Our times are revolutionary for the future of fintech and digital assets. We are seeing the emergence of new carbon-neutral strategies, NFTs, and the Metaverse. It will see the increased importance of ESG – the Environmental, Social, and Governance investment factors. These will be driving most of the trends for the world economy overall.

To summarise these are the top areas to consider:

1. ESG 360 will become a new DNA for finance and businesses

2. Digital assets, including Bitcoin, will become mainstream

3. Metaverse NFT certification will become mainstream

4. Carbon footprint will become the new financial credit score

5. The healthcare sector and data will become the new ID fintech footprint

6. DeFi and Cefi will increasingly merge

7. AI Open Finance Web3.0 Metaverse will lead, disrupt, and replace the global financial economy

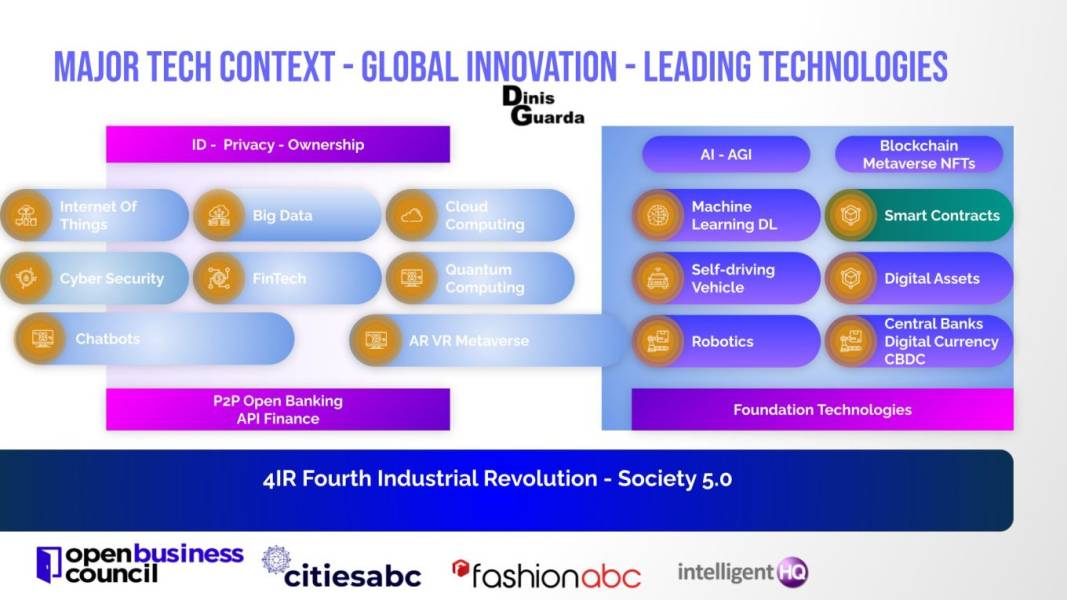

The last years were the years of fostering innovation and digital transformation for fintech and for our society, partly because of the Covid-19 pandemic. However, 2022 will accelerate the AI and P2P growth, creating fintech-driven communities continuously using Blockchain, the Metaverse, and NFTs as critical pillars of their foundations.

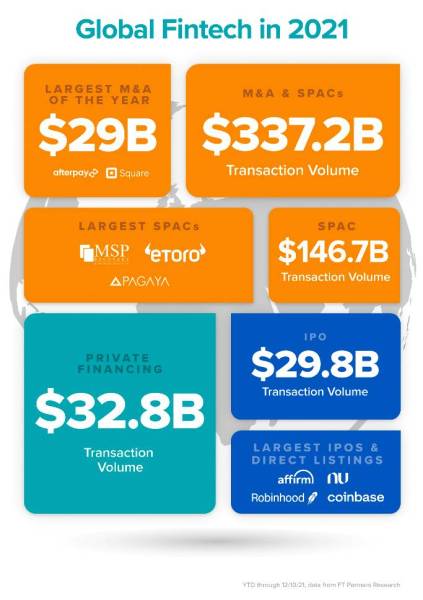

The financial services continued to have their waves and moments, as fintech fundraising surpassed the levels seen in previous years. In the next years, we might experience some troubles in the financial sector. Hence why we project that 4IR and Society 5.0 will drive fintech. These technologies will transform our society in a way that welcomes fintech into all business sectors, with a view that every business becomes a fintech eventually.

According to the data from Infinite Market Capitalisation, the market cap of Ethereum has surpassed that of every global bank, including JP Morgan.

1. Digital assets, including Bitcoin, become mainstream

As businesses evolved over the previous decades, taken over by the internet and wireless communications in every dimension, the use of crypto is gradually becoming a common trend, especially in the financial services industry. Finance-related apps are increasingly adding crypto products and features to their wallets. For example, some challenger banks are allowing their customers to increase their share of yield by offering DeFi (decentralised finance) solutions. Similarly, larger banks are experimenting, for now at a small scale, with lucrative crypto offers. Another trading app, Robinhood, has recently started to allow crypto trading on its platform.

To facilitate the integration and management of the correct balance between the fiat and crypto financial solutions, we will see the advent of more (and better) crypto infrastructure. This trend will enable consumers to utilise transfers, yield, and many more related services. Further, these infrastructure moves will support a new wave of fintech companies, giving rise to a revolutionary phenomenon – DeFi mullets in 2022 (DeFi in the back end, and fintech in the forefront).

Over the past decades, Bitcoin has entered the mainstream to successfully become a value store. After a slow rise, it gained immense traction in 2021, reaching all-time highs, and building up a considerable demand for the cryptocurrency. This trend is promising to blossom in the coming year, with the increase in trust among the users of the underlying blockchain technology.

2022 looks very promising for Bitcoin owing to its guerilla-style marketing strategy involving word-of-mouth practice and heightened expectations due to promising projections. Further, its unpopularity amongst the federal governments is one of the factors that drive the victims of the flawed system of traditional banking to embrace revolutionary technology.

2. Institutional retail interest in digital assets grows

With many institutions accepting the trade of cryptocurrency for carrying out their businesses, the masses are increasingly vesting their trust in blockchain technology. By the end of the previous year, institutional investments started flowing in from the like as – The European Investment Bank, Visa, JP Morgan, Square, and even Twitter.

The trend looks even brighter for the coming year with the rise of more crypto exchanges in the marketplace. This is bringing more cash flows due to conversions from fiat currencies to crypto. Technology seems to be evolving with the passage of time, tempting many new players to enter the grounds.

3. A shift to Metaverse experiences progresses

The web-based social platforms – Reddit, Twitter, Meta, and other online discussion forums are constantly discussing crypto for good reasons. A variety of participants- crypto enthusiasts, investors, and traders are increasingly getting involved in almost every manner- discussion forums, chats, and even live interactive broadcasts. These are the enlightening sources that can guide a seasoned as well as a new entrant in the world of crypto about price trends, trading strategies, and volatility.

Community-level crypto fundraisers like GameStop saga, ConstitutionDAO, or Citadel’s Ken Griffin provide an illustrious picture of the digital community that willingly directs its funds for a greater cause. Such a trend will gain momentum in 2022 when collective action of the community would involve various technological solutions like NFTs, digital assetisation, and Metaverse experiences.

4. Carbon footprint becomes the new financial credit score

ESG (Environmental, Social, and Corporate Governance) is a critical aspect of our modern-day sustainable living.

According to an estimate by OECD and World Bank, an investment of 6.9 trillion will be required by 2030 to meet the ESG targets for climate and development. The current spending on infrastructure is no more than USD 3.4 – 4.4 trillion, lagging significantly more than what is required.

Fiscal constraints and societal challenges like health, ageing population, and education overwhelm the governments and central institutions in bridging this gap. These enormous infrastructure challenges make it difficult to realise the UN estimates that by 2050, approximately 70% of the global population would be inhabiting urban areas. Thus, while governments, communities, and businesses would be upgraded to an equal economic status, society still faces the challenge to increase the momentum of development with innovation and technological advancements.

5. The healthcare sector becomes fintech-savvy

Some fintech products have the potential to be a breakthrough for the healthcare sector. In this industry, diversification into new revenue streams is critical. The payments are usually complicated (using the third-party payer system), for instance, which means that traditional products such as Stripe may not be the answer. The potential here is enormous.

6. Metaverse, NFTs, and DeFi increasingly merge with fintech

Decentralisation is the term of the day. Everyone is speaking about it. DeFi (Decentralised Finance) is not just a trend, however. It is clear that the everyday person is tired of centralised money supply control; the growth of Bitcoin and other cryptocurrencies proves that. And although the federal government may still stop this development and come in with new regulations, this would be against the wishes of its electorate.

7. AI Web3.0 community will lead the global financial economy and society

The current financial system is not working for everyone, it is clear. The communities that have been unable to build generational wealth are looking for a meaningful alternative. This is where Web3.0 comes in. Its constituency is young and diverse. Statistically, 9% of millennial voters, 73% of Hispanic voters, and 79% of Black voters are more likely to support a candidate who agrees that we should expand Web 3.0.

Conclusion:

“It is not the strongest of the species that survives, nor the most intelligent that survives. It is the one that is the most adaptable to change” – Charles Darwin.

If the 1st generation of the digital revolution brought us the Internet of information and data, the 2nd generation, now powered by blockchain + AI, as well as NFTs and Web3.0, is bringing us the Internet of value, money as digital assets, and digital twins identity.

We are now at a stage where digital community, token-driven platforms are the go-to platforms reshaping the world of business, healthcare, wellness, finance, and human affairs.

Finance is about managing financial assets. What we are experiencing now is all about technology and data but without forgetting the basics – the relationships between clients/partners.

New technologies are rapidly reshaping the entire financial services sphere. Fintech is no longer the headline, it is now the industry reality. Banks, insurers, and asset managers are knee-deep into the potential of such technologies. These will soon merge with Web 3.0 integration. This is followed by Blockchain, NFTs, and increasingly the Metaverse, where digital twins will become an integral part of our lives.

These technologies are the main drivers helping transform the finance industry and to stay on top of ever-changing consumer expectations. 2022 will be a powerhouse year for substantial disruption in this area.

Dinis Guarda is an author, academic, influencer, serial entrepreneur, and leader in 4IR, AI, Fintech, digital transformation, and Blockchain. Dinis has created various companies such as Ztudium tech platform; founder of global digital platform directory openbusinesscouncil.org; digital transformation platform to empower, guide and index cities citiesabc.com and fashion technology platform fashionabc.org. He is also the publisher of intelligenthq.com, hedgethink.com and tradersdna.com. He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays, and governments all over the world.

With over two decades of experience in international business, C-level positions, and digital transformation, Dinis has worked with new tech, cryptocurrencies, driven ICOs, regulation, compliance, and legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

He creates and helps build ventures focused on global growth, 360 digital strategies, sustainable innovation, Blockchain, Fintech, AI and new emerging business models such as ICOs / tokenomics.

Dinis is the founder/CEO of ztudium that manages blocksdna / lifesdna. These products and platforms offer multiple AI P2P, fintech, blockchain, search engine and PaaS solutions in consumer wellness healthcare and life style with a global team of experts and universities.

He is the founder of coinsdna a new swiss regulated, Swiss based, institutional grade token and cryptocurrencies blockchain exchange. He is founder of DragonBloc a blockchain, AI, Fintech fund and co-founder of Freedomee project.

Dinis is the author of various books. He has published different books such “4IR AI Blockchain Fintech IoT Reinventing a Nation”, “How Businesses and Governments can Prosper with Fintech, Blockchain and AI?”, also the bigger case study and book (400 pages) “Blockchain, AI and Crypto Economics – The Next Tsunami?” last the “Tokenomics and ICOs – How to be good at the new digital world of finance / Crypto” was launched in 2018.

Some of the companies Dinis created or has been involved have reached over 1 USD billions in valuation. Dinis has advised and was responsible for some top financial organisations, 100 cryptocurrencies worldwide and Fortune 500 companies.

Dinis is involved as a strategist, board member and advisor with the payments, lifestyle, blockchain reward community app Glance technologies, for whom he built the blockchain messaging / payment / loyalty software Blockimpact, the seminal Hyperloop Transportations project, Kora, and blockchain cybersecurity Privus.

He is listed in various global fintech, blockchain, AI, social media industry top lists as an influencer in position top 10/20 within 100 rankings: such as Top People In Blockchain | Cointelegraph https://top.cointelegraph.com/ and https://cryptoweekly.co/100/ .

Between 2014 and 2015 he was involved in creating a fabbanking.com a digital bank between Asia and Africa as Chief Commercial Officer and Marketing Officer responsible for all legal, tech and business development. Between 2009 and 2010 he was the founder of one of the world first fintech, social trading platforms tradingfloor.com for Saxo Bank.

He is a shareholder of the fintech social money transfer app Moneymailme and math edutech gamification children’s app Gozoa.

He has been a lecturer at Copenhagen Business School, Groupe INSEEC/Monaco University and other leading world universities.