III. IoT – Connecting Matter with People

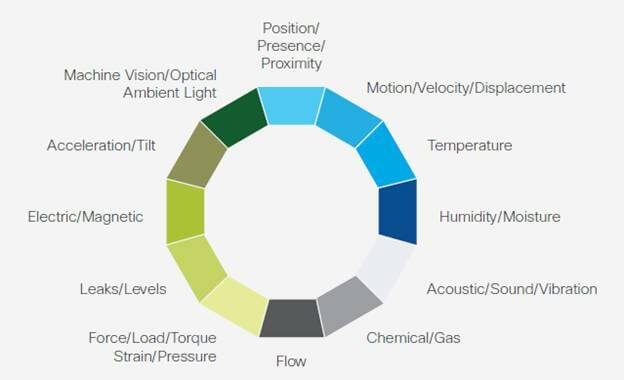

The Internet of Things (IoT) is another powerful tech that is enabling the swift transition to the 4IR. The IoT can be simply defined as objects that “talk to each other”. Matthew Evans, the IoT programme head at techUK, says: “Simply, the Internet of Things is made up of devices – from simple sensors to smartphones and wearables – connected together”.

Sensors are increasingly getting smaller and cheaper thus the IoT will tend to expand tremendously. Its capabilities are promising, as with a swift IoT architecture, companies and people are able to improve efficiency and innovate processes, and methodologies. It is not exempt of problems though and one possible solution to these would be the convergence of blockchain and the Internet of Things. Currently there are existing implementations, solutions, and initiatives happening experimenting with the use of this convergence.

According to an article by i-scoop (2018), Internet of Things applications are by definition distributed so it’s only normal that blockchain (which is a distributed ledger technology) will play a role in how devices will communicate directly between each other. Blockchain technology enables the possibility of keeping a ledger of not just devices but also how they interact and, potentially, in which state they are and how they are “handled” in the case of tagged goods.

Some tech giants have started to research how blockchain can help the IoT, which is the case of a recent project by IBM Blockchain. For IBM Blockchain, the most interesting possibilities for Blockchain are exactly the combination of AI, IoT, and blockchain across industries.

IoT will then be one of the key technologies to implement the cyber physical spaces of the 4IR that Klaus Schwab speaks about.

- Fintech: The energy heart of the world

Another key data driven 4IR technology is fintech. Fintech is revolutionising what we understand as money. Money is now becoming digital, with all kinds of solutions around finance, payments, and investment being built faster than regulators, policy makers, or financial institutions can keep up with. With the evolution of technology over the past decades we have seen incredible creativity in this sector, from community currencies, to digital money, mobile money, peer to peer lending et cetera. We have also seen the emergence of novel models of financing and investment such as crowdfunding and more recently the ICO (Initial Coin Offering) phenomenon, automated wealth management platforms, and also a rise in ethical and social investment digital platforms, open to everyone.

Writing for the Journal of Innovation Management, Patrick Schueffel defines Fintech as “the new financial industry that applies technology to improve financial activities” (2017). This is a thriving new area that uses technology and innovation as ways to innovate and offer alternatives to traditional financial methods. Finance, investing, and banking apps, the whole area of crypto-economics, transfer and remittance of payments, mobile money, and insurtech are all examples of fintech areas where thriving creativity and innovation is making financial services more accessible to people located not only in western countries but also in developing countries.

Fintech and The Mobile Revolution

The massive adoption of mobile phones boosted our global interconnectedness to new heights and these have impacted the huge amount of banking transactions that are completed every day, crossing borders at an amazing speed, resulting from conventional financial institutions, but also non-traditional ones, such as payment transfers, lending, investment, insurance, p2p lending etc.

Fintech benefited a lot from the mobile revolution which triggered some new areas of Fintech such as cryptocurrencies, wealth management tools such as robo-advisors, insurtech and others.

Fintech, financial inclusion and the 4IR

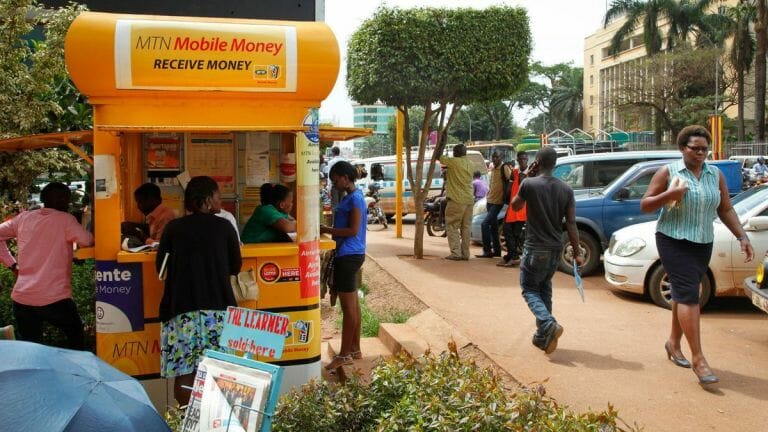

Another promising area of fintech which makes it so important for the evolution of the 4IR is financial inclusion. As stated previously, Fintech operates mainly through apps specifically developed for mobile phones. These have been adopted massively in developing countries. Mobile phones can thus be a possible solution for the inclusion of an estimated 2 billion people in the world that have no access or ability to obtain a bank account or manage their money, yet they have a mobile phone. These people are known as the “unbanked” and come from all walks of life from around the world. Not being able to manage your own money is a major problem that needs to be addressed to promote financial inclusion, which is where everyone has access to useful and affordable financial products and services. Fintech is looking at financial inclusion with profound interest also because its an area supported by large institutions such as the UN and the World Bank Group. Universal Financial Access (UFA) is a proposal by the World Bank Group and its achievement is seen as a top priority.

Banking the unbanked has been a difficult problem to overcome for many years, but there are various solutions trying to provide financial inclusion. Blockchain, in combination with fintech can be one of the possible solutions This is due to its capabilities of providing proper and safe identification to people that lack identification papers, which is by far the largest problem withholding the unbanked to be integrated in the global financial system.

As we have seen in this little overview, Fintech is incorporating more and more people in all kinds of economics activities happening globally. It is thus an area which is expected to grow and become key for the strong transition into the 4IR we are seeing in the world.

Challenges of the 4IR

As seen previously, digital transformation and the Industry 4.0 can lead us to experience a new phase of profound evolution in humanity and the world overall that can be quite beneficial. But there are problems as well and the dimension of those is quite scary. One possible side effect of the present phase of digital transformation and the fourth industrial revolution is job loss. In the past, we have witnessed how every single industrial revolution gave rise to some kind of automation, that then resulted in the development of new kinds of jobs.

These generally tended to be more stimulating and providing people with a better lifestyle, even if in the short term they were more unhealthy. When the first portable engines came to the fields, farmers stepped into the Industrial plants that built and maintained these and other machines. When robots entered the production lines, workers became responsible for the production and maintenance of these robots and whole new job categories were created at the same time. We have thus grown used to seeing how previous revolutions always bring about some kind of evolution in terms of jobs: from the fields to the factories, from the factories to services.

What about the present, 4IR? Academics studying the current shift all arrive to the same conclusion: this time round, we might actually have fewer new jobs in the new industries invented. A study done by Oxford Martin University (2013) called “the future of employment: how susceptible are jobs to computerisation” ( Frey, C.B: Osborne, M.A, 2013) reached the conclusion how about 47 percent of total US employment was at risk.

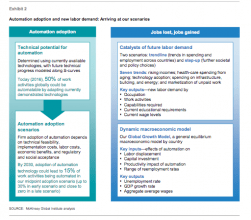

Another study done by McKinsey Global Institute in 2017, entitled Jobs lost, jobs gained: Workforce transitions in a time of automation, assessed the number and types of jobs that might be created under different scenarios through 2030 and compared that to the jobs that could be lost to automation.

Their conclusion was that countries with less resources and money would not be affected so much in the initial stages of this new revolution, but would be taken out of the world economic main stage if their workers are not reskilled.

The results also revealed a complex scenario of potential shifts in all kinds of work in the future. The report’s most important finding was that even though there will be enough job activities to maintain full employment until 2030,the transitions will be very challenging.

As seen in both studies outlined previously and in many others, the job challenge is real. What then needs to be done to solve it? Erik Brynjolfsson and Andrew McAfee. for example, propose the basic income guarantee (BIG) by turning the Earned Income Tax Credit into a fully-fledged Negative Income Tax (NIT) and making it larger and universal.

Contrary to Rifkin whose stance is that in the future labour will disappear, as humans will dedicate themselves to more creative, social, and spiritual endeavors, Brynjolfsson and McAfee feel that we will always need to work, since work is fundamental to the well-being of humans.

Other voices tackling the fourth industrial revolution, also propose an unconditional basic income (UBI) and see it as fundamental to respond to the expected deep shifts in the economy and the job market.

Besides jobs, other dangers of the Industry 4.0 are those related to security: as our world become increasingly governed by extremely complex automated digital systems, a whole new set of cybersecurity concerns will appear.

Finally, there are profound ethical questions that will need to be answered, particularly with the advancement of AI, which challenges the boundaries of what is to be a human or a machine. On the other hand, Humans are also changed while using technology, and develop novel cognitive capacities. With an increasing investment in education, we will have more informed, creative, and active citizens, at a global scale. These will have new needs (for example the ones living in authoritarian countries will push for further freedom and more civil rights). On the other hand, more automation will free people from long working days, particularly in Western Countries. As they work shorter weeks, they will have more time to engage in creative, social, political and spiritual outlets to express their drives. With better and fast communication tools, they will be able to inform themselves and self-organize more quickly and effectively with other like minded people. Their political and social awareness will evolve and all kinds of social and people’s movements might appear.

On the other hand, in terms of business, management and economics, authors like Adam Lent (Small is Powerful, 2016) and many others have written how disruptive technologies are subtly triggering all kinds of new organizational, management, and political structures which will be flatter and peer to peer, making ownership, power and resources become dispersed on a smaller scale, in a way that is better and fairer for everyone.

Digital Transformation, Innovation and Legislation

As we have seen, digital transformation is making us enter at quick speed into the fourth industrial revolution, which is here to stay. With novel and radical technologies such as AI, Blockchain, IoT, Fintech and many others, the impact of these will be profound as it transcends and overlaps in many different areas of our economy, society, environment, and personal lives. On the other hand as these technologies fuse with each other and operate in an integrated way, they will blur the lines between the physical, digital, and biological spheres.

As we have written previously, if this is to be a beneficial revolution overall, one must be careful and try to anticipate as much as possible its challenges and threats.

One area of key importance for the success of the 4IR is legislation. It is important to develop innovative policies and regulation, balancing them in such a way, that one does not fall into the trap of either killing innovation through over regulation or loosening it so much, that we end up having to face all kinds of dangerous outcomes.

Luxembourg is an interesting example in terms of policy making. This small country has been appointed as a case study of pioneering regulation that fosters innovation in a balanced way, due to the way they legislated in the financial sector, intellectual property management, and also, more recently, the highly controversial area of space mining.

The impact of the Digital transformation and the 4IR is not only economical. It also questions our existing culture and way of thinking, doing, and communicating, and the governance and management models that we embraced over the last 200 years. The current shifts can become, if we engage in careful planning, key to a more sustainable way of relating to the socio-economic resources of the future. They can help us improve our lives. But in order to do so, we have to look not only at their opportunities but also at its dangers. This is key if we want to avoid a dystopian control society and rather embrace a human-centred wise one.

What if we approach digital transformation and the 4IR as passionate pioneering creators, actively participating in the shaping of the radical technologies that are triggering it, such as AI, blockchain, IoT and Fintech?

Whatever answer is delivered to this question, one thing is certain: as we are entering the second decade of the 21st century, we will have to face the massive impact of escalating digital transformation and the 4IR. There is no way back.

Part 5 will be posted tomorrow

Digital Transformation and the 4IR – AI, Blockchain, IoT, Fintech part 1

Digital Transformation and the 4IR – AI, Blockchain, IoT, Fintech part 2

Digital Transformation and the 4IR – AI, Blockchain, IoT, Fintech part 3

Dinis Guarda is an author, academic, influencer, serial entrepreneur, and leader in 4IR, AI, Fintech, digital transformation, and Blockchain. Dinis has created various companies such as Ztudium tech platform; founder of global digital platform directory openbusinesscouncil.org; digital transformation platform to empower, guide and index cities citiesabc.com and fashion technology platform fashionabc.org. He is also the publisher of intelligenthq.com, hedgethink.com and tradersdna.com. He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays, and governments all over the world.

With over two decades of experience in international business, C-level positions, and digital transformation, Dinis has worked with new tech, cryptocurrencies, driven ICOs, regulation, compliance, and legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

He creates and helps build ventures focused on global growth, 360 digital strategies, sustainable innovation, Blockchain, Fintech, AI and new emerging business models such as ICOs / tokenomics.

Dinis is the founder/CEO of ztudium that manages blocksdna / lifesdna. These products and platforms offer multiple AI P2P, fintech, blockchain, search engine and PaaS solutions in consumer wellness healthcare and life style with a global team of experts and universities.

He is the founder of coinsdna a new swiss regulated, Swiss based, institutional grade token and cryptocurrencies blockchain exchange. He is founder of DragonBloc a blockchain, AI, Fintech fund and co-founder of Freedomee project.

Dinis is the author of various books. He has published different books such “4IR AI Blockchain Fintech IoT Reinventing a Nation”, “How Businesses and Governments can Prosper with Fintech, Blockchain and AI?”, also the bigger case study and book (400 pages) “Blockchain, AI and Crypto Economics – The Next Tsunami?” last the “Tokenomics and ICOs – How to be good at the new digital world of finance / Crypto” was launched in 2018.

Some of the companies Dinis created or has been involved have reached over 1 USD billions in valuation. Dinis has advised and was responsible for some top financial organisations, 100 cryptocurrencies worldwide and Fortune 500 companies.

Dinis is involved as a strategist, board member and advisor with the payments, lifestyle, blockchain reward community app Glance technologies, for whom he built the blockchain messaging / payment / loyalty software Blockimpact, the seminal Hyperloop Transportations project, Kora, and blockchain cybersecurity Privus.

He is listed in various global fintech, blockchain, AI, social media industry top lists as an influencer in position top 10/20 within 100 rankings: such as Top People In Blockchain | Cointelegraph https://top.cointelegraph.com/ and https://cryptoweekly.co/100/ .

Between 2014 and 2015 he was involved in creating a fabbanking.com a digital bank between Asia and Africa as Chief Commercial Officer and Marketing Officer responsible for all legal, tech and business development. Between 2009 and 2010 he was the founder of one of the world first fintech, social trading platforms tradingfloor.com for Saxo Bank.

He is a shareholder of the fintech social money transfer app Moneymailme and math edutech gamification children’s app Gozoa.

He has been a lecturer at Copenhagen Business School, Groupe INSEEC/Monaco University and other leading world universities.