Leadership teams in financial services organisations “do not appreciate the potential impact of technology disruption” – that’s according to more than half (52%) of the business decision makers in the sector. New research released today from connected planning specialist, Vuealta – The Future of Financial Services: Planning for Every Eventuality – reveals the array of challenges and disruptors that the industry will face over the next five years.

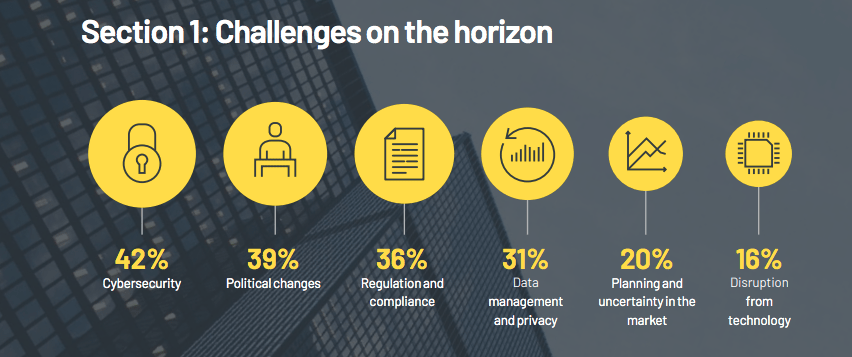

When asked what the biggest challenges their business would face over the next five years, respondents replied:

The financial industry is far from settled

Ian Stone, CEO of Vuealta, commented: “Now, more than a decade on from the events of 2008, the finance industry is far from settled. It’s chaos at the speed of the digital era. In fact, the next five years are set to be just as dynamic as the previous ten – filled with challenges and disruption but equally, presenting opportunities for those that navigate the period well. To do so, it is crucial that businesses remain calm, proactive and pragmatic. Control what you can control and make sure you can react quickly to the things you can’t.”

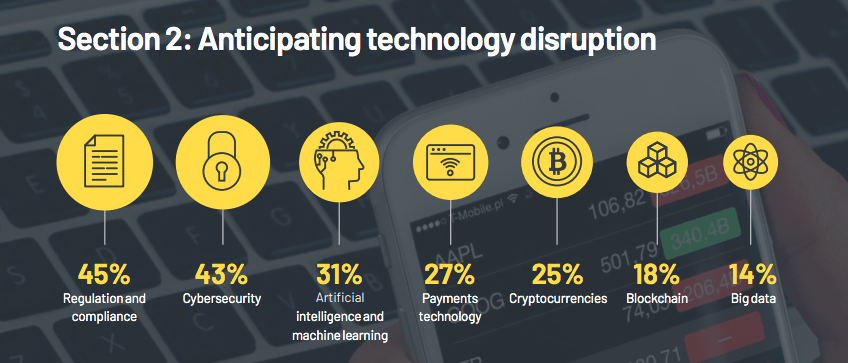

Amid the chaos, perhaps the most dynamic event in the industry in recent years has been the FinTech explosion. It saw global investment of $57.9bn in the first half of 2018 – more than it did in the entirety of the year before – and this looks set to continue. When asked what will be most disruptive to their business over the next five years, the respondents focussed on key technologies:

What are the Challenges?

There are myriad challenges and disruptors for financial services organizations around the world. The key is planning – planning effectively, at speed, and with instant access to the precise information you need.

However “The Future of Financial Services: Planning for Every Eventuality” report also revealed that a large proportion of organisations are trying to run their business with inadequate planning tools and processes: only 50% of respondents claim to plan with “all departments working from one tool which is updated in real time”; more than a third (35%) keep planning siloed within departments; 38% use multiple documents for different departments which are then used to try and create one plan for the business; nearly a quarter (24%) share one spreadsheet across business units.

Ian Stone, CEO of Vuealta, concluded: “The temptation for many businesses can be to take a wait-and-see approach. Organisations need to understand the environment that surrounds them, have a clear view of what is approaching on the horizon and then connect that to their own business information – enabling them to plot a route to success. Through this connected planning approach, you can reduce the impact of uncertainty and build realistic, actionable responses to all potential ‘what ifs’. Only then can you be armed with the insight you need, at the speed you require to face the challenges and disruptions that will shape the financial services industry in the years to come.”

The full report can be downloaded here.

The report was done by Vuelta, an international company providing tailored advisory, implementation and ongoing support services exclusively for Anaplan, a leading planning platform provider. A trusted advisor in business process and transformation, we work with global organisations to take a more unified and collaborative approach to planning – connecting people, plans and data to enable faster decision making. Vuealta has offices in Europe, Asia Pacific and the Americas.

Founder Dinis Guarda

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news, and distribution to create an unparalleled, full digital medium and social business networks spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems