The world economy and the financial industry are only in its early days of digitalisation and disruption. We are going through a wave of emergent disruptive fintech systems and blockchain decentralised models. At the moment there is a process of digitisation / Tokenisation of the economy/ financial industry, and a new evolution of the economy might be designing itself in the landscape of the future. It’s name? Crypto Economics.

Crypto Economics can be defined as the emergent commoditisation / digitalisation / Tokenisation of the economy with new digital / crypto models of finance and trading using decentralised DTL blockchain foundational technologies.

But the world economy is only in its early days of digitalisation. At the moment there is a process of understanding the parallel between commoditisation and digitalisation. Tokenisation of the economy and new digital models of finance and trading will thus be critical in the future world. Presently, both systems coexist.

The challenge is how to leverage real economy and digital economy, and how this affects established financial models. This is paramount as there is a dysfunctional unbalance between all present economic fundamentals, relations between commodities values and all digital assets, such as tech stocks and bitcoin valuations, and digital currencies and old solid commodities value such as Ggold, silver and now also tech platforms worth more than most of some countries.

Some considerations to look at

Governments, regulators and financial institutions need to consider decentralised models in order to enhance industry resilience, integrity and stability and work in governance structures while using data driven technology to leverage this.

Crypto Economics models needs to be at the centre of any government, financial organisation or regulator and by chain affect any business.

KYC (know your customer) and AML (anti money laundry) have to be digitalised and use blockchain smart contracts ASAP.

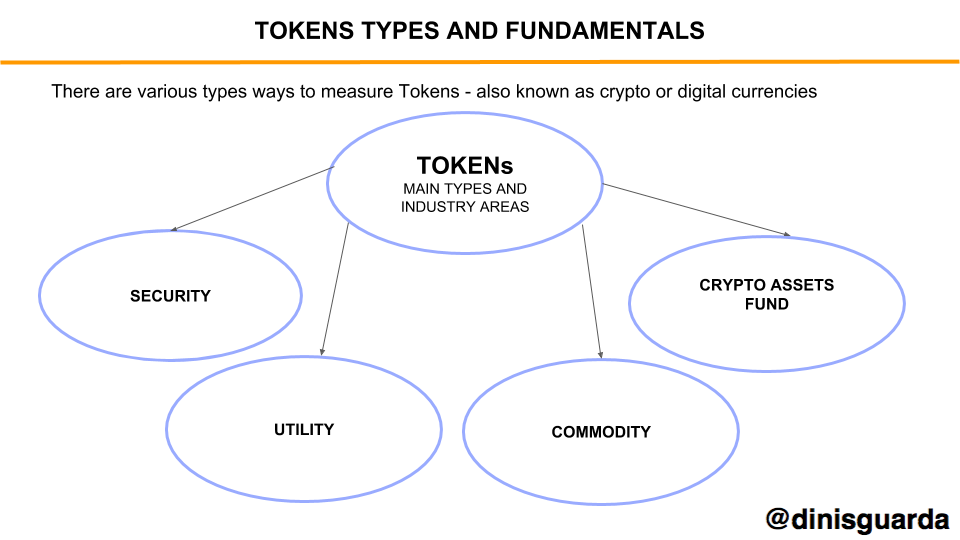

Types of ICOs

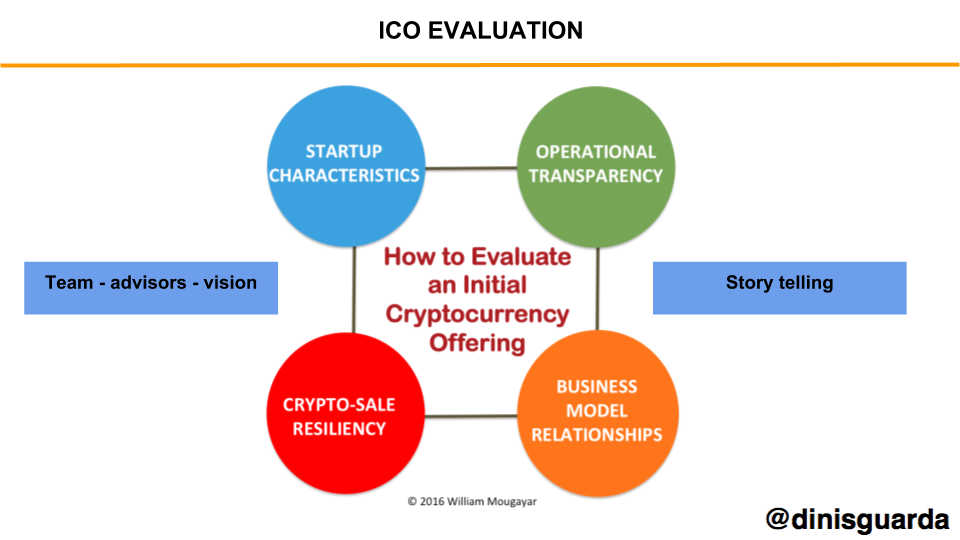

ICOs have hit the world by storm, particualrly in 2017, as an innovative way to fund a brand new blockchain project. As I head towards the last quarter of 2018, some conclusions can be taken about the ICO experience. There have been different approaches on how these ICO campaigns are set up. Hardly any ICO has been conducted in the same ways as another. The price of a token during the ICO period often runs through different stages. We can say there are four different pricing mechanisms:

1. Price increases: ICO runs in stages where the team sets a fixed exchange rate for the tokens. The rate could increase incrementally with time. This way early investors who take the biggest risk get the best price per coin ratio. Backers send Bitcoins or Ethereum to the provided addresses and get the new token.

2. Price decreases: Another option would be a dutch auction as presented by the Gnosis team for the first time, where the sale starts at the highest price per token, then proportionally decreases until the end of the auction. Gnosis for example used a dutch auction mechanism to raise funds for their project.

3. Price is fixed: If the exchange rate of the issued token is fixed, this gives investors the opportunity to get as many tokens as they like at that fixed price. This mechanism is appealing to large investors because they don’t have to worry about influencing the price by purchasing a big number of tokens. After a token sale ends, there is a cool-off period where tokens might be frozen (investors are not allowed to transfer their coins for a certain amount of time) or kept away from exchanges. After the end of the cool-off period, exchanges can start listing token thus allowing other people to trade it at a market price.

4. Price not determined : A developer might decide not to sell his tokens at a fixed exchange rate but rather let people invest in his startup and then distribute the new tokens proportionally by giving each person a percentage of the tokens corresponding to the portion of his investment which is part of total investments. In the EOS token sale the total money invested got divided by the amount of available tokens in order to determine the price. In this case, if a startup gets a single investor he/she will get 100% of the tokens.

ICOs Steps and Requirements

The main steps to launch an ICO are the following:

- White paper – business model – strategy ;

- Team – management and technology ;

- Advisory board ;

- Token definition

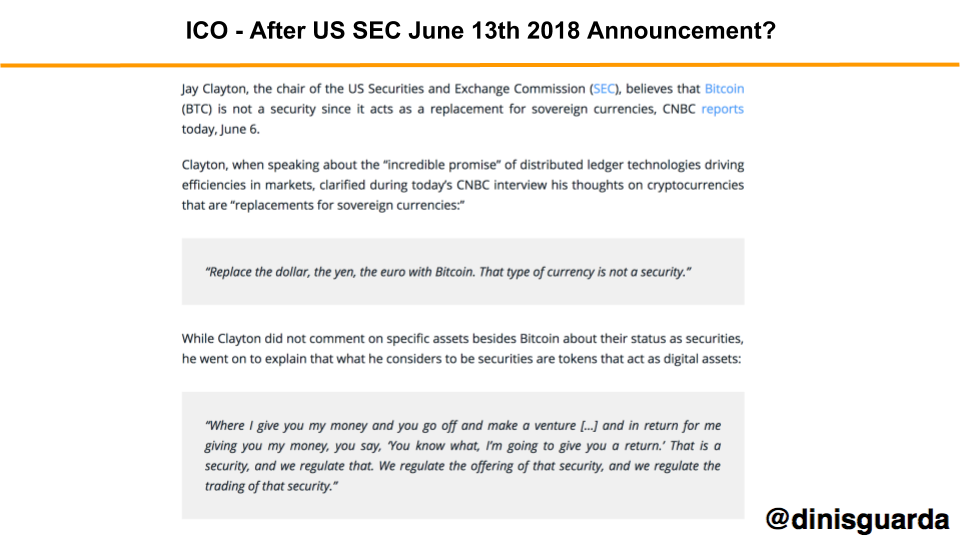

- Understanding if your token is a security, The “Howey Test”

- Incorporation – Foundation – country of choice ;

- Smart contracts and technology crypto set up ;

- Public presentation – PR – Communications – Marketing ;

- Token strategy and roll out ;

- Terms and Conditions ;

- Securities Laws ;

- Commodities Laws ;

- Taxes ;

- AML/KYC ;

- Consumer Protection ;

- Road map ;

- Investor relations.

ICO step by step

Pre-Announcement:

This is the business model, strategic plan in the form of a strong white paper, marketing / communications stage of a future project through sites frequented by cryptocurrency investors. The creators of the project should prepare a solid white paper, essentially an investor presentation outlining the details of the project, goals and road map. Once the white paper has been circulated, the company will get a sense of whether there is investor interest in the project proposed, with the company then addressing concerns and addressing risks raised by would be investors. This feedback then allows the team to reach a final business model and a final version of the white paper.

Road show and Offering:

This is the final version of the white paper, setting out the terms of a contract for the benefit of the investors, made on behalf of the company entering into the ICO. The offer will outline the project details, the total amount of capital required, together with project timelines. It will also indicate the financial instrument to be sold during the ICO, normally tokens, the road map and a road show to attract investors. The financial instrument will have a value assigned to it, together with the rights of the investor along with the expected period after which the company will commence returning earnings to investors, traditionally by way of dividends. Once the offer has been signed, the ICO start date is announced and the marketing campaign moves into overdrive.

Marketing Campaign:

This is a pivotal component of the ICO, with the marketing campaign key to the company being able to raise the necessary capital. Companies are generally nascent and unknown, bringing marketing agencies into the frame to make the necessary presentations, etc. The campaign will tend to last up to a month on average, target audience being institutional and some smaller investors. Participants of crowdfunding programs tend to be the main segment, investors are generally more willing to back projects, when their involvement in the project is considered to be a positive for both the investor and the company. Once the marketing campaign comes to an end, the buying and selling of tokens commences, with the company having established an exchange for investors to acquire tokens.

Important Considerations Before You Start

Some questions to ponder include:

- In what jurisdiction is the company / foundation incorporated?

- What legal structures are being disclosed?

- What is the token distribution structure?

- How is security handled?

- What are the apparent, perceived or real regulatory risks?

- Are there plans for external or internal audits?

- If there is a DAO-like component, is its articulation realistic and well grounded?

- Who has written up the token issuance contracts and actual token issuance software?

- Which blockchain infrastructure is backing-up their sale?

- Have they published the terms and conditions of the sale in clear language?

- Have you talked to at least 3 other entities who have successfully done a token sale before?

The Coin Center has published a very good analysis entitled “Could your decentralized token project run afoul of securities laws?” that is worth reading. It mentions two important points to keep in mind: 1/ tokens must be a utility to the operations of the business, and 2/ they should only become available after your operations, not prior.

A Mind Map of What to Do Before Launching an ICO Project

#Defining / Planning The Project

- What is you clear storytelling approach to a project?

- Can you create a project explanation in less then 60 seconds?

- What purpose does the blockchain have in your project?

- What are the biggest challenges you expect to face and how do you plan to overcome these challenges?

- What role does the coin have?

- Who will want to buy this coin?

- Is your service already offered by a centralized entity? If so, why does decentralizing it make it better?

- Who is/are your competitors?

- What is your competitive advantage?

- What are your biggest weaknesses?

- What is your total addressable market (TAM) and what do you estimate is the max share your network will take?

- How long do you estimate it will take for the network to launch and see adoption?

- What exchange(s) will/do you plan to be listed on?

- What is your Fiscal Policy? Instamines, premines, buying, spending, icing, discounting, and/or burning any tokens?

- What is your Monetary Policy? Inflationary? Deflationary? Fixed supply forever or additional tokens to be issued?

- If the project is forked off another coin, what is different and why the need for a new asset?

- What is the consensus algorithm used by the project and how was it picked?

- What languages will your website, whitepaper, and marketing initiatives be in?

#The Token Sale / Investor relations / Fundraising

- How many coins will be sold during the ICO?

- When does the ICO start and end?

- How did you determine the number of coins to be sold?

- What is your minimum and/or maximum fundraising threshold? How did you come up with each?

- What will you do with unsold tokens?

- What kind of discounts are offered to early investors?

- How were said discounts determined? Do the discounts incentivize HODLing or profit taking upon launch?

- Will your ICO include a roadshow? Where can I find your roadshow schedule?

- Are the instructions for participating in the ICO clear?

- Are you taking an precautionary measures to ensure scammers will not be able to mislead investors into sending funds to the wrong address?

#Definition of The Team, Partners, & Goals

- Who is on the team, what are their backgrounds & credentials, and do they have any public track records?

- Where are you physically based out of?

- How many tokens will be owned by the foundation & founders? Is there a vesting schedule?

- Who are your advisers?

- What do your advisers bring to the table?

- Are there any earlier backers of your project?

- What companies are you partnered with or seeking to partner with?

- Is there a clear, concise, and well written road map available for investors?

- What milestones do you have in place? How will you inform investors when milestones are achieved?

- Will your team be conducting any online events, such as webinars, Q&As, or AMA on Reddit?

#The Legal set up and related details

- Is your ICO project structured as a corporate or non-corporate entity?

- Does your ICO fall within SEC jurisdiction?

- Are you SEC compliant?

- Where do the tokens fall on the Howey Test?

- Are you offering a guaranteed rate of return to investors? (RED FLAG)

#The Business Development and the Financials

- What are the assets & liabilities of your project?

- What will be the use of the proceeds raised?

- What kind of expenses do you expect to incur?

- What is your cash burn for the year(s) to come?

- How much are your employees getting paid?

- Are employees going to be paid in tokens? If so, do they have a lockup period before they can sell in the open market?

#The Blockchain tech set up / Code

- Is the project open source?

- Where can I find the source code?

- Does your project have a bug bounty program?

- Where can I find your GitHub, Twitter, Facebook, LinkedIn, Slack and/or Subreddit?

- What is the web address for your project? What are the related social networks?

- How can we get in contact with you?

Sources and references:

50+ Questions To Ask When Evaluating An Initial Coin Offering (ICO)

https://medium.com/@petehumiston/50-questions-to-ask-when-evaluating-an-initial-coin-offering-ico-82d130501ee0

Dinis Guarda is an author, academic, influencer, serial entrepreneur, and leader in 4IR, AI, Fintech, digital transformation, and Blockchain. Dinis has created various companies such as Ztudium tech platform; founder of global digital platform directory openbusinesscouncil.org; digital transformation platform to empower, guide and index cities citiesabc.com and fashion technology platform fashionabc.org. He is also the publisher of intelligenthq.com, hedgethink.com and tradersdna.com. He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays, and governments all over the world.

With over two decades of experience in international business, C-level positions, and digital transformation, Dinis has worked with new tech, cryptocurrencies, driven ICOs, regulation, compliance, and legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

He creates and helps build ventures focused on global growth, 360 digital strategies, sustainable innovation, Blockchain, Fintech, AI and new emerging business models such as ICOs / tokenomics.

Dinis is the founder/CEO of ztudium that manages blocksdna / lifesdna. These products and platforms offer multiple AI P2P, fintech, blockchain, search engine and PaaS solutions in consumer wellness healthcare and life style with a global team of experts and universities.

He is the founder of coinsdna a new swiss regulated, Swiss based, institutional grade token and cryptocurrencies blockchain exchange. He is founder of DragonBloc a blockchain, AI, Fintech fund and co-founder of Freedomee project.

Dinis is the author of various books. He has published different books such “4IR AI Blockchain Fintech IoT Reinventing a Nation”, “How Businesses and Governments can Prosper with Fintech, Blockchain and AI?”, also the bigger case study and book (400 pages) “Blockchain, AI and Crypto Economics – The Next Tsunami?” last the “Tokenomics and ICOs – How to be good at the new digital world of finance / Crypto” was launched in 2018.

Some of the companies Dinis created or has been involved have reached over 1 USD billions in valuation. Dinis has advised and was responsible for some top financial organisations, 100 cryptocurrencies worldwide and Fortune 500 companies.

Dinis is involved as a strategist, board member and advisor with the payments, lifestyle, blockchain reward community app Glance technologies, for whom he built the blockchain messaging / payment / loyalty software Blockimpact, the seminal Hyperloop Transportations project, Kora, and blockchain cybersecurity Privus.

He is listed in various global fintech, blockchain, AI, social media industry top lists as an influencer in position top 10/20 within 100 rankings: such as Top People In Blockchain | Cointelegraph https://top.cointelegraph.com/ and https://cryptoweekly.co/100/ .

Between 2014 and 2015 he was involved in creating a fabbanking.com a digital bank between Asia and Africa as Chief Commercial Officer and Marketing Officer responsible for all legal, tech and business development. Between 2009 and 2010 he was the founder of one of the world first fintech, social trading platforms tradingfloor.com for Saxo Bank.

He is a shareholder of the fintech social money transfer app Moneymailme and math edutech gamification children’s app Gozoa.

He has been a lecturer at Copenhagen Business School, Groupe INSEEC/Monaco University and other leading world universities.