Konstantin Peric (Kosta Peric) is a visionary technologist and thought leader, that has been working in the fusion between technology, finance and innovation. One of the top fintech worldwide personalities, he is Deputy Director, Financial Services for the Poor, at the Bill & Melinda Gates Foundation, where he leads the team that focuses on finance inclusion and digital payments. From governance through business models to technology, from ideas through architecture to development, he oversees the strategy and grants to deliver secure, reliable and affordable financial inclusion and digital payment solutions.

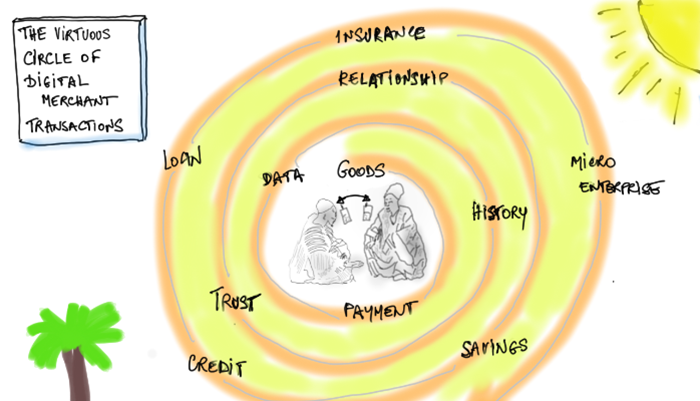

Konstantin Peric leads the organization’s efforts to build what he calls a digital financial system that, if successful, would include everyone to financial services. Financial inclusion means creating channels of financial support during times when people need it the most.

Previously, Kosta Peric was the co-founder and leader of Innotribe, the SWIFT initiative to enable collaborative innovation in the financial industry. At SWIFT, he was also the chief architect of SWIFTNet, the backbone worldwide secure network currently connecting 8,000 banks and 1,000 corporations, and servicing daily the world economy. He co-founded as well Innotribe, the initiative for collaborative innovation in the financial industry, and was the chief architect of SWIFTNet, SWIFT’s worldwide secure network currently connecting 8,000 banks and 1,000 corporations, and servicing daily the world economy.

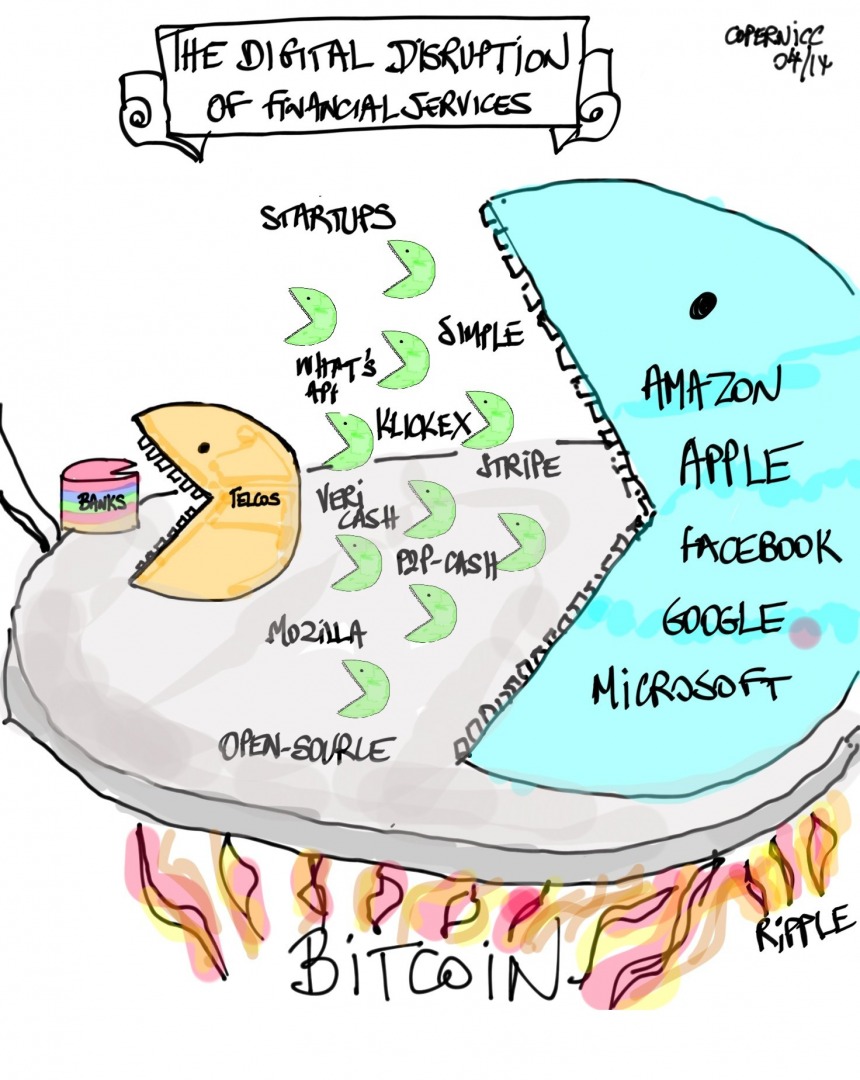

Kosta Peric is the author of The Castle and the Sandbox, a book on how to innovate in conservative companies. You can find him on Twitter @copernicc, and Google+ and read his forward thinking blog where you can as well appreciate his less well known artistic expression, with drawings and sketches that work as both art and thought provoking infographics!

In the following fascinating interview, given recently to Intelligenthq, Kosta Peric tells us about his background, his present challenges working at the Bill & Melinda Gates Foundation and his positive vision of a future of financial inclusion and prosperity for all.

Personal background and views

Can you tell us about your education and your personal and professional background?

I was born in Belgrade, in what was then Yugoslavia and is now Serbia. When I was 11, my father, a geophysicist, took our family to Burundi so he could work for the United Nations Development Program. I learned to speak French in Burundi, and when I was 17, I went to Belgium to earn my master’s degree in computer science at Free University of Brussels. I ended up staying in Belgium for 30 years, working for several companies, including SWIFT. My wife and I moved to Seattle two years ago when I started my focus on financial inclusion on the Financial Services for the Poor team at the Bill and Melinda Gates Foundation.

You wrote the book The Castle and The Sandbox – Transforming Conservative Companies In Established Industries Using Open Innovation. Your book is a very influential publication that bridges business and open innovation. Can you tell us about the book’s vision and how do you get the metaphor of the Castle and sandbox in a time of “startupization” and accelerated disruption?

In 2008, the incoming CEO of SWIFT Lazaro Campos asked me to think about how to inject more innovative thinking into the company, which, at that time, was quite risk-averse and conservative. As I explored options, I really came to value the simple notion that innovative ideas can be found everywhere—clients, suppliers, competitors, and many other sources, such as internal marketing and R &D. Since then, I’ve made it my practice to include as many people and opinions as possible in the ideation process. This is the first key concept in the book – open innovation.

The second concept is to truly empower those with ideas both entrepreneurs outside of the company and “intrapreneurs” to actually go ahead and act on them. This led to the “castle and sandbox” concept, where I encouraged idea owners to think outside the traditional parameters they’re used to playing in—the castle–and equipped them with the resources they needed to “play in the sandbox” and bring those ideas to life. Later on, the team and I extended this sandbox idea to technology startups, as they represented the essence of disrupting and transforming established industries through open innovation.

One of the key ideas and questions is how conservative companies in established industries become consistently innovative. Can you give us your input 2 years after the book launch and whether you witnessed or not progress in the business world?

Today, I’m happy to see that there is a thriving world of technology-driven innovation in the financial industry. In 2008, the financial industry didn’t openly embrace innovation — there were no incubators, accelerators or innovation hubs. Now, the landscape has changed tremendously. The key question of how to bring innovation back into the castle has itself produced innovative outcomes.

As I predicted, it has proven to be almost impossible to inject sandbox-style innovation back into the castle when the castle itself hasn’t changed. Instead, innovations coming out of the sandbox have emerged as new core business drivers that are helping to remake these conservative companies. And there’s real change happening. At Money20/20 this year, some of the key innovative voices were actually financial providers, which is very exciting.

One of the areas you have been talking is about the digitalisation of areas of society, after digitalisation of money and now the digitalisation of each of us. Can you elaborate of this?

Well, we’ve already digitized pictures, music, movies and books. The next step is inevitable we need to digitize our personas (with digital identity) and then our assets (including digital money, but also physical assets such as houses, livestock and land).

How do you see this going as we construct a great parallel world of data?

I see the digitalization of identity and assets having a huge impact on the unbanked poor. Rather than functioning in a cash-based, physical economy that keeps them at a disadvantage, those in poor communities can establish a digital identity that will allow them to take advantage of digital financial services and finally be part of the global economy.

How do you see Open innovation as we get more into open data and IoE and all the challenges and opportunities that brings with it?

The original open innovation concept is still valid because good ideas are everywhere. For example, if you are in the marketing or R&D department of a medium to large-sized company, you should be thinking about how to draw upon the energy and innovation across the organization and transform it into kinetic change that will benefit everyone.

SWIFT background and the financial industry

Your vision of finance has been quiet influential and special your work in SWIFT – Innotribe was a shift forward towards the conservative way the financial / banking industry has been driving business. Can you tell us about your experience in SWIFT?

It was a tremendous ride. Innotribe was an “internal startup” at SWIFT that became a key generator of products. We used open innovation to provide a forum and meeting place where anyone passionate about the future of finance could experiment and test out their ideas.

In my time at SWIFT, I saw everything from new products and new startups make waves in the market to the establishment of a permanent innovation lab that helped drive the financial industry forward. I’m happy to see all of this continuing—Gottfried Leibbrandt, the current CEO of SWIFT, mentioned that the lab is currently active in exploring the potential of blockchain technology, which is great.

Can you tell us how do you see both finance and innovation present landscape, namely in the bridge between the big players and new comers?

I’m happy to see a growing world of accelerators, incubators, conferences and venture capital firms as part of the FinTech landscape. Compared to 2008, it is a tremendous change something that I probably wouldn’t have dared to envision back then. I’m also very encouraged to see traditional banks becoming part of this movement. It’s no longer “out there” for them; rather, it’s becoming a key part of how they’re changing their internal castles. And the biggest change of all has been connecting the startups to the traditional financial sector. This is so obvious today, but when I started Innotribe it was a totally foreign concept.

Fintech and Finance innovation have disruptive the financial world as we know it. What are you views of it in a time when Fintech became the most positive and media amplification for the industry still so marked by scandals and lack of credibility by the global public audiences?

In a nutshell, we’re not there yet. There is a growing realization that technology must include more people in the system for it to really be beneficial. In particular, financial inclusion—the notion of the financial sector contributing directly to the growth of emerging economies by including more people—should be the next horizon for innovation and disruption.

As Apple and Google get into payments and finance how do you see Silicon Valley role in finance innovation?

I think Apple, Google, Facebook, Alibaba, and other large tech players are in a great position. They have a lot of buying power, so they “harvest” innovation through their acquisitions (such as WhatsApp’s acquisition by Facebook). However, they themselves tend to have a blind spot—they often assume that technology is pervasive in all corners of the globe.

I saw recently at Money20/20 that the payment industry among these large players is almost like a tech arms race. Right now, you need to have hundreds of dollars of technology on you (in addition to bank accounts and credit cards) to make seamless and safe payments, which is excluding more and more people from the financial system. This is a step in the wrong direction. I think nimble, frugal innovation is required to ensure we’re taking into account the needs and requirements of all people, including the poorest.

Universal Financial Inclusion – Interview with Kosta Peric Part 2

Dinis Guarda is an author, academic, influencer, serial entrepreneur, and leader in 4IR, AI, Fintech, digital transformation, and Blockchain. Dinis has created various companies such as Ztudium tech platform; founder of global digital platform directory openbusinesscouncil.org; digital transformation platform to empower, guide and index cities citiesabc.com and fashion technology platform fashionabc.org. He is also the publisher of intelligenthq.com, hedgethink.com and tradersdna.com. He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays, and governments all over the world.

With over two decades of experience in international business, C-level positions, and digital transformation, Dinis has worked with new tech, cryptocurrencies, driven ICOs, regulation, compliance, and legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

He creates and helps build ventures focused on global growth, 360 digital strategies, sustainable innovation, Blockchain, Fintech, AI and new emerging business models such as ICOs / tokenomics.

Dinis is the founder/CEO of ztudium that manages blocksdna / lifesdna. These products and platforms offer multiple AI P2P, fintech, blockchain, search engine and PaaS solutions in consumer wellness healthcare and life style with a global team of experts and universities.

He is the founder of coinsdna a new swiss regulated, Swiss based, institutional grade token and cryptocurrencies blockchain exchange. He is founder of DragonBloc a blockchain, AI, Fintech fund and co-founder of Freedomee project.

Dinis is the author of various books. He has published different books such “4IR AI Blockchain Fintech IoT Reinventing a Nation”, “How Businesses and Governments can Prosper with Fintech, Blockchain and AI?”, also the bigger case study and book (400 pages) “Blockchain, AI and Crypto Economics – The Next Tsunami?” last the “Tokenomics and ICOs – How to be good at the new digital world of finance / Crypto” was launched in 2018.

Some of the companies Dinis created or has been involved have reached over 1 USD billions in valuation. Dinis has advised and was responsible for some top financial organisations, 100 cryptocurrencies worldwide and Fortune 500 companies.

Dinis is involved as a strategist, board member and advisor with the payments, lifestyle, blockchain reward community app Glance technologies, for whom he built the blockchain messaging / payment / loyalty software Blockimpact, the seminal Hyperloop Transportations project, Kora, and blockchain cybersecurity Privus.

He is listed in various global fintech, blockchain, AI, social media industry top lists as an influencer in position top 10/20 within 100 rankings: such as Top People In Blockchain | Cointelegraph https://top.cointelegraph.com/ and https://cryptoweekly.co/100/ .

Between 2014 and 2015 he was involved in creating a fabbanking.com a digital bank between Asia and Africa as Chief Commercial Officer and Marketing Officer responsible for all legal, tech and business development. Between 2009 and 2010 he was the founder of one of the world first fintech, social trading platforms tradingfloor.com for Saxo Bank.

He is a shareholder of the fintech social money transfer app Moneymailme and math edutech gamification children’s app Gozoa.

He has been a lecturer at Copenhagen Business School, Groupe INSEEC/Monaco University and other leading world universities.