When we think about AI and other emergent technologies, we picture in our minds, scenarios happening in advanced economies. That is actually, far from reality. Sometimes countries with emergent economies are the most adept in experimenting with these new technologies, since they have nothing to loose. Their lack of mature infracstructures can then, be transformed into an opportunity for innovating and leapfrogging, since there are no old stiff institutions, with entrenched vested interests, holding them back. In this article, I will examine several country examples. I will focus on India, Mauritius and a few African examples to showcase the situation with AI and the blockchain as far as government initiatives are concerned, providing the reader with a balanced view of how emergent markets are approaching the research, development and adoption of these technologies as well as the filling of manpower needs for the application of these new technologies. Similarities, differences and improvements or lack of them will be examined.

Background

Emerging market countries tend to lag behind in development and adoption of new technologies, and when it comes to AI and the blockchain, current trends seem to suggest that things are no different. Apart from countries like China and India, many of the emerging market countries in Africa, Latin America and some sections of Asia are still playing catch-up when it comes to research, development, adoption and application of Artificial Intelligence and blockchain technology. These countries can benefit from the advances that these technologies bring, because since they lack some basic infrastructures, they can, more easily, leapfrog certain stages of development, by building from scratch those infrastructures, using these new technologies.

There are though, additional limitations in the human and material resources that are required to power the development of homegrown AI and blockchain-driven initiatives. A lot of reliance on external help from countries which already have advanced knowledge and infrastructure in these areas is therefore going to be needed. China is best positioned to drive this growth by virtue of the country’s firm foothold in Africa and several Latin American countries. China already has several cooperative agreements in place with governments in these countries. It is therefore quite likely that the deficient emerging market economies will have to look to China and possibly India to drive research, and development of AI/blockchain-based applications, and also to provide direction as to how emerging economies can use these technologies for growth and development.

Why are use cases for AI and the blockchain in emerging economies quite different from what obtains in advanced societies? This is as a result of the peculiar challenges that are found in the economies of emerging markets. What are these challenges?

A major challenge is the performance of economic activity using traditional channels and outdated technology.

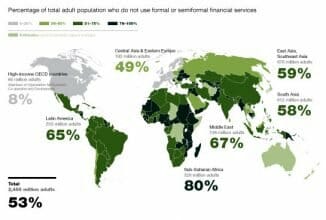

Another, is cultural beliefs, which tend to define how new technologies are viewed by the populace. Another is financial inclusion. The percentage of the population that performs financial transactions outside of the channels provided by the recognized financial institutions is large. This is also a consequence of belief in more traditional ways of performing financial transactions, as well as a general distrust of financial institutions. Some of the distrust is steeped in cultural and traditional beliefs. For instance, many low-income earners as well as those involved in informal businesses prefer to save their money using traditional cooperative societies, or keep their money in traditionally constructed safes. This segment of the population also has little formal education and finds it hard to use modern methods of financial transactions. Finally, most people are not accepted by traditional banking institutions, since they lack credit record and even identification papers.

Data collection, storage and management systems in these economies are largely obsolete. Some governments in emerging economies have no official population data and still rely on figures that are as old as 20 years in planning and projections.

As a consequence of deficient data collection and management, information that requires sanctity of the collection and storage process cannot be relied upon as being accurate. For instance, Kenya has a long-recognized problem of land-grabbing. This is perpetrated by fraudsters, in connivance with land registry officials that are alleged to alter official land records (Olewe, 2018).

Solutions based on AI and blockchain technology will for emerging economies, find their greatest purpose when they are deployed to do the following:

1. Enhancing financial inclusion.

2. Improving the supply chain.

3. Creating transparent databases. These, theoretically, can become secure and inviolable e.g. for academic records, digital identity, land registration, mining, etc. For instance, Kenya is already looking at using the blockchain to deal with land-grabbing, and Rwanda is exploring the use of the blockchain to create an immutable database of ethically-sourced minerals (Estevez, 2018).

4. Healthcare The use of AI and the blockchain in maintenance of medical records as well as health insurance management.

5. Job creation/job augmentation.

With these points in mind, let us examine some of the emerging economies where some AI-powered/blockchain-based initiatives are already being used.

How Can Emergent Economies Benefit From Blockchain Plus AI ? A Case Study part 2

Dinis Guarda is an author, academic, influencer, serial entrepreneur, and leader in 4IR, AI, Fintech, digital transformation, and Blockchain. Dinis has created various companies such as Ztudium tech platform; founder of global digital platform directory businessabc.net; digital transformation platform to empower, guide and index cities citiesabc.com and fashion technology platform fashionabc.org. He is also the publisher of intelligenthq.com, hedgethink.com and tradersdna.com. He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays, and governments all over the world.

With over two decades of experience in international business, C-level positions, and digital transformation, Dinis has worked with new tech, cryptocurrencies, driven ICOs, regulation, compliance, and legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

He creates and helps build ventures focused on global growth, 360 digital strategies, sustainable innovation, Blockchain, Fintech, AI and new emerging business models such as ICOs / tokenomics.

Dinis is the founder/CEO of ztudium that manages blocksdna / lifesdna. These products and platforms offer multiple AI P2P, fintech, blockchain, search engine and PaaS solutions in consumer wellness healthcare and life style with a global team of experts and universities.

He is the founder of coinsdna a new swiss regulated, Swiss based, institutional grade token and cryptocurrencies blockchain exchange. He is founder of DragonBloc a blockchain, AI, Fintech fund and co-founder of Freedomee project.

Dinis is the author of various books. He has published different books such “4IR AI Blockchain Fintech IoT Reinventing a Nation”, “How Businesses and Governments can Prosper with Fintech, Blockchain and AI?”, also the bigger case study and book (400 pages) “Blockchain, AI and Crypto Economics – The Next Tsunami?” last the “Tokenomics and ICOs – How to be good at the new digital world of finance / Crypto” was launched in 2018.

Some of the companies Dinis created or has been involved have reached over 1 USD billions in valuation. Dinis has advised and was responsible for some top financial organisations, 100 cryptocurrencies worldwide and Fortune 500 companies.

Dinis is involved as a strategist, board member and advisor with the payments, lifestyle, blockchain reward community app Glance technologies, for whom he built the blockchain messaging / payment / loyalty software Blockimpact, the seminal Hyperloop Transportations project, Kora, and blockchain cybersecurity Privus.

He is listed in various global fintech, blockchain, AI, social media industry top lists as an influencer in position top 10/20 within 100 rankings: such as Top People In Blockchain | Cointelegraph https://top.cointelegraph.com/ and https://cryptoweekly.co/100/ .

Between 2014 and 2015 he was involved in creating a fabbanking.com a digital bank between Asia and Africa as Chief Commercial Officer and Marketing Officer responsible for all legal, tech and business development. Between 2009 and 2010 he was the founder of one of the world first fintech, social trading platforms tradingfloor.com for Saxo Bank.

He is a shareholder of the fintech social money transfer app Moneymailme and math edutech gamification children’s app Gozoa.

He has been a lecturer at Copenhagen Business School, Groupe INSEEC/Monaco University and other leading world universities.