Bitcoin and its underlying technology, Blockchain, was designed to disrupt the financial industry through democratising its processes and making the industry more transparent, efficient, and secure. But the same features that will change the face of the financial industry are also set to change industries worldwide. Many of the fundamental principles of blockchain are not new, some have been around for decades, but it is the way these principles have been integrated and implemented in blockchain technology that has made it revolutionary. Though Blockchain is still in its infancy, we are beginning to see the true potential of its power and the many ways in which it can be applied to a range of industries worldwide that will benefit from better security, greater transparency, and a more decentralised system. Below we take a look at some of the key components that make Blockchain ripe for disrupting the industries in the 21st century.

It’s Decentralised

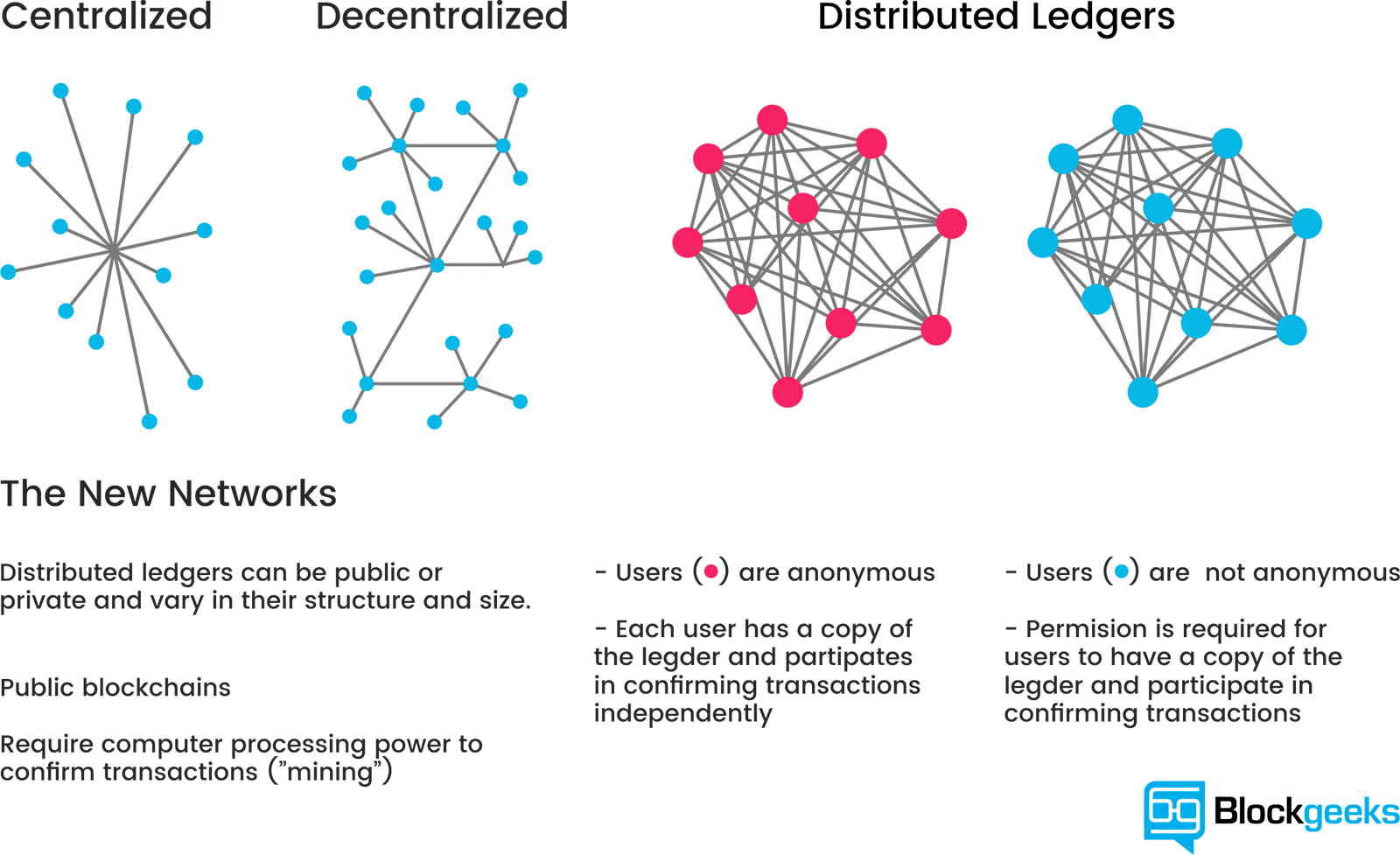

Arguably the most widely spoken about feature and also the intended purpose of bitcoin over traditional financial institutions is that it’s decentralised. Instead of a single entity being responsible for confirming and recording all transactions, transactions are instead confirmed by a network of users, and the historical records of all transactions are stored on a public ledger, accessible to anyone. Each node in the network stores an exact copy of the ledger, and when a new block is added to the blockchain each ledger is updated simultaneously. This distributed system eliminates the need for third party intermediaries to be involved in a financial transaction because the transactions are instead confirmed by a peer-to-peer network of users. This fairly simple to understand feature has many profound and positive implications. Overhead costs are no longer a requirement as there are no intermediaries charging to process transactions, therefore reducing transaction costs for the user. It is also far more resistant to hacking attempts because the blockchain is stored on a vast number of nodes, so there is no central point of control. Even if a percentage of computers were attacked, the ledger still remains on every other computer. While being a widely understood and key feature of bitcoin, it is blockchain technology that makes decentralisation possible and this feature could be applied across many industries to not only reduce costs, but to redistribute wealth back to the users who run the network rather than a central point of authority.

It’s Secure

Blockchain offers a level of security that has gained a lot of attention, from customers wanting better protection for their finances to governmental organisations, or security contractors. There are three key components that contribute to the security that blockchain provides.

It’s distributed. As we discussed in the previous section, blockchain’s decentralised element solves one of the great vulnerabilities many organisations such as investment firms, banks, or government agencies face by having their security operate from a centralised network. In a traditional environment where security runs from a central server, a malicious attack just needs to be penetrate one point. But because the blockchain stores a record of transactions across a vast number of networks, an attack to a computer or number of computers holding a number of copies would prove irrelevant, as the ledger would remain unaffected across the rest of the network. To take control of a distributed network such as blockchain, a hacker would theoretically have to compromise a majority of the networks in order to successfully attack the system, which when applied to blockchain is virtually impossible.

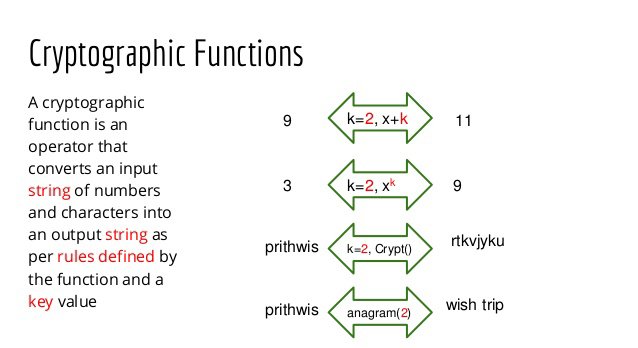

Cryptography plays a pivotal role in blockchain’s security through the use of hash functions and public key cryptography. Let’s start with hash functions. Each block is made up of 4 sections: a header, the body of transactions, the miner’s address, and a random number. The information from all 4 sections is input through a computational algorithm which produces a fixed unique output, otherwise called a hash. This hash can’t be produced by inputting any other data other than what was in the exact input that produced it. It’s also a one way system, which means that you cannot determine the input by knowing the output. The hash of each block is very unique, as changing one character in the input would produce a significantly different output. When a new block is created it must contain by hash of the previous block for it to be validated by the network. If a hacker attempted to come along and tamper with a block for personal gain, this would drastically change the block’s output and would not match the hash required in the following block. For a hacker to successfully attack the blockchain they would require enough processing power to be able to change all the blocks in the chain from where they attacked to change all the following block’s hashes, which to date is virtually impossible.

In Public Key Cryptography, a person generates a public-private key pairing which works like a kind of padlock and key. Public keys can be distributed to anyone but private keys, the key to the metaphorical padlock, must be kept private. Anyone can use your public key to encrypt a message they send to you, for instance if they send you some bitcoin, which can then only be decrypted using the private key associated with that public key. Transactions or messages encrypted by a private key can be decrypted by anyone knowing the associated public key. In this scenario private keys act as a sort of digital signature that are used to “sign” a transaction, so that someone with the public key can verify the authenticity and owner of the given transaction.

It’s Transparent

Blockchain technology has lifted the wool from over our eyes when it comes to understanding business practices – everything from seeing how a company spend their funds, to how the product you bought was made and transported to the place of purchase. With a public blockchain, any user is able to view all transactions completed on the blockchain, which address were used in each transaction, and how many bitcoins are held by an address. While this may seem like an invasion of privacy, having visibility of someone’s address doesn’t disclose the identity of that person. The transparency of the blockchain allows you to see the history of transactions and distributed ownership of the value on that network which allows for greater traceability and accountability of all involved. Charities are an excellent example of the benefit of traceability, as donors can now be assured of exactly where their donations have gone and organisations can now increase their integrity by showing their funds have gone where they said they would. Thinking beyond the benefit of transparent financial transactions, supply chains are another industry that can benefit from putting their business on the blockchain. Customers can now trace the cut of beef purchased from their local supermarket all the way back to the location and farm the cow came from, to the steps and length of time taken to get the meat to the supermarket where it was bought. Purchaser’s of clothes can now track where their item came from, and whether it was made ethically and under workers’ rights. Blockchain has handed the right back to customers of any industry, be it investment firms, supply chain logistics, healthcare providers, non-profit organisations and more, to know where their funds have gone and the quality and history of the product they are purchasing.

Through the integration of blockchain’s benefits into industry practices we are able to redesign the way businesses operate and perform at the benefit of business, employee, and end user. The key benefits of blockchain mentioned above lead to one very important aspect of blockchain and why it is making headlines around the world – it is trustless. We no longer need to rely on trusting a third party to confirm the integrity of any transaction, blockchain’s components enable this automatically. The question we expect to start asking ourselves is what future do third parties now face if businesses adopt blockchain on a global scale? Does this drastically cut jobs and professions, or will the new world adapt to the digital revolution by creating new jobs in new business structures that didn’t exist before? As we continue to evolve in the fourth industrial revolution we look towards digital technologies such as blockchain that are changing on a large scale the way businesses run and operate across the world.

Passionate speaker, digital technology blogger, and founder of the community Tech Talk Berlin. Coffee lover and sucker for cat videos on YouTube. Lauren has been working in business development for a number of Blockchain companies, most notably Kora where she works as Chief Administrative Officer. She creates, edits, and advises on white paper content and business strategy across a number of startups, and writes about technologies leading innovation and their applications in our future.