There has been a recent shift toward investing in overseas companies, which has resulted in a rise in the number of investors all throughout the world using Finartmedia. One of the benefits of this is significant potential returns on investment. However, in addition to its benefits, it also has a number of drawbacks, including exorbitant brokerage fees.

Although it is possible to invest huge sums of money in stocks and shares listed in the United States, it is crucial to keep in mind that the Reserve Banks have set the maximum amount that may be invested by a resident at $250,000.

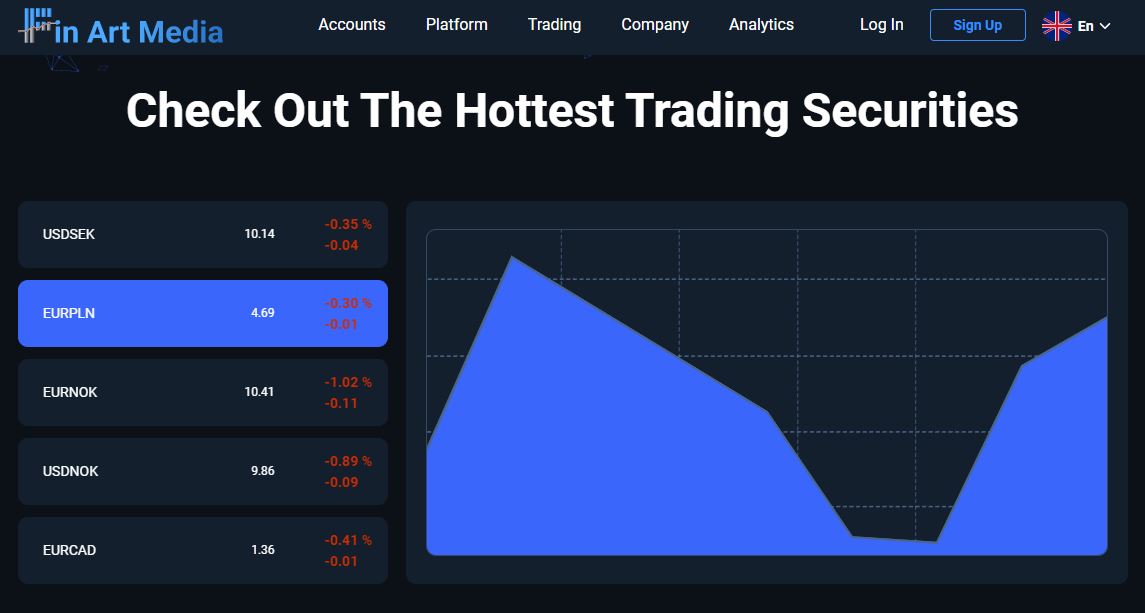

Finartmedia review: Benefits of investing in US stocks

The improved exchange rate that allows individuals to bag large gains is one of the primary reasons why many people buy foreign stocks. This is one of the primary reasons why many people invest in foreign stocks. In addition, many investors might work toward the goal of having a diverse portfolio by making investments beyond the boundaries of the nation. In addition, the United States stock market is home to some of the world’s most well-known and successful companies, including Tesla, Google, Amazon, Facebook, General Motors, Apple, and Microsoft, amongst a great many more.

These US stocks perform extraordinarily well, and their net worth is continuing to increase at a quick rate since they represent the future generation of industry innovators.

How to invest in equities listed on US exchanges

Finartmedia Investing in US equities might seem to be a strange and difficult endeavour. The procedure, on the other hand, is not very complicated and may carry out in one of two general ways:

1. Investments made directly

In order to directly invest in US stocks, you will need to follow one of the two steps outlined below:

- Create a Demat account with a global broker that affiliates with a broker from another country.

The Demat account opening procedure – is by far the most straightforward option since so many fund houses are geared up to support investments in international companies.

- Create an account with a broker based in another country.

There are a number of well-known international brokerage firms that facilitate investors’ access to the US equity markets.

2. Investing that is not direct

You have the option of making an indirect investment in foreign stock via any one of the following three methods:

Exchange-Traded Funds

Either a national or an global broker may facilitate the purchase of US ETFs on your behalf directly. You won’t be required to have a certain minimum deposit level when you invest in exchange-traded funds (ETFs).

Apps developed more recently

Investing in foreign stocks may also trade via the use of a variety of cutting-edge applications that have recently been made available by entrepreneurs.

Construct a Reputable Portfolio with the Help of Finartmedia

Building a successful portfolio and taking advantage of favourable trading circumstances are both possible with the assistance of this brokerage firm. This company protects both your personal information and financial assets by encrypting all of your transactions and storing them in a separate, separate account. Trading shares with this supporting investing business also comes with a number of additional perks.

Founder Dinis Guarda

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news, and distribution to create an unparalleled, full digital medium and social business networks spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems