Economy is a living organism. As any other living thing it has been conceived, born, developed and, even, it has been taken to its twilight throughout human history. This particular organism has a twist, a special characteristic that allows it to permute, to change as it adapts to new scenarios, new necessities.

Nowadays, we are going through changing times. The subsequent crisis of 2007 showed us how fragile was the capitalism system and how it was paradoxically, centralised. If one of the big stock markets sneezes, the whole world gets a cold. Seen the risks of that, new waves of sharing and making economy arose. This was focused on the people instead of big companies, using high tech tools to connect them and bringing them closer. An entire new world where the start-ups and freelances had their voice, and where they were in the middle of everything.

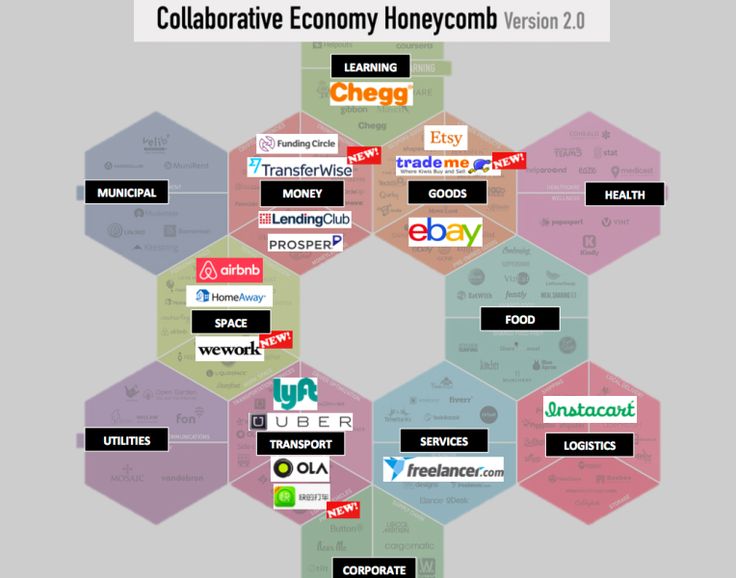

In that new world, this world, is where the term “sharing economy” came up, more or less one decade ago. It is based in a sort of peer-to-peer system, where every individual counts and all share the same position. These individuals actively participate as users, providers, lenders or borrowers in varied and evolving user-to-user (or more accurately business-to-business) exchange schemes which are often web-mediated through technological tools. They are all needed to make it work, and they all make it happen.

These users interact between them and provide services or products in exchange for a payment (it might be in goods). Besides, these shares are usually made in marketplaces found throughout the web, where the members interact and reach a business deal. They set the price to be paid and the transaction is made. Trending companies such Uber, Airbnb, Bla Bla Car, or even Ebay were born under the sharing economy principles.

Paying and being paid in the sharing economy: the cryptocurrencies

The users of the sharing economy still use tools from the old world, relics of the physical life, like cash. Official currencies as US Dollars or Sterling Pounds are the most common currencies used on sharing platforms, but they can also be seen as a barrier. Credit cards have high security measures and controls which limit the natural develop of this new economy. However, this trend (as everything does under this concept) is starting to change, to evolve, to break down the old walls.

The newly born cryptocurrencies are making it easy, agile and much more versatile to make payments while using sharing economy platforms. What is interesting with virtual money like Bitcoins is that they are decentralized. Bitcoins are not under the watch of a state or a bank who has the last word about your shopping. The bitcoin currency has its own rules, its own pace. When using bitcoins there are no transaction fees and no need to give your real name. They keep you anonymous, which means security (mostly). In addition, international payments are easy and cheap because bitcoins are not tied to any country or subject to regulation.

These cryptocurrencies are offered in exchange markets as well and can be acquired using different currencies (for a fee), and even other cryptocurrencies through a digital wallet. People can send bitcoins to each other using mobile apps or their computers. It’s similar to sending cash digitally.

Payment Method: Bitcoins Accepted

Cryptocurrencies still show some apprehension among many users. This math-puzzle digital coin is not easy to decode or even understand. The information given by the mass media and official channels is diffuse and incomplete. One of the last virus attacks towards worldwide companies, was asking for bitcoin payments. Certainly, not the best marketing towards bitcoin.

However, Bitcoin is a non-stop growing currency. Its value in the exchange market has gone up by more than 500 GBP in the last 6 months, and it has settled now at a rate of 1 XBT (Bitcoin) = 1580 GBP. More users are starting to trust its strength. Big companies all around the world begin to accept Bitcoins as a payment method, and even encourage it for its security and ease. Large companies like Microsoft, the media owner Bloomberg, the Japanese e-commerce giant Rakutan or the dating site Badoo allow you to pay using Bitcoin.

Therefore, it is just a matter of time that this new wave of start-ups and companies, under the collaborative consumption rules, see the cryptocurrencies potential and promote them. They share the same principles, they both are made by and for the people.

Thought leadership series on the collaborative economy, sharing economy and blockchain, powered by Humaniq

Launched in 2016, Humaniq aims to provide mobile finance to the 2 billion unbanked population through its mobile app for good, that uses biometric authentication to replace traditional methods of ID and security. Humaniq’s open source stack and API will be available for startups and other businesses to build services on its core technology, making it easy to adapt their service and plug it into Humaniq’s network to reach a huge, untapped audience.

Founder Dinis Guarda

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news, and distribution to create an unparalleled, full digital medium and social business networks spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems