With the advent of the so-called blockchain revolution, it is important to contextualise the permanent shifts and challenges that the Internet (and consequently the world) will be facing in a near future. Blockchain comes profoundly mixed with the Internet of Everything, and these novel technologies impact and shape new models of economics such as the circular economy and the future of finance.

In the third part of this series of articles, I will continue to reflect on how these technologies are impacting finance.

Why Financial Organisations Prefer Blockchain to Bitcoin?

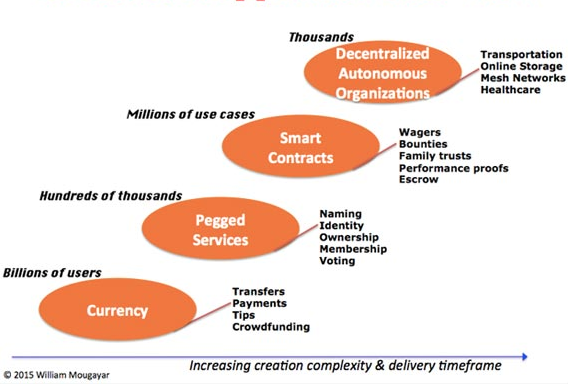

The purpose of Bitcoin was to revolutionize the exchange of value between users without the need for using intermediaries or public institutions to verify the validity of the transaction and without having to use legal tender. This is how bitcoin is used, as a unit of exchange. But in order to be able to send bitcoins, first you need to have bitcoins or exchange legal tender for bitcoins.

Due to the aforementioned process specific companies were created, specializing in facilitating currency exchange, which in many cases are the same ones that provide you with the wallet to store them. Not all these companies through, are fulfilling the legal requirements of customer knowledge and money laundering prevention. In some cases, they are not even entities subject to compliance with those requirements.

Banks and other financial institutions are strictly regulated to prevent those practices from happening, and may even be fined if any of those transactions is executed through the common citizen. The European Banking Authority published a series of warnings in this regard for users and financial institutions.

By enforcing convergence on common data standards and eliminating the need for a central authority to hold a “golden record,” we can reduce reconciliation and facilitate the seamless transfer of digital assets.

Bearing this in mind it is critical to ask why Blockchain is reflecting and driving a transition to a full-scale digital economy, that require lesser middlemen, both organisations and technologies, rather focusing on a bigger picture of direct reach.

The blockchain infrastructure is now approachable and more and more tangible. Its emergence and growth shows a clearing up of general and common myths and demonstrates that, as the world becomes increasingly tech globalised, this technology has, in fact, the potential to reshape / revolutionise the entire financial and investment markets and fundamentally the user identity and client experience.

Who Wins WiTh Blockchain and How to Manage the efforts Between Centralised and Decentralised?

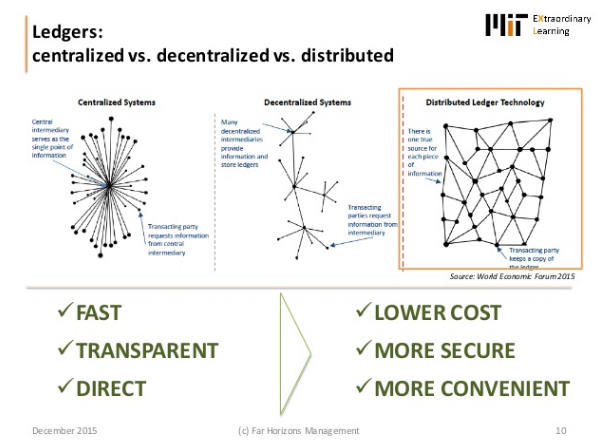

The big advantage of blockchain is that it’s public. Everyone participating can see the blocks and the transactions stored in them. This doesn’t mean everyone can see the actual content of your transaction, however; that’s protected by your private key. A blockchain is decentralized, so there is no single authority that can approve the transactions or set specific rules to have transactions accepted. That means there’s a huge amount of trust involved since all the participants in the network have to reach a consensus to accept transactions.

The obvious advantage of blockchain for financial and banking organisations / investors is that with Blockchain they can expect to have simpler transaction processes and receive their capital / cash in their own settlement accounts almost instantaneously, without the time-consuming hassle of moving through a large number of 3d parts, and this, simply after selling a parcel of shares. Of course, this implies that all works well.

Centralization has been a core organizing principle for the economy and society since the inception of the agricultural revolution. As the human population grew, people had to make decisions that benefited the general population, not just the individual, family, or clan.

Larger organisations tend towards vertical integration and centralised functions, to increase efficiencies and reduce costs. Economic centralization is the most effective organizing principle when communication and transaction costs are high. But this centralization is changing and will have profound implications for

But this centralization is changing with profound implications for human organizations. The Internet brought communication costs down and enable the emergence of more peer to peer processes within a global reach. Blockchain will do the same for transaction costs.

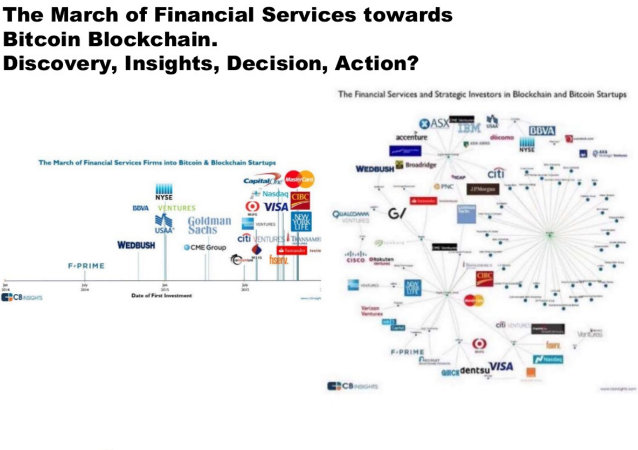

With Blockchain, banks and financial organisations can control their financial destiny, manage a direct approach with their users / clients and process all their operations in a swift way that saves them billion of USD, as it compacts their structures and processes of accessing their own data and records.

The potential for competition amongst post-trade processors globally, could also lower brokerage fees and make overseas markets more accessible to retail investors. The trend towards international exchange merging could also accelerate with the ASX, a takeover candidate and Europe’s largest exchanges in the UK and Germany potentially merging in a blockbuster deal.

However, the real winners from blockchain would be the investment banks if they are able to slash costs by seeing their cash market settlement fees reduced as 30-year-old trade processing methods at clearing houses are consigned to the history books.

How Blockchain simplifies costly and time operational errors for the trading arms of investment banks.

Blockchain could also simplify costly and time-consuming operational errors for the trading arms of investment banks, with real-time clearing even having potential to help eliminate failed trades. If blockchain really could achieve this, banks are likely to be sitting on a huge winner.

Most importantly, it’s a solid and safe alternative in a time of various cyber security challenges. The ledger database can only be extended and previous records cannot be changed (at least, there’s a very high cost if someone wants to alter previous records and would leave a track record of any operation).

Clearing houses may also currently wear of the risk of default by a clearing participant (protecting investors as well) and have supervisory rights to demand costly intraday margining, end-of-day exposure monitoring and capital adequacy requirements on market participants such as brokers. Instant settlement times could lessen some of these monitoring obligations as counterparty exposures disappear with real-time settlement.

No surprise then that the investment banks are wildly enthusiastic about the cost-decimating potential of blockchain in managing their multiple compliance, counterparty, margining, and operational risks when processing trades.

Blockchain The Evolution of the Internet, IoT and Circular Economy part 1

Blockchain The Evolution of the Internet, IoT and Circular Economy part 2

Dinis Guarda is an author, academic, influencer, serial entrepreneur, and leader in 4IR, AI, Fintech, digital transformation, and Blockchain. Dinis has created various companies such as Ztudium tech platform; founder of global digital platform directory openbusinesscouncil.org; digital transformation platform to empower, guide and index cities citiesabc.com and fashion technology platform fashionabc.org. He is also the publisher of intelligenthq.com, hedgethink.com and tradersdna.com. He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays, and governments all over the world.

With over two decades of experience in international business, C-level positions, and digital transformation, Dinis has worked with new tech, cryptocurrencies, driven ICOs, regulation, compliance, and legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

He creates and helps build ventures focused on global growth, 360 digital strategies, sustainable innovation, Blockchain, Fintech, AI and new emerging business models such as ICOs / tokenomics.

Dinis is the founder/CEO of ztudium that manages blocksdna / lifesdna. These products and platforms offer multiple AI P2P, fintech, blockchain, search engine and PaaS solutions in consumer wellness healthcare and life style with a global team of experts and universities.

He is the founder of coinsdna a new swiss regulated, Swiss based, institutional grade token and cryptocurrencies blockchain exchange. He is founder of DragonBloc a blockchain, AI, Fintech fund and co-founder of Freedomee project.

Dinis is the author of various books. He has published different books such “4IR AI Blockchain Fintech IoT Reinventing a Nation”, “How Businesses and Governments can Prosper with Fintech, Blockchain and AI?”, also the bigger case study and book (400 pages) “Blockchain, AI and Crypto Economics – The Next Tsunami?” last the “Tokenomics and ICOs – How to be good at the new digital world of finance / Crypto” was launched in 2018.

Some of the companies Dinis created or has been involved have reached over 1 USD billions in valuation. Dinis has advised and was responsible for some top financial organisations, 100 cryptocurrencies worldwide and Fortune 500 companies.

Dinis is involved as a strategist, board member and advisor with the payments, lifestyle, blockchain reward community app Glance technologies, for whom he built the blockchain messaging / payment / loyalty software Blockimpact, the seminal Hyperloop Transportations project, Kora, and blockchain cybersecurity Privus.

He is listed in various global fintech, blockchain, AI, social media industry top lists as an influencer in position top 10/20 within 100 rankings: such as Top People In Blockchain | Cointelegraph https://top.cointelegraph.com/ and https://cryptoweekly.co/100/ .

Between 2014 and 2015 he was involved in creating a fabbanking.com a digital bank between Asia and Africa as Chief Commercial Officer and Marketing Officer responsible for all legal, tech and business development. Between 2009 and 2010 he was the founder of one of the world first fintech, social trading platforms tradingfloor.com for Saxo Bank.

He is a shareholder of the fintech social money transfer app Moneymailme and math edutech gamification children’s app Gozoa.

He has been a lecturer at Copenhagen Business School, Groupe INSEEC/Monaco University and other leading world universities.