Case Study 1: How Emergent Governments Can Prosper with Blockchain and AI Tech: The Indian Experience

With close to 1.4 billion people, the Indian government at all levels is presented with one of the most enormous population management challenges of any government across the world. Providing governance for such an enormous population is an enormous challenge in terms of data management, identity management and provision of services to citizens. Faced with these challenges, India finds itself in a place where it has to look towards new technology to make the task of governing such a large number of people much easier.

India is known as a powerhouse in Information and Computer Technology (ICT). Therefore, it is almost unthinkable that India will be left out of the AI and blockchain revolution sweeping across the world. For India, this could not have come at a better time, as the current Prime Minister Narendra Modi has provided leadership to drive several government initiatives that will see increased use of new and emerging technologies to drive India’s growth. Prime Minister Modi has openly expressed support for the use of AI and the blockchain, so much so that at the February 2018 convocation ceremony of the Sher-e-Kashmir University of Agriculture Sciences and Technology in Jammu, he declared that the Indian agricultural sector would require innovative technologies such as the blockchain in order to take it to the next level (Caspi, 2018).

India’s strategy for the use of AI and the blockchain can be broken down as follows:

- Development of a core national strategy for the development of AI and blockchain applications.

- Encouraging the creation of incubation hubs dedicated to the development of applications from AI and the blockchain.

- Initiating pilot projects that are based on AI and the blockchain, which will serve as workable foundations for wide-scale deployment across the country.

- The pilot projects are mostly being done at state level.

- Increase national budgetary allocations for AI and blockchain-based projects.

In India, a national strategy for the harnessing and adoption of new/emerging technologies, including AI and the blockchain, has been developed. This initiative commenced with the establishment of the National Institution for Transforming India (NITI Aayog), a government think-tank that has been given task to direct efforts on a national scale to research and develop applications from emerging technologies such as artificial intelligence (Bhunia, 2018). This initiative is also to support the earlier-created Task Force on Artificial Intelligence for Economic Transformation in India, a brainchild of the Commerce and Industry Ministry of India.

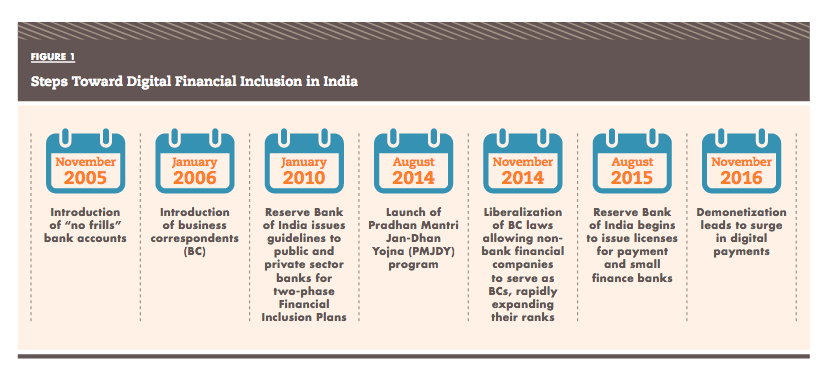

Such open political support has led to the increase in the use of AI and the blockchain in India to achieve improvements in governance across several sectors. For instance, one of the areas in which there have been vast improvements has been in financial inclusion. Under the present Indian government, the percentage of adults in the country with bank accounts has risen from 45% to 85%.

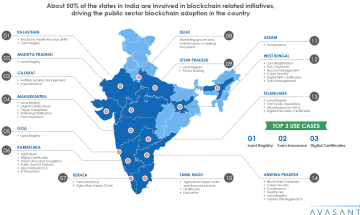

Indian state governments are also taking the cue from the center and are pursuing some blockchain initiatives. The government of the state of Telangana has setup a district that will be home to blockchain startups; the first of its kind in the entire country (Das, 2018). This project, which is a partnership between the Telangana State Information Technology, Electronics and Communication Department (ITE&C) and Tech Mahindra (an IT services company), will provide for an incubator hub in Hyderabad (the state’s capital) where local startups and companies can establish and develop various blockchain-based solutions for the local and international market. The state of Telangana has been very proactive in adoption of blockchain technology as it has implemented a few blockchain projects in the last year.

Indian state governments are also experimenting with the use of the blockchain to manage data in a secure fashion. As was mentioned earlier, one of the areas where secure data collection, processing and storage are desired is in land registration. The governments of Andhra Pradesh and Telangana have pilot projects in place where land registration is presently being done using blockchain technology (Das, 2017). This is expected to enable open access to information on who owns land anywhere in those states. This has great potential to eliminate fraud in land acquisition and registry by utilizing the factor of immutability as contained in open-access distributed ledger technology. This project is expected to be rolled out fully by the end of 2018 in all parts of these states.

Despite the gains made by India in financial inclusion and deployment of blockchain and AI into areas such as agriculture, land registry and human capacity development, there are still recognized problems that are hampering large-scale deployment of these technologies in the country. In an online article written by Sirish Kumar and titled “Financial Inclusion Can Leapfrog with Blockchain Technology”, one of the problems that was identified is that a large chunk of the Indian population lacks the requisite identification documents required to achieve milestones such as near-complete financial inclusion. Kumar advocates for the Indian government to stretch the use of blockchain technology further to include the creation of unique digital identities for every Indian, especially for those living in the hinterlands. Such a blockchain-driven digital identity database would then serve as the one-stop shop for all government-citizen interaction that would require identity verification.

Some experts such as Professor Kartik Hosanagar, who teaches Tech and Digital Business in the University of Pennsylvania’s Wharton School, believe that India is doing too little too late in terms of funding for research into AI and the blockchain. They may not be far from the truth if current statistics are anything to go by. India is said to spend only 0.6% of its GDP on research, which is far less than what China spends on similar research projects, and Indian blockchain/AI startups have not traditionally been research-oriented and are therefore not attracting funds created for such purposes. Furthermore, the government is relying heavily on partnerships with the private sector to drive its AI development, and the input of local companies is still quite low when compared with China, whose model India is following (Bhattacharya, 2018). However, some of these issues are what NITI Aayog hopes to address. It is expected that the incubation hubs being setup across India will help to improve the local input in terms of research and development of applications that run on AI and the blockchain.

In summary, India is making progress. Even though the country still lags behind China, India is still better placed than many emerging economies when it comes to AI and the blockchain.

Part 3 will be posted tomorrow.

How Can Emergent Economies Benefit From Blockchain Plus AI ? A Case Study part 1

Dinis Guarda is an author, academic, influencer, serial entrepreneur, and leader in 4IR, AI, Fintech, digital transformation, and Blockchain. Dinis has created various companies such as Ztudium tech platform; founder of global digital platform directory businessabc.net; digital transformation platform to empower, guide and index cities citiesabc.com and fashion technology platform fashionabc.org. He is also the publisher of intelligenthq.com, hedgethink.com and tradersdna.com. He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays, and governments all over the world.

With over two decades of experience in international business, C-level positions, and digital transformation, Dinis has worked with new tech, cryptocurrencies, driven ICOs, regulation, compliance, and legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

He creates and helps build ventures focused on global growth, 360 digital strategies, sustainable innovation, Blockchain, Fintech, AI and new emerging business models such as ICOs / tokenomics.

Dinis is the founder/CEO of ztudium that manages blocksdna / lifesdna. These products and platforms offer multiple AI P2P, fintech, blockchain, search engine and PaaS solutions in consumer wellness healthcare and life style with a global team of experts and universities.

He is the founder of coinsdna a new swiss regulated, Swiss based, institutional grade token and cryptocurrencies blockchain exchange. He is founder of DragonBloc a blockchain, AI, Fintech fund and co-founder of Freedomee project.

Dinis is the author of various books. He has published different books such “4IR AI Blockchain Fintech IoT Reinventing a Nation”, “How Businesses and Governments can Prosper with Fintech, Blockchain and AI?”, also the bigger case study and book (400 pages) “Blockchain, AI and Crypto Economics – The Next Tsunami?” last the “Tokenomics and ICOs – How to be good at the new digital world of finance / Crypto” was launched in 2018.

Some of the companies Dinis created or has been involved have reached over 1 USD billions in valuation. Dinis has advised and was responsible for some top financial organisations, 100 cryptocurrencies worldwide and Fortune 500 companies.

Dinis is involved as a strategist, board member and advisor with the payments, lifestyle, blockchain reward community app Glance technologies, for whom he built the blockchain messaging / payment / loyalty software Blockimpact, the seminal Hyperloop Transportations project, Kora, and blockchain cybersecurity Privus.

He is listed in various global fintech, blockchain, AI, social media industry top lists as an influencer in position top 10/20 within 100 rankings: such as Top People In Blockchain | Cointelegraph https://top.cointelegraph.com/ and https://cryptoweekly.co/100/ .

Between 2014 and 2015 he was involved in creating a fabbanking.com a digital bank between Asia and Africa as Chief Commercial Officer and Marketing Officer responsible for all legal, tech and business development. Between 2009 and 2010 he was the founder of one of the world first fintech, social trading platforms tradingfloor.com for Saxo Bank.

He is a shareholder of the fintech social money transfer app Moneymailme and math edutech gamification children’s app Gozoa.

He has been a lecturer at Copenhagen Business School, Groupe INSEEC/Monaco University and other leading world universities.