee’s HTTP solution was universally adopted as an almost immediate standard, there’s a great deal of competition in Layer 2 blockchain solutions. What opens up before our eyes with Layer 2 solutions is unimaginable, as all kinds of new applications can be developed.

Layer 2 solutions become more clear looking at an example. Examples of layer two solutions are lightning payments, plasma, raiden, polkadot, cosmos, interledger.

The Lightning Network is a “second layer” payment protocol that operates on top of a blockchain (most commonly Bitcoin). It provides instant transactions between participating nodes and has been mentioned as a solution to the bitcoin scalability problem. It features a peer-to-peer system for making micropayments of digital cryptocurrency through a network of bidirectional payment channels without delegating custody of funds and minimizing trust of third parties.

MIT prestigious university has been very attentive upon lightning network. In 2015, they began organizing a Digital Currency Initiative, as a way to further R&D on cryptocurrencies. A series of events explored how lightning network could be combined with smart contracts to not only handle millions of transactions, but do so with a greater degree of complexity.

In an article for Coinbase, Alyssa Hertig writes about the initiative stating how “ the test envisions a system wherein transactions would take place automatically in the case of defined external events, based on say today’s weather or the current price of U.S. dollars.

This is possible due to MIT’s creative use of so-called “oracles,” trusted entities meant to broadcast data to smart contracts. For this demo, researchers Tadge Dryja and Alin S. Dragos built a test oracle to broadcast the recent price of U.S. dollars in satoshis, the smallest unit of bitcoins, which anyone can grab and use for their smart contracts.”

It is still early days, but what we can anticipate is a competitive dance between the interests of established corporations against Layer 2 startups such as Lightning Labs, and others, such as Blockstream, Ripple and Parity, as well as potentially hundreds of independent coders around the world. What will result from this problem, will be new standards and protocols, and a handful of companies/technologies, mediated by consortia like the World Wide Web Consortium, better known as W3C.

Lightning’s payment channels, and other solutions being invented, might be the much awaited key, that finally enables the low-fee, fast-paced payments that bitcoin promised but failed to deliver. That would, in theory, fulfil all the bombastic promises of bitcoin/blockchain, as taking away business from centralized heavy institutions such as banks, credit card companies and money transmitters.

How governments and regulation will deal with this whole new system is still an incognito, since there is a strong possibility, that transactions will be very hard for them to track. Plus, how these off-chain solutions will go mainstream, maintaining their p2p ethos, which breaks through from the powerful corporate interests, is still an incognito.

The second part will be published tomorrow

Dinis Guarda is an author, academic, influencer, serial entrepreneur, and leader in 4IR, AI, Fintech, digital transformation, and Blockchain. Dinis has created various companies such as Ztudium tech platform; founder of global digital platform directory openbusinesscouncil.org; digital transformation platform to empower, guide and index cities citiesabc.com and fashion technology platform fashionabc.org. He is also the publisher of intelligenthq.com, hedgethink.com and tradersdna.com. He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays, and governments all over the world.

With over two decades of experience in international business, C-level positions, and digital transformation, Dinis has worked with new tech, cryptocurrencies, driven ICOs, regulation, compliance, and legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

He creates and helps build ventures focused on global growth, 360 digital strategies, sustainable innovation, Blockchain, Fintech, AI and new emerging business models such as ICOs / tokenomics.

Dinis is the founder/CEO of ztudium that manages blocksdna / lifesdna. These products and platforms offer multiple AI P2P, fintech, blockchain, search engine and PaaS solutions in consumer wellness healthcare and life style with a global team of experts and universities.

He is the founder of coinsdna a new swiss regulated, Swiss based, institutional grade token and cryptocurrencies blockchain exchange. He is founder of DragonBloc a blockchain, AI, Fintech fund and co-founder of Freedomee project.

Dinis is the author of various books. He has published different books such “4IR AI Blockchain Fintech IoT Reinventing a Nation”, “How Businesses and Governments can Prosper with Fintech, Blockchain and AI?”, also the bigger case study and book (400 pages) “Blockchain, AI and Crypto Economics – The Next Tsunami?” last the “Tokenomics and ICOs – How to be good at the new digital world of finance / Crypto” was launched in 2018.

Some of the companies Dinis created or has been involved have reached over 1 USD billions in valuation. Dinis has advised and was responsible for some top financial organisations, 100 cryptocurrencies worldwide and Fortune 500 companies.

Dinis is involved as a strategist, board member and advisor with the payments, lifestyle, blockchain reward community app Glance technologies, for whom he built the blockchain messaging / payment / loyalty software Blockimpact, the seminal Hyperloop Transportations project, Kora, and blockchain cybersecurity Privus.

He is listed in various global fintech, blockchain, AI, social media industry top lists as an influencer in position top 10/20 within 100 rankings: such as Top People In Blockchain | Cointelegraph https://top.cointelegraph.com/ and https://cryptoweekly.co/100/ .

Between 2014 and 2015 he was involved in creating a fabbanking.com a digital bank between Asia and Africa as Chief Commercial Officer and Marketing Officer responsible for all legal, tech and business development. Between 2009 and 2010 he was the founder of one of the world first fintech, social trading platforms tradingfloor.com for Saxo Bank.

He is a shareholder of the fintech social money transfer app Moneymailme and math edutech gamification children’s app Gozoa.

He has been a lecturer at Copenhagen Business School, Groupe INSEEC/Monaco University and other leading world universities.