Art Market, Digital Transformation, Blockchain: Challenges And Opportunities

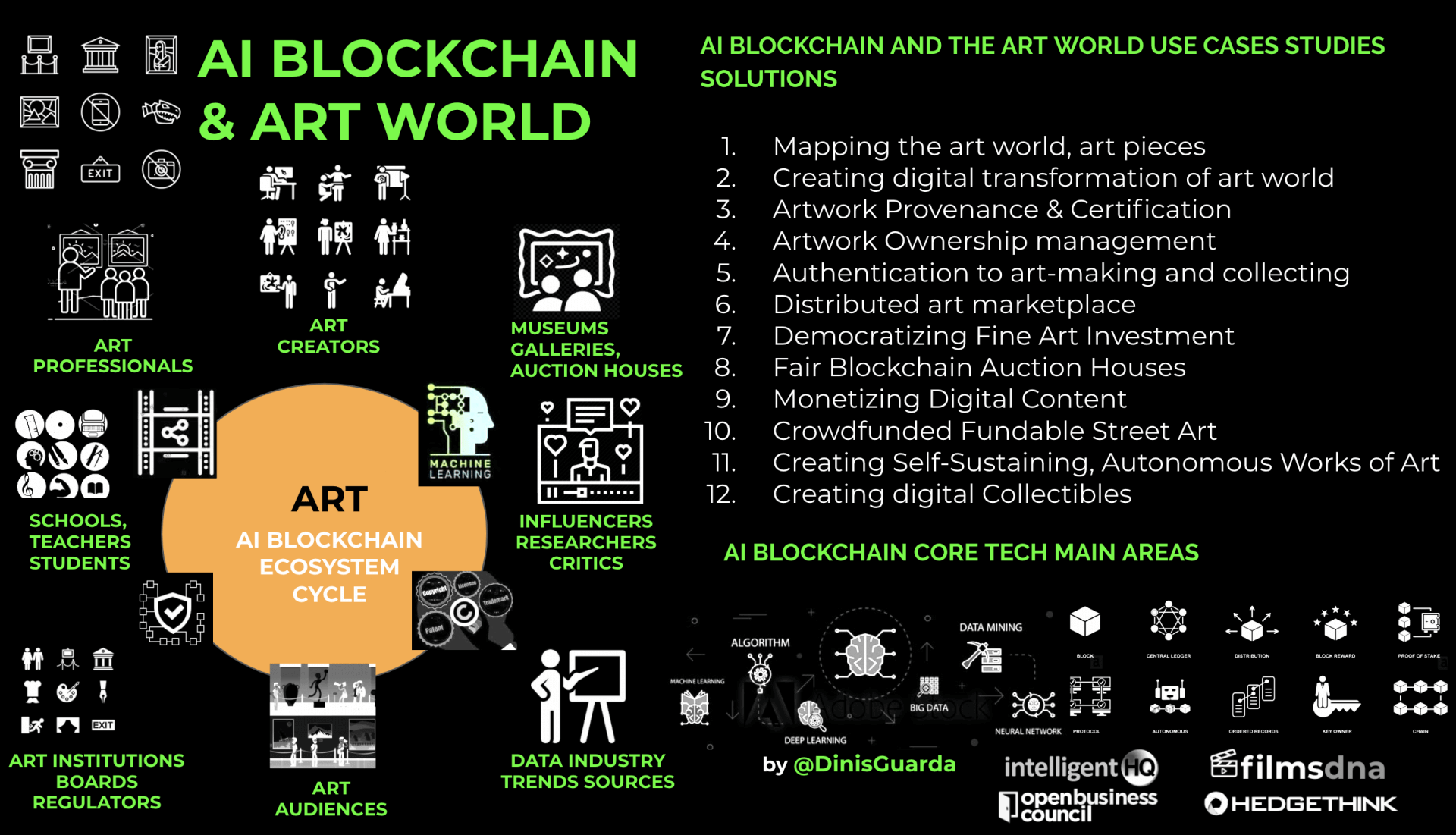

Our world is increasingly digital. The Art World will no exception and wil be going through digital transformation and special Blockchain has a power to change it in ways never seen

We journey through the city with the help of google maps, book tickets through eventbrite, and pay a coffee with an app installed on our phone. If the fever of digitization has taken the world by storm, and radically changed our experiences, there are still areas yet to be digitized. The world of the art is one of those few sectors.

The reason why is because historically the art sector tends to be seen as fragmented and inefficient, prone to irrational laws, besides being under funded, and very dependent on political circumstances. It has for centuries been largely informal, managed by elites and tribes. It is a sector that is still mostly unregulated and opaque and has led many players to be slow and resistant to innovative disruption, digitization and technological in depth innovation.

But one can actually look at the art market through the lens of a fantastic opportunity, even from a commercial standpoint, since it reaches out to sectors such as heritage, creative industries, technological developments in design, UX, UI, architecture, contemporary art, the cultural sector, trends and fashion among others. The world of art impacts education as well, in all its different sectors. The art economy, valued directly at nearly $50 billion, indirectly reaches around half a trillion USD.

Digital platforms for art are proliferating and the leading ones in terms of impact are as follow:

1. Instagram

2. Behance

3. Artsy

4. artnet

5. Christie’s LIVE

6. Sotheby’s BIDnow

7. Auctionata | Paddle8

8. Saatchi Art

9. Artspace

10. Auctionata

11. eBay Art

12. DeviantArt

When innovative disruption reaches the art market

As the world by large becomes increasingly digitized, so the art market. As such, that is an area which is experiencing, presently, a tipping point, with immense opportunities. Over the past decade, some larger art museums and institutions made an effort and took impressive leaps to adopt tech innovations to engage/ with audiences, by developing a strong digital presence.

But most of the art world, particularly traditional art-market gatekeepers, like small/medium sized museums, art foundations, galleries and auction houses, have been very slow to adopt the digital world, and have failed to fully digitize their databases, that contain information about prices, details of art work characteristics, provenance, and records of previous sales.

Moreover these organisations still struggle to understand how to use digital tools – besides digitisation of collections, there is so much that can be done – thus they keep a very offline existence.

Ian Robertson, in his book “Understanding Art Markets: Inside the world of art and business says:

“The art market does not conform to the Efficient Market Hypothesis (EMH). It is an imperfect and asymmetrical place in which prices fail to reflect all published and unpublished data. The assumptions that the irrational trades or art-market players are cancelled out by traditional arbitrageurs (Shleifer 1999), that prices instantaneously adjust to available information (Hagstrom 2001) and that indices capture all economic activity do not apply. Even the weak form of EMH fails to represent art-market activity.”

The process of digitization nonetheless is here now, and in many ways it is already improving the art market, becoming a core element of its DNA.

A positive outcome from this is that it is transforming art-market’s core business model, which has been until now, greatly secretive and complex, ruled by mysterious forces no one understands. The art market is being forced to become more transparent, and this is happening in an irreversible fast forward velocity.

A bog post entitled “The Art Market Shuns Digitalization, But Can It Survive?” posted in a study community fostered by Harvard Business School, states:

“The availability of a plethora of art market e-data has rendered a market that is usually seen as secretive and lacking in disclosure much more transparent. Moreover, digitization has created innumerable possibilities for research on the relationship between information access and social practice in the art world.”

For example, today, even if through a process burdened with a lot of inefficiencies and hardships, one can start tracking in many cases the price histories of some given works of art through time as them exchange hands from buyer to buyer. Secondly, art market data’s is starting (in some markets) to have a wider availability.

This fact has been essential in supporting the globalization and commercialization of art, which has turned new art lovers into buyers and has encouraged growth in emerging markets beyond New York, London and Paris. But a lot needs to be done and there is a need for a global player to disrupt and innovate.

Who will be the disruptive platform, which will transform the art world, is yet to be known. For now definitely the blockchain tech is one if the possibilities and increasingly the best positioned digital transformation of the 4IR – Fourth Industrial Revolution tools.

The art industry has been having auction records broken in the last years. More important the online art market grew 9.8% in aggregate in 2018 to $4.64 billion according to research from Hiscox Online Art Trade Report 2019. The confidence levels in the growing digital art world have wavered, and social media platforms, special instagram (the king of the platforms for artists and the art world by far), facebook, continued to change the artist’s and the art industry role(s).

The online art market is still on its early days and it is probably one of the last sectors of the world economy to be digitised due to its unique properties and sensibilities. Probably the most notable changes is how to digitise the art world, its ecosystem and on this path there is an increasing interest and focus in the possibilities of the holistic blockchain technology.

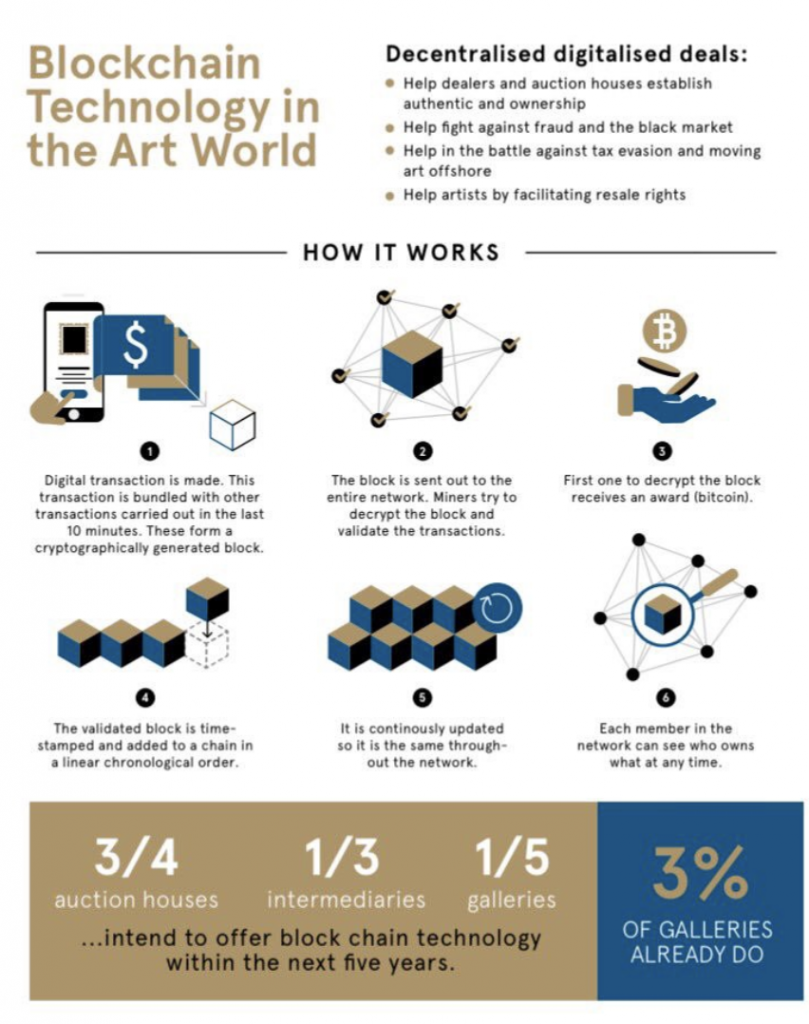

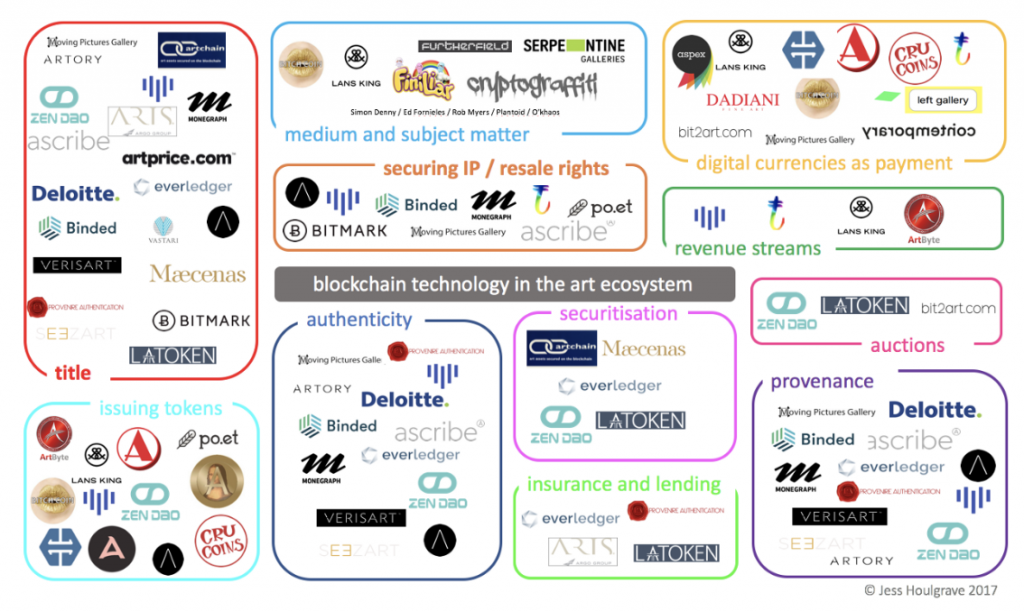

This tech also known as distributed ledgers technology is being introduced to solve and broaden the market’s issues and concerns around transparency, track ownership and provenance, and also as a way to provide an infrastructure for the possibilities that can be used with the tokenization of the art, artists and fractional artwork sales.

The art industry’s growing interest in digital transformation and particular blockchain has been increasing and is fully and increasingly present in the media. There was a noticeable growth in the possibilities of the digital transformation and datification for the art world. 2018 was a particular year of ground breaking and mainstream art institutions such as Christie’s, one of the most impactful world’s leading auction houses, held its first-ever Art+Tech Summit, dedicated partly to ‘Exploring Blockchain’ in the art industry.

Art and Tokenizisation

Tokenisation or Crypto Economics are The emergent commoditisation / digitalisation / Tokenisation of the economy with new digital / crypto models of finance and trading using decentralised DTL blockchain foundational technologies.

Tokens – In numismatics, token coins or trade tokens are coin-like objects used instead of coins as a conversion form of exchange. Digital tokens, are the online offering of coins, representing coins and currencies. These are typically managed over the internet, allowing people and communities to visit a paid website and purchasing digital tokens, or be rewarded with, using a fiat currency (such as US dollars) or another digital currency, crypto assets like bitcoin or ether.

The experience in July 2018, when blockchain platform Maecenas partnered with London gallery Dadiani Fine Art to offer a new radical ways to sell art pieces in fractional stakes in Andy Warhol’s 14 Small Electric Chairs (1980) was one of the first mainstream ways to tokenise the art world. With this experiment 31.5% of the Warhol work went up for sale in the form or tokens, also known as cryptocurrencies, including Bitcoin and Ethereum. The total dollar value of the cryptocurrency share of the work at the time was $5.6 million. It was one of the first big experments and a remarkable landmark for taking art minstream in technology.

Another breakthrough moment was when Christie’s New York made art world history when it partnered with blockchain-secured registry Artory to digitise an entire art collection. The moment happened when the auction house did the $318 million sale of the Barney A. Ebsworth collection, one of the most important sales of the year, and did the transactions recorded entirely via blockchain.

The use of blockchain, has many other possibilities and, enables the whole industry and the companies to efficiently create records of trust, ledgers that can “vet, permanently memorialize and expertly protect” transaction data, and also autheticate art pieces in digital records using smart contracts. Thiese set of possibilities open many new possibilties and the full use and combination opportunities may overcomes every traditional obstacle to an artwork title registry, opening the door to a new era of possibility of create digital records of trust in provenance and authenticity.

The blockchain like any other tech is a tool and is only as good as the way sthe tech is set up and the smart contract data inputted. The industry has therefore a lot of challenges to use it properly as an emerging tech and its main priority is to continue expanding its records and solutions. The only way to make this a success is by seeing the industry in an holistic ways and by onboarding all the art market players, artists, curators, art dealers and auction houses, museums, galleries and working with art data providers, investors and industry and government authorities.

Digital Transformation and Blockchain Technology as a way to create a trustful ecosystem for the art world

Over the last years, artists, art professionals and investment experts have tried to digitise the art world and some of them have been at the forefront of digital transformation and trying to use blockchain innovation as the way to solve many of the art world challenges. As well as using it to digitise and somehow find better solutions with its tokenization or finding ways to authenticate, or easily reproducible works with respect to IP and artists rights. There are lots of ways blockchain can be used and some artists have been using blockchain as a medium itself to create elaborated new arts pieces and solutions..

Digital Transformation and special Blockchain will be continuing to make bigger and bigger waves in the art industry, but a lot of work is required to digitise the sensitive and still offline art market. Although artists and the whole art world use increasingly digital tools lots need to be done to create best transparency and trust in the art world. Blockchain, AI and other digital tools will increasingly critical for the present and future of the art ecosystem and if well used can create a more transparent and trustful art world and also open new solutions to fund and create a more sustainable ecosystem to artists, curators and professionals of this special and creative of the industries.

Dinis Guarda is an author, academic, influencer, serial entrepreneur, and leader in 4IR, AI, Fintech, digital transformation, and Blockchain. Dinis has created various companies such as Ztudium tech platform; founder of global digital platform directory openbusinesscouncil.org; digital transformation platform to empower, guide and index cities citiesabc.com and fashion technology platform fashionabc.org. He is also the publisher of intelligenthq.com, hedgethink.com and tradersdna.com. He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays, and governments all over the world.

With over two decades of experience in international business, C-level positions, and digital transformation, Dinis has worked with new tech, cryptocurrencies, driven ICOs, regulation, compliance, and legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

He creates and helps build ventures focused on global growth, 360 digital strategies, sustainable innovation, Blockchain, Fintech, AI and new emerging business models such as ICOs / tokenomics.

Dinis is the founder/CEO of ztudium that manages blocksdna / lifesdna. These products and platforms offer multiple AI P2P, fintech, blockchain, search engine and PaaS solutions in consumer wellness healthcare and life style with a global team of experts and universities.

He is the founder of coinsdna a new swiss regulated, Swiss based, institutional grade token and cryptocurrencies blockchain exchange. He is founder of DragonBloc a blockchain, AI, Fintech fund and co-founder of Freedomee project.

Dinis is the author of various books. He has published different books such “4IR AI Blockchain Fintech IoT Reinventing a Nation”, “How Businesses and Governments can Prosper with Fintech, Blockchain and AI?”, also the bigger case study and book (400 pages) “Blockchain, AI and Crypto Economics – The Next Tsunami?” last the “Tokenomics and ICOs – How to be good at the new digital world of finance / Crypto” was launched in 2018.

Some of the companies Dinis created or has been involved have reached over 1 USD billions in valuation. Dinis has advised and was responsible for some top financial organisations, 100 cryptocurrencies worldwide and Fortune 500 companies.

Dinis is involved as a strategist, board member and advisor with the payments, lifestyle, blockchain reward community app Glance technologies, for whom he built the blockchain messaging / payment / loyalty software Blockimpact, the seminal Hyperloop Transportations project, Kora, and blockchain cybersecurity Privus.

He is listed in various global fintech, blockchain, AI, social media industry top lists as an influencer in position top 10/20 within 100 rankings: such as Top People In Blockchain | Cointelegraph https://top.cointelegraph.com/ and https://cryptoweekly.co/100/ .

Between 2014 and 2015 he was involved in creating a fabbanking.com a digital bank between Asia and Africa as Chief Commercial Officer and Marketing Officer responsible for all legal, tech and business development. Between 2009 and 2010 he was the founder of one of the world first fintech, social trading platforms tradingfloor.com for Saxo Bank.

He is a shareholder of the fintech social money transfer app Moneymailme and math edutech gamification children’s app Gozoa.

He has been a lecturer at Copenhagen Business School, Groupe INSEEC/Monaco University and other leading world universities.