Blockchain technology triggers unease and fear for the world’s traditional financial and economic institutions. Never before has the concept of money been challenged and pushed further through the advent of social media, co-creation, the social graph and concepts such as gamification. These forces are challenging the status quo and creating a kind of twilight zone.

A few decades after the invention of the Internet, we are coming to terms with a strange paradox: even though the web brought information and connectedness to larger numbers of people than ever before, the promise of opportunities and equality for all has thus far failed. The levels of inequality have risen to unimaginable levels in a time of economic growth in countries that were bankrupt just ten years ago.

The 21st century is one of staggering inequalities, as evidenced in the research of Edward N Wolff, of New York University: “as of 2007, the top 1% of households in America owned 34.6% of all privately held wealth, and the next 19% had 50.5% of the wealth.” According to the Congressional Budget Office, 20% of the world population owned 85% of the wealth, leaving only 15% of the wealth for the bottom 80% of the people. (More info can be found in the Wikipedia entry about the Occupy Wall Street movement.)

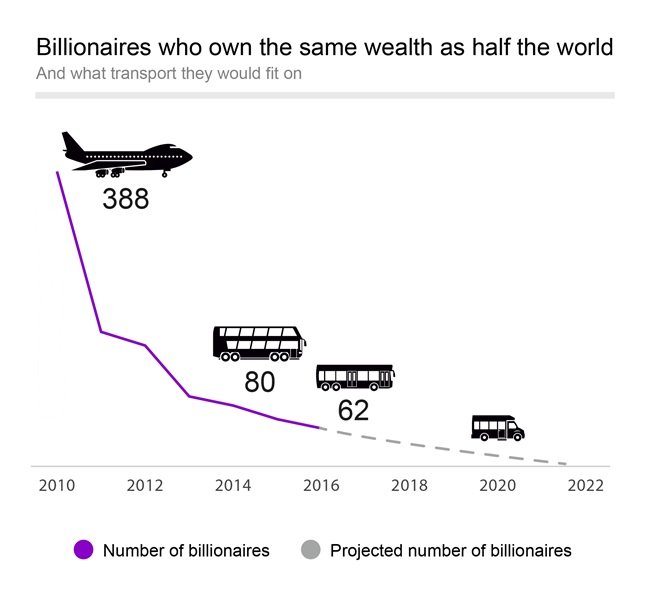

Today, the wealthy are wealthier and more powerful than ever in history: a minority of one percent of people owns almost half of the global assets. According to an Oxfam report published in 2016, 62 people own as much as the poorest half of the world’s population. The global inequality crisis is reaching new extremes.

These thought-provoking statistics illustrate the world’s schizophrenia and disparity.

In this troubling context, one must ask how society can cope with massive financial meltdowns as witnessed around the world this century. Corrective action is certainly needed to remedy an unsustainable situation with the potential to drive mankind (as we have repeatedly learnt from history) to more and more confrontation, riots, demonstrations, unemployment, and the proliferation of extremist movements and local guerrillas.

What can explain how the mentioned levels of inequality, coexist with a highly technological world where the creation of wealth, commodities, goods, advanced technology and health systems has developed further than in any historical moment before?

As David Kirkpatrick writes, one of the main issues with our present society is that:

“(…) the world lacks enough leaders who understand the potential for new, technology-driven solutions for global problems. To the degree that there is such leadership, it is concentrated in the business community. But even there, an understanding of tech’s potential is disturbingly uneven. Some companies thrive by embracing new methods of marketing, managing, developing products, and engaging with society. Others, by contrast, steadfastly operate in the old ways.”

Tackling these questions would undoubtedly lead to even more interrogations. For the moment, I prefer not to prescribe a specific solution. It would be too arrogant. I believe action can only come with moderation, homework, research, and wise thinking. In the past, all attempts to change the world in a radical, violent way just changed the surface.

Those looking for solutions need to bear that in mind that it is not so much about complexity, rather simplicity. The present landscape where we live strives to encourage users to engage in desired behaviors in connection with other people, and for the first time in history, thinkers around the world can connect in real-time, using social media, co-creation, and open thinking. I believe that open government, open business, open data can be fostered by using social tech tools, and other applications to exchange ideas and resources for positive impact.

We are in a time where the concept of money is going through a massive revolution. Money is now becoming digital, with new payment systems being built faster than regulators, policy makers, or financial institutions can keep up with. Current trends in the exchange of currency data, virtual currencies, trading algorithms, peer to peer exchange, software and general semantic engines, algorithms, search and social media are redesigning the way humans will interact with money forever. And all of this is going faster than politicians, governments, and organisations realise. If the economy is on the brink and most governments are sitting on the sidelines, unwilling or unable to help, there is major risk of continued massive shifts and redefinitions of the creation of wealth and commodities.

The Austrian School of economics advocates a methodological “individualism” (through a sound action mode of experimental research and natural experiments). But when interpreting economic developments with the theory that the essence of money is non-neutral, and emphasizing the organizing power of the price mechanism, it is clear that it is not possible to apply a rational way of looking at the present shift.

However, there is something deeper going on that even the wiser / informed economic and financial players are not understanding. As the Austrian school puts it very well, there are no perfect a-priori or non-empirical models or solutions.

That is the backdrop scenario of two paradoxical worlds: on the one hand, we have massive wealth in the form of mega corporations, both long-established and recent, coming from the startup world of Silicon Valley, New York, Bangalore, Taiwan, Hong Kong, Tokyo, London. The immense wealth of global companies such as Microsoft, Oracle, IBM, Google or Apple could individually bail out a country like Ireland of Portugal. On the other hand, the frustration and angry voice of a population increasingly aware of stagnant wages and unacceptable levels of inequality.

Herein lies an interesting paradox emerging in the middle of the dual ecosystem. The increasingly aware population is aware and knowledgeable because of the technology developed by some of those mega-corporations. iPhones, computers, iPads, tablets, and social media platforms Twitter, Facebook, Google+ are providing people with information, resources, connection and organizational tools. The population is also becoming increasingly aware that companies like Facebook and Google are, at the end of the day, networked monopolies that result from the participation of all of us, the users. Their economic profit results from our private data, but the profit of our data is not given back to us. The way to solve this conundrum, according to some experts, may very well be blockchain technology.

Blockchain technology also contributes much-needed transparency and trusted technology that enables us to create decentralized applications that cut out the middleman and to redistribute and take advantage of all the profit resulting from our data.

Even though it can help a lot, blockchain cannot, and will not be, the holy grail for a perfect world. There is no easy solution to the current state of affairs. On the contrary, it all comes down to awareness, an effort to demystify and to have an open spirit. Realising all this it is thus critical to think out of the box.

Change should be focused on an open way of thinking, a shift towards open personal and open business strategies allowing people to interact through all the fast-changing social media platforms, and the ever-increasing power of mobile devices. This can only help in the effort to find solutions in a reasonable way. And this is the main challenge democracies, business, finance, banking and the money industry needs to face.

Reading List about Blockchain

Blockchain Revolution: How the Technology Behind Bitcoin Is Changing Money, Business and the World

Blockchain: Blueprint for a New Economy

The Business Blockchain: Promise, Practice, and Application of the Next Internet Technology

Dinis Guarda is an author, academic, influencer, serial entrepreneur, and leader in 4IR, AI, Fintech, digital transformation, and Blockchain. Dinis has created various companies such as Ztudium tech platform; founder of global digital platform directory openbusinesscouncil.org; digital transformation platform to empower, guide and index cities citiesabc.com and fashion technology platform fashionabc.org. He is also the publisher of intelligenthq.com, hedgethink.com and tradersdna.com. He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays, and governments all over the world.

With over two decades of experience in international business, C-level positions, and digital transformation, Dinis has worked with new tech, cryptocurrencies, driven ICOs, regulation, compliance, and legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

He creates and helps build ventures focused on global growth, 360 digital strategies, sustainable innovation, Blockchain, Fintech, AI and new emerging business models such as ICOs / tokenomics.

Dinis is the founder/CEO of ztudium that manages blocksdna / lifesdna. These products and platforms offer multiple AI P2P, fintech, blockchain, search engine and PaaS solutions in consumer wellness healthcare and life style with a global team of experts and universities.

He is the founder of coinsdna a new swiss regulated, Swiss based, institutional grade token and cryptocurrencies blockchain exchange. He is founder of DragonBloc a blockchain, AI, Fintech fund and co-founder of Freedomee project.

Dinis is the author of various books. He has published different books such “4IR AI Blockchain Fintech IoT Reinventing a Nation”, “How Businesses and Governments can Prosper with Fintech, Blockchain and AI?”, also the bigger case study and book (400 pages) “Blockchain, AI and Crypto Economics – The Next Tsunami?” last the “Tokenomics and ICOs – How to be good at the new digital world of finance / Crypto” was launched in 2018.

Some of the companies Dinis created or has been involved have reached over 1 USD billions in valuation. Dinis has advised and was responsible for some top financial organisations, 100 cryptocurrencies worldwide and Fortune 500 companies.

Dinis is involved as a strategist, board member and advisor with the payments, lifestyle, blockchain reward community app Glance technologies, for whom he built the blockchain messaging / payment / loyalty software Blockimpact, the seminal Hyperloop Transportations project, Kora, and blockchain cybersecurity Privus.

He is listed in various global fintech, blockchain, AI, social media industry top lists as an influencer in position top 10/20 within 100 rankings: such as Top People In Blockchain | Cointelegraph https://top.cointelegraph.com/ and https://cryptoweekly.co/100/ .

Between 2014 and 2015 he was involved in creating a fabbanking.com a digital bank between Asia and Africa as Chief Commercial Officer and Marketing Officer responsible for all legal, tech and business development. Between 2009 and 2010 he was the founder of one of the world first fintech, social trading platforms tradingfloor.com for Saxo Bank.

He is a shareholder of the fintech social money transfer app Moneymailme and math edutech gamification children’s app Gozoa.

He has been a lecturer at Copenhagen Business School, Groupe INSEEC/Monaco University and other leading world universities.