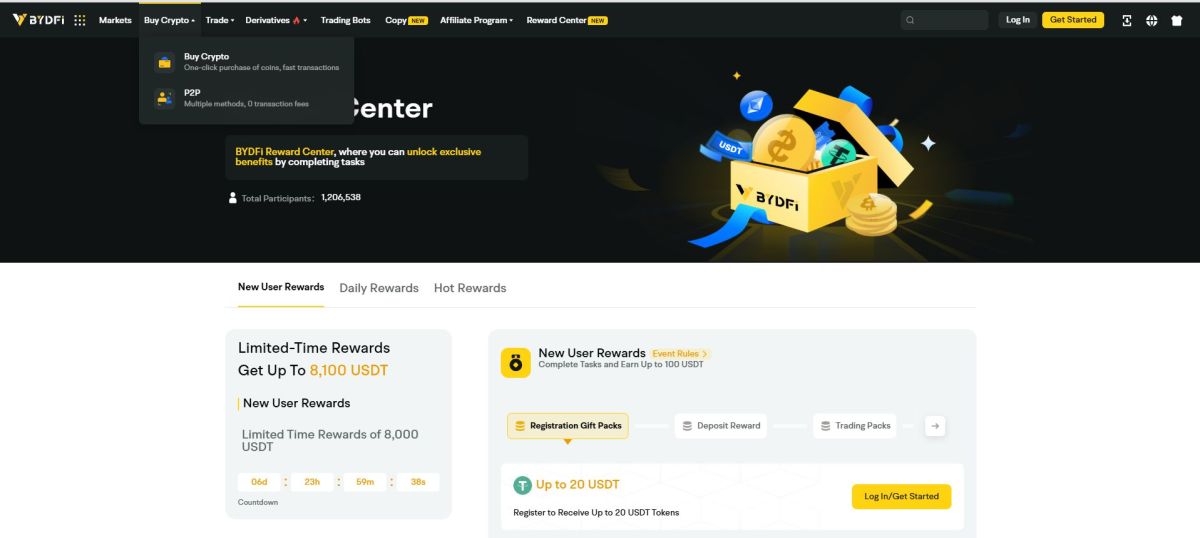

Looking for a secure and legal crypto exchange in the US? One of the standout platforms is BYDFi: A Trusted Crypto Exchange for US Traders, offering legal, secure, and user-friendly access to crypto markets. Explore BYDFi and discover a crypto exchange built for US investors.

The world of cryptocurrency trading is growing at an unprecedented pace. As of early 2025, the global crypto market is valued at over $2.5 trillion, with more than 420 million users worldwide engaging in digital asset trading, according to Statista. Exchanges play a crucial role in this ecosystem, facilitating over $100 billion in daily trading volume across both spot and derivative markets.

BYDFi—a trusted crypto exchange for US traders is gaining attention for offering legal, secure, and user-friendly access to crypto markets.

In the United States alone, approximately 46 million people—nearly 14% of the population—own some form of cryptocurrency. However, US-based traders face a unique set of challenges when choosing a crypto exchange. These include navigating complex regulatory frameworks, ensuring legal compliance, and securing access to platforms that protect user funds and support transparent operations.

Trade smarter and safer with a trusted crypto exchange for US traders that puts security and legality first.

What is BYDFi vs. MEXC

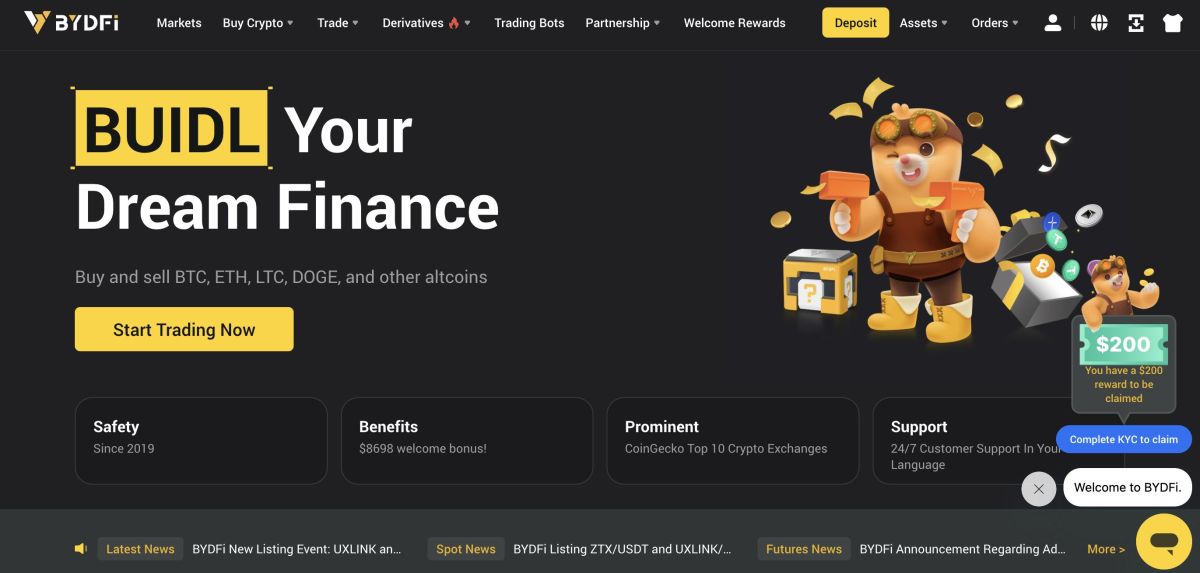

BYDFi, short for “BUIDL Your Dream Finance” is a one-stop social trading platform for individual investors, offering professional, convenient, and innovative trading solutions to global users. One of the key advantages of BYDFi is its legal accessibility to US traders. The platform is a member of South Korea’s CODE VASP Alliance and is registered with FinCEN (US Money Services Business registration) and FINTRAC (Canada), making it compliant with relevant financial regulations in both countries. Headquartered in Singapore, BYDFi offers a wide array of trading products including:

- Spot trading

- Perpetual futures contracts

- Grid trading (spot and futures)

- Copy trading

- Martingale strategy tools

- A demo trading environment with virtual funds

MEXC, founded in 2018, has quickly risen to prominence with over 10 million users across 170+ countries. The platform offers a wide selection of cryptocurrencies—over 2,100 trading pairs—and supports spot, margin, and futures trading. MEXC is known for its:

- Zero maker fees

- Futures insurance fund

- Advanced trading dashboard

- Native utility token (MX) for fee discounts

BYDFi vs. MEXC: Detailed Comparison

BYDFi vs. MEXC: Detailed Comparison

Let’s explore the key areas of comparison between BYDFi and MEXC, particularly focusing on aspects that matter most to traders and investors in the United States.

1. Platform Availability and Legal Compliance

BYDFi: BYDFi is one of the few international cryptocurrency exchanges that is legally accessible to users in the United States. The platform is registered as a Money Services Business (MSB) with the Financial Crimes Enforcement Network (FinCEN) in the US, and with FINTRAC in Canada. It adheres to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations as required.

- US Accessibility: Available in all 50 states

- Legal Status: Compliant with US regulatory requirements

- No VPN Required: Platform access is direct and unrestricted for US users

MEXC: MEXC, while widely used in over 170 countries, is not legally available to US residents. Access from a US IP address results in a prompt notifying users that services are not provided in the region. According to its terms of service, US residents are prohibited from registering or using the platform.

- US Accessibility: Blocked

- Legal Status: No regulatory approval in the US

- VPN Use: Considered a breach of terms; may result in account suspension

2. KYC and Verification Requirements

BYDFi: BYDFi operates a flexible and user-friendly KYC policy, making it ideal for privacy-conscious users:

- No KYC Required for spot trading and withdrawals up to 1.5 BTC per day

- KYC Required only for:

- Fiat deposits or withdrawals

- Higher withdrawal limits

- Verification Process: Upload government-issued ID and proof of address

- Status Options: “Verified” or “Unverified”—no complicated KYC levels

MEXC: From June 2024, MEXC implemented a mandatory KYC policy for all users:

- Primary KYC: Requires basic ID verification (passport, driver’s licence, or ID card)

- Advanced KYC: Includes facial recognition and biometric verification, Unlocks higher withdrawal and trading limits

- KYC is mandatory to access most trading services, regardless of region

3. Trading Products and Tools

BYDFi: BYDFi offers a diverse set of trading tools aimed at both beginners and experienced traders:

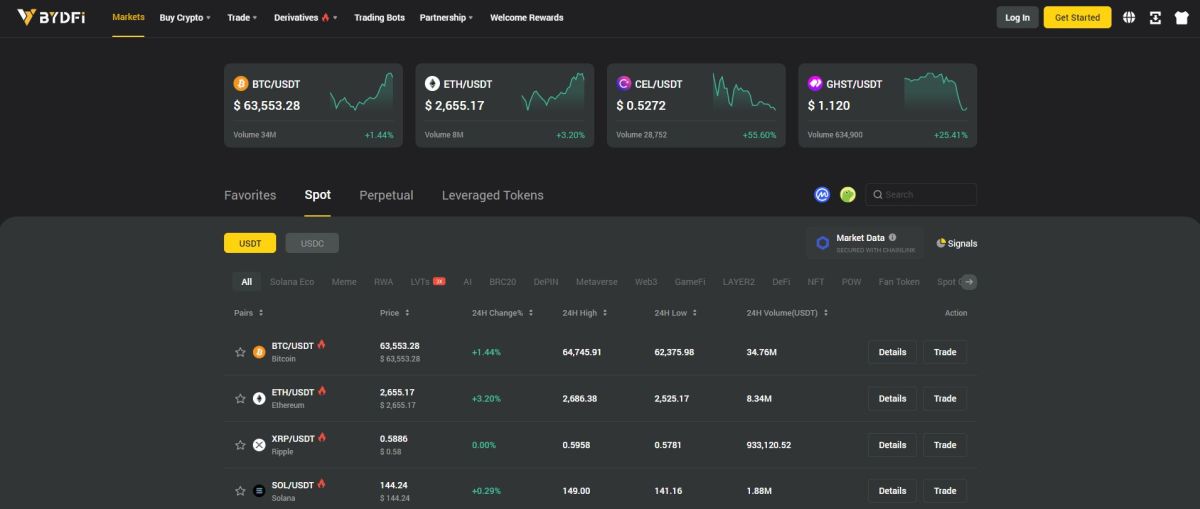

- Spot Trading: Over 600 trading pairs, including BTC, ETH, XRP, ADA, and emerging tokens

- Futures Trading: USDT-M and Coin-M perpetual contracts with up to 200x leverage

- Copy Trading: Users can follow top traders and replicate their strategies

- Grid Trading: Automated buy-low/sell-high within a set price range

- Martingale Strategy: Automated investment strategy to increase position size after losses

- Demo Account: Simulated trading environment with 100,000 USDT

- Low Entry Threshold: Trade with as little as $10

MEXC: MEXC is recognised for its extensive range of trading products and sophisticated tools:

- Spot Trading: More than 2,100 trading pairs, including niche tokens

- Futures Trading: Up to 200x leverage on USDT-margined contracts

- P2P Trading: Direct peer-to-peer transactions with fiat support (non-US only)

- Savings Accounts: Flexible and locked options to earn passive income

- Loans: Crypto-backed loans for liquidity without selling assets

- Zero-Fee Zone: Selected pairs available with 0% maker/taker fees

4. Fees and Cost Structure

Below is a comparison of the fee structures on both platforms:

| Fee Type | BYDFi | MEXC |

| Spot Trading | 0.1% – 0.3% (maker/taker) | 0% maker, 0.05% taker |

| Futures Trading | 0.02% maker / 0.06% taker | 0% maker (select pairs), 0.02% taker |

| Leveraged Tokens | 0.2% + 0.03% daily management fee | N/A |

| Conversion Fee | 0.1% – 0.15% per trade | Varies by coin and provider |

| Withdrawals | Based on network gas fees | Based on coin and network |

Additional Insights:

- BYDFi maintains a transparent fee structure, with real-time tracking of transaction history, fees, and profits.

- MEXC’s zero-maker fee policy benefits high-frequency traders, but US users cannot legally access this benefit.

5. Deposit and Withdrawal Methods

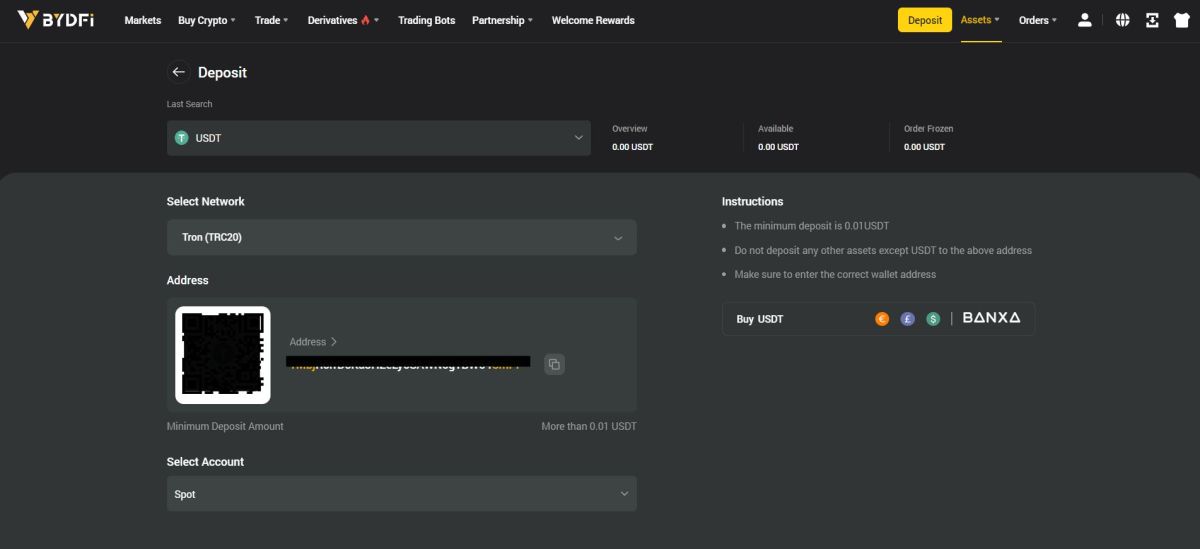

BYDFi: BYDFi offers comprehensive deposit and withdrawal options designed to accommodate both fiat and crypto users:

- Fiat Payment Methods: Credit and debit cards, Bank transfers, Partnerships with Banxa, Transak, Mercuryo, and Coinify

- Fiat Support: Over 100 currencies

- Withdrawal Limit:

- Higher limits with KYC

- Up to 1.5 BTC/day without KYC

- Withdrawal Processing Time: Between 9:00 AM and 9:00 PM (SGT)

MEXC: MEXC supports various funding methods—but not for US residents:

- Non-US Deposits: SEPA transfers, Card payments, P2P fiat/crypto trades

- Withdrawals: Processed 24/7, Subject to blockchain network load

6. Security Measures

BYDFi: Security is a top priority at BYDFi, with a focus on cold storage and asset protection:

- Cold Wallets: Majority of assets stored offline

- Segregated Accounts: Client assets kept separate from platform funds

- Whitelisting: Only approved addresses can receive withdrawals

- Encryption & Authentication: SSL protection and Two-Factor Authentication (2FA)

- Proof of Reserves:

- Ethereum (ETH): 171%

- Bitcoin (BTC): 157%

- Tether (USDT): 154%

MEXC: MEXC applies a multi-layered security framework to prevent unauthorised access:

- Hot/Cold Wallet Hybrid: Balances accessibility and security

- Anti-Phishing Tools: Email verification codes for user protection

- Risk Control Systems: Includes big data monitoring

- Futures Insurance Fund: Covers losses that exceed margin collateral

- CoinGecko Trust Score: Rated 9/10

Comparison Table: BYDFi vs. MEXC

| Feature | BYDFi | MEXC |

| US Accessibility | Yes (all 50 states) | No (prohibited for US users) |

| Regulatory Status | FinCEN (US) & FINTRAC (Canada) registered | Not legally compliant for US access |

| Spot Trading Pairs | 600+ | 2,100+ |

| Futures Leverage | Up to 200x | Up to 200x (not for US users) |

| Copy Trading | Yes | No |

| Demo Account | Yes (100k USDT virtual funds) | Limited access |

| Trading Fees (Spot) | 0.1%–0.3% | 0% maker, 0.05% taker |

| Futures Fees | 0.02%/0.06% (maker/taker) | 0%/0.02% (selected pairs) |

| Cold Storage | Yes, segregated & whitelisted | Yes, hot/cold wallet mix |

| Withdrawal (No KYC) | 1.5 BTC/day | 30 BTC/day (pre-2024), now KYC mandatory |

| Mobile App | Simple, supports full trading | Advanced tools, high user ratings |

| Fiat Support | Yes (via partners) | Yes (non-US only) |

| Proof of Reserves | BTC: 157%, ETH: 171%, USDT: 154% | Over 100% coverage |

| Insurance Fund | No | Yes (Futures Insurance Fund) |

| Operating Hours (Withdrawals) | 9am – 9pm (SGT) | 24/7 |

| User Interface | Beginner-friendly | Suited for experienced traders |

In a market where regulation and reliability are key, a trusted crypto exchange for US traders like BYDFi stands out as a secure, legally accessible option for US traders, while MEXC remains better suited for users outside the United States.

Choose wisely to ensure your crypto journey.

Founder Dinis Guarda

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news, and distribution to create an unparalleled, full digital medium and social business networks spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems

BYDFi vs. MEXC: Detailed Comparison

BYDFi vs. MEXC: Detailed Comparison