Investors are becoming more socially aware and this is a very positive step, leading to their ability to be able to make what one could call as supposedly ‘good’ investments. But to understand precisely how to do this, to drive positive change, can be quite challenging for people and companies, and really measuring social and environmental impact alongside return on investments financially can be almost impossible. This is a subject explored by Cathy Clark (2014) in the Stanford Social Innovation Review. Good investing, argues Clark, involves quite simply investing money with a view to achieving not only a financial return but also a social impact.

Primarily, Cathy Clark recommends a book called The Power of Impact Investing, written by Judith Rodin and Margot Brandenburg. The book is based on a major effort that was undertaken to drive a new investment movement, and the book is focused on trying to get people involved in that effort by understanding why as well as how investing should be ‘good’. The emphasis is on the use of investment by third parties (not government or philanthropists) to be able to solve both social and environmental problems. It also reviews the challenges faced in trying to invest in places like Southeast Asia and Latin America and how learnings from investing in different places can be used to assist with challenges in completely different places.

The book starts by citing the experience of Ron Cordes, that having built a successful investment services fund in the US, sold it in 2006 by 230 million dollars, having decided to contribute to Society, by setting up a Foundation. After a while he realized that his approach to philanthropy had to change, as he aimed to see more results. He decided to tackle social and environmental challenges with the same strategies as he had used in his entrepreneurship: by seeking solutions that would be self sustaining and replicable. He became aware that more was achieved if he would put the funds into innovative social entreprises being developed by others. Cordes gave a talk in a TEDx event, explaining his process, and his story can be seen as an example of Impact Investing.

What is Impact Investing

Impact investing is defined as a form of socially responsible investing that can serve as a guide for various investment strategies. According to the definition of the Global Impact Investing Network :

“Impact investments are investments made into companies, organizations, and funds with the intention to generate a measurable, beneficial social and environmental impact alongside a financial return. Impact investments can be made in both emerging and developed markets, and target a range of returns from below-market to above-market rates, depending upon the circumstances.”

Impact Investing can be defined as well in a more straightforward way as: “investments that intend financial returns and social and environmental benefits.”

Five Steps leading you to make “Good Investments”

The Good Investor provides excellent advice on how to carry out the practice of ‘good’ investment. This is offered in a step by step approach that enables investors to be able to handle the situation in such a way that they really offer impact investing. At the outset it is recommended that:

“Investors in the early stages of setting up a fund will need to spend a little time thinking about what they want to achieve through their investments, and about their mission, focus and approach”.

This means looking at the types of sectors to target and the kinds of groups that the investor wants to benefit. It also means consideration should be paid to the direct impact on beneficiaries as well as the wider impact on communities and society as a whole. Carrying out this research means understanding what the true impact of the investment will be and making sure that it really helps the beneficiaries without doing damage in some way to other stakeholders. Following the planning stage, The Good Investor advocates screening and mapping to make sure that applicants for the investment are able to understand what they need to do to make a successful application. This requires a focus on looking at whether organisations have a well-developed mission, how much impact will be created, and what the governance is like. Potential profits also need to be examined and a transparent approach is necessary.

Following this it is argued that an Impact Analysis should be carried out. This requires looking at risk to understand how likely it is that the desired impact will be achieved. This requires examining areas such as feasibility and whether or not the applicant has a compelling and evidenced approach. It requires developing an impact plan to understand how impact will be generated. In particular when looking at impact generation, The Good Investor recommends exploring the direct impact on beneficiaries, the wider impact on the community, the sector and society at large and the impact for the investor, since the investment does also have to be beneficial for the latter too. The investor may be able to assist with delivering impact if they have a network or expertise that can add value, so this should also be considered.

The third step is making the investment decision and arriving at a deal. The Good Investor argues that this involves “Weighing the four parameters of impact risk, impact generation, financial risk and financial return”.

Coming to an investment deal meanwhile requires developing objectives, understanding how oversight and reporting will be achieved and developing measures for protection. Once the deal is set up it has to be monitored and evaluated and this is the fourth step. This helps the investor to understand if the investment is achieving its goals or not. It requires the investor to monitor both the reporting and the quality of information provided, as well as verifying any results and considering how the investment is likely to perform in the future.

Finally, the fifth step is impact investor reporting where true picture of results is provided to the investor. Following a robust process of which due diligence is a part is likely to be very beneficial for good investing and it is recommended to follow this process.

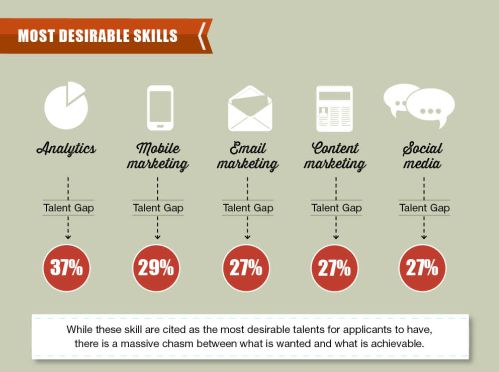

Additional resource: Infographic by Intelligenthq on the five steps for a “good” investment.

Infographic done by Maria Fonseca Intelligenthq

Paula Newton is a business writer, editor and management consultant with extensive experience writing and consulting for both start-ups and long established companies. She has ten years management and leadership experience gained at BSkyB in London and Viva Travel Guides in Quito, Ecuador, giving her a depth of insight into innovation in international business. With an MBA from the University of Hull and many years of experience running her own business consultancy, Paula’s background allows her to connect with a diverse range of clients, including cutting edge technology and web-based start-ups but also multinationals in need of assistance. Paula has played a defining role in shaping organizational strategy for a wide range of different organizations, including for-profit, NGOs and charities. Paula has also served on the Board of Directors for the South American Explorers Club in Quito, Ecuador.