Artificial Intelligence (AI) seems to be the hottest topic of current times. AI is the driving force behind the wave of disruptive technologies sweeping the world, as it is producing the most amazing breakthroughs in all kinds of areas and industries. On the other hand, it is also raising profound fears, particularly in terms of future employment.

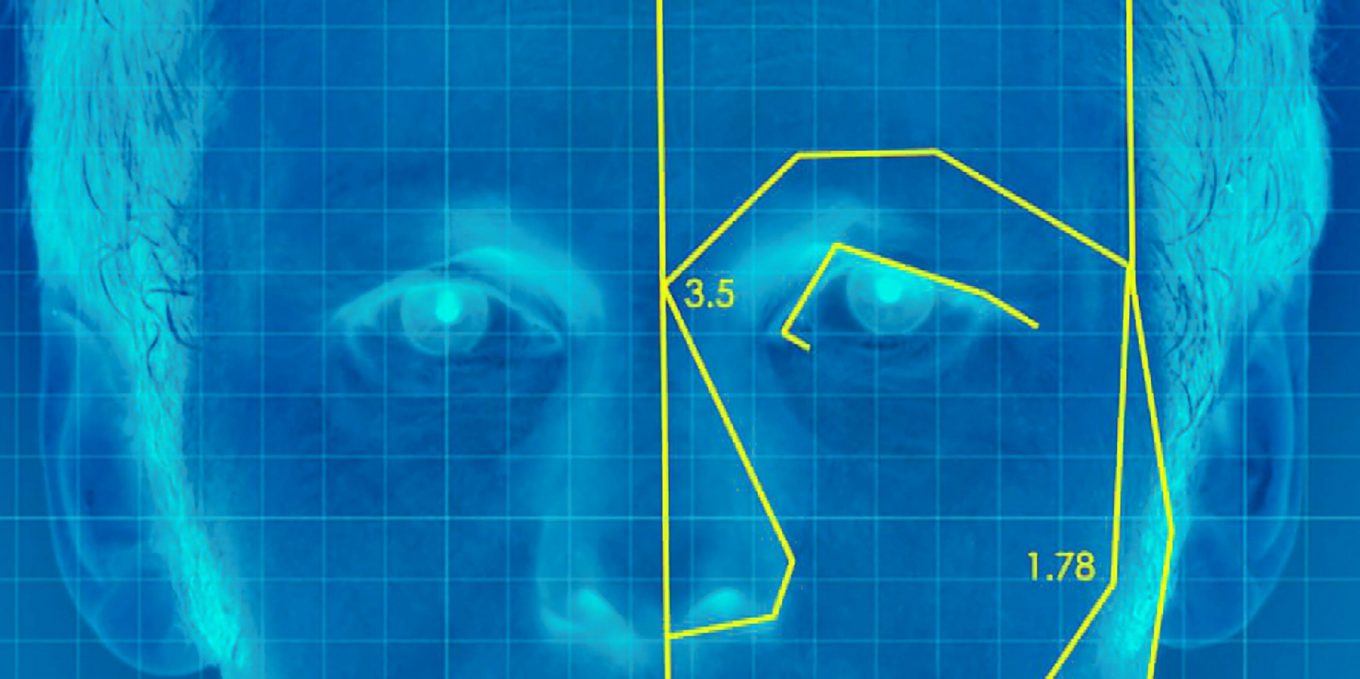

One of the areas where AI is producing important change is in credit decision. In recent years, the data sources used in credit decision-making have become increasingly broad and non-traditional, now including social media activity, retail spending habits and even political inclinations.

Intertrust, a global leader in providing expert administrative services to clients operating and investing in the international business environment, surveyed over 500 capital markets executives to identify the impact that AI, as a disruptive technology is having on jobs and skills and credit decision. Of these, one in six (14%) believe that AI has already surpassed human-based systems.

The research revealed a division in the industry about the impact of using such data on the quality of decision-making. While a third (30%) of respondents believe that using a broader range of data reduces subjectivity, a fifth (18%) think AI exacerbates existing prejudices in the credit decision-making process.

Artificial intelligence (AI) will produce more accurate, reliable and transparent credit decisions than human-based systems within five years, according to capital markets professionals surveyed by Intertrust.

The main results of the research revealed that:

- 14% of capital markets professionals believe that AI is already outperforming human-based systems

- 36% believe tighter legislation is required to protect borrowers’ rights

- 20% believe the use of non-traditional data has overstepped the ethical line

Intertrust’s study also highlighted privacy concerns regarding expanded data sets. Although almost a third (31%) of respondents think that the use of non-traditional data such as and personalised algorithms leads to better credit decisions than just relying on detached data, 36% believe tighter legislation is required to protect borrowers’ rights when they apply for funding and to restrict the information included in the assessment. A fifth (20%) suggested that the use of non-traditional data has already overstepped the ethical line and needs to be better controlled.

Cliff Pearce, Global Head of Capital Markets at Intertrust said, “The use of AI in credit decision-making has become increasingly commonplace, with the potential to make quicker more accurate credit decisions based on an expanded set of available data.

“A challenge in this area is that AI systems are only as good as the information programmed into them. For example, while a prospect may look like a poor risk at first sight, there may be extenuating circumstances overlooked by the system that a human would have noted. Put simply, AI underlines the contrast between the prime and more specialised non-conforming lending markets.”

About Intertrust

Intertrust is a global leader in providing expert administrative services to clients operating and investing in the international business environment. The Company has more than 2,500 employees across 41 offices and 29 jurisdictions in Europe, the Americas, Asia Pacific and the Middle East. Intertrust has leading market positions in selected key financial markets, including the Netherlands, Luxembourg, Jersey and the Americas. Intertrust delivers high-quality, tailored corporate, fund, capital market and private wealth services to its clients, with a view to building long-term relationships. The Company works with global law firms and accountancy firms, multinational corporations, financial institutions, fund managers, high net worth individuals and family offices.

Founder Dinis Guarda

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news, and distribution to create an unparalleled, full digital medium and social business networks spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems