Social Finance is a UK organisation which is a non-profit that works with the government, the financial community and the social sector through partnerships to develop improved approaches to dealing with social problems both in the UK and further afield.

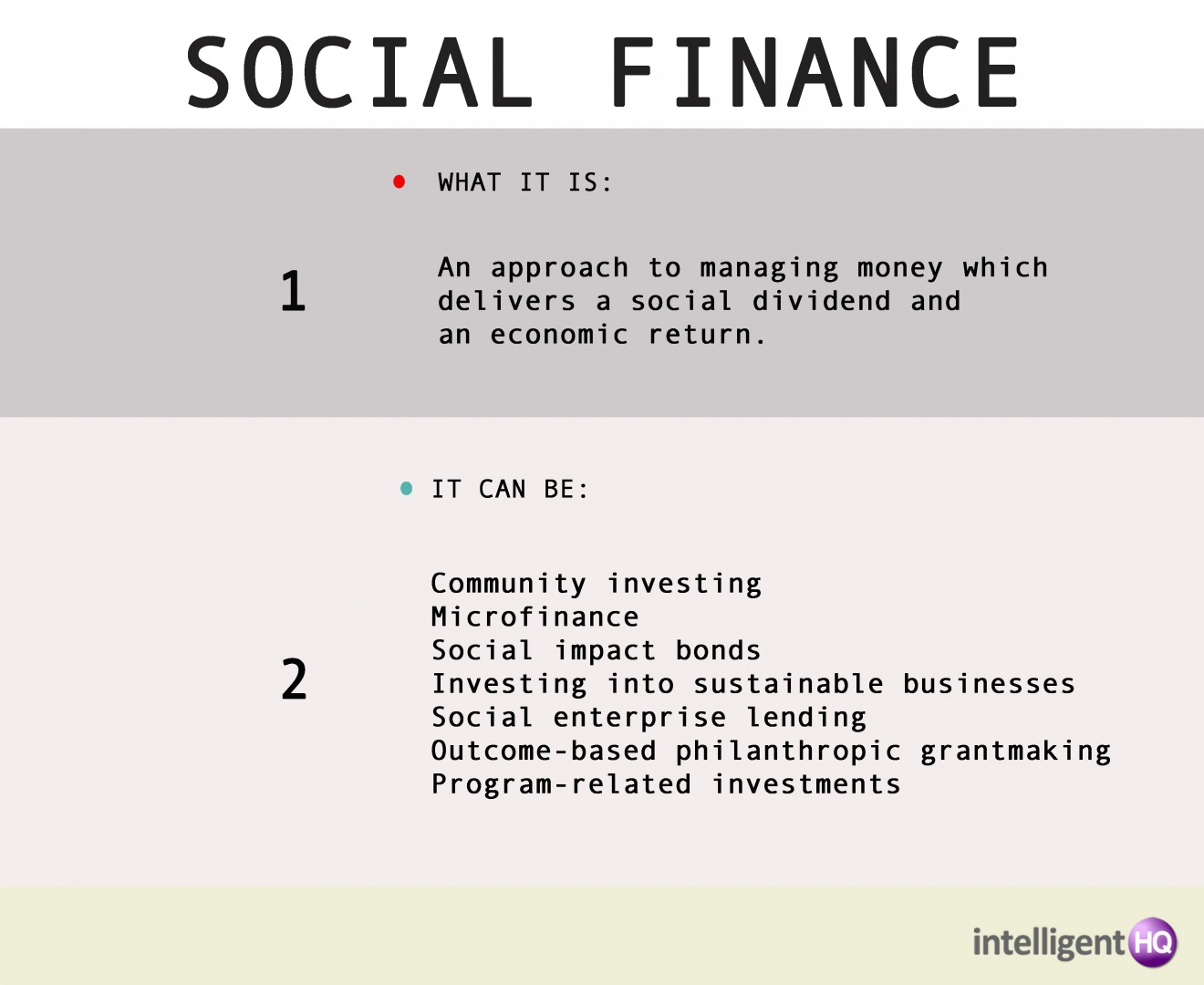

What is social finance ? Social finance, is an approach to managing money which delivers a social dividend and an economic return. The term includes community investing, microfinance, social impact bonds, investing into sustainable businesses, and social enterprise lending. Outcome-based philanthropic grantmaking and program-related investments, sometimes referred to as venture philanthropy, can be also seen as a form of social finance.

Social Finance UK started in 2007. Since then, the organisation mobilised more than £75 million of social investment being behind the first Social Impact Bond. It has also developed and implemented a range of programmes that help with addressing difficult social challenges. This has included providing help to prison offenders, those who are not in education or employment or training (NEETs), rough sleepers and those in poverty. The organisation has also provided thousands of micro loans in Wales at an affordable rate, and helped 15,000 families to gain access to nursery places and children’s services for free.

The organisation had in the beginning the remit to explore and understand shortfalls that the social sector experiences in funding. The initial work drew together people from different sectors such as the government, the finance sector and the social sector to look at opportunities that community organisations and voluntary entities have to provide services for people that are vulnerable and disadvantaged. This led the organisation to gain a deeper understanding of the problems faced, specifically that it was not just a matter of not enough money for these organisations. One of the areas of conflict uncovered was the fact that people that pay for social services are not the same people that use them. This creates problems that can lead to ineffective operating for such services.

As a result of what Social Finance uncovered it started to create a range of financial and advisory services and also products designed for use by social sector organisations. These included structures to help with longer term funding and providing flexibility as well as approaches to drive innovation.

The organisation was responsible for helping to get the Social Investment Bank off the ground, as well as pioneering Social Impact Bonds, Development Impact Bonds, Jam Jar Accounts and a fund known as the Care and Wellbeing Fund. The approach taken to enable the organisation to have achieved so much in such a short time has been to carry out detailed analysis to understand problems in depth from both a finance and social perspective.

In terms of impact, the benefits that Social Finance has brought to society have been considerable. With regard to young people in particular, the organisation has looked at how social investment can provide funding for services to make sure that vulnerable children are identified and supported earlier. This has been where Social Impact Bonds have been beneficial to support children in care, teenagers who are thought to be at risk, and complex families. The housing sector is another area where Social Finance has added value. Housing is considered to be vital because once people are housed it is possible to help them to deal with other social issues faced. On this matter Social Finance works to help increase the accommodation that is available by liaising with local authorities, housing associations and other providers. The rehabilitation of criminals has been another area of focus. A problem was identified in that 60% of short sentence prisoners re-offend within a period of one year after release. Working on better rehabilitation can address that. Projects have been run in Peterborough and London to help with rehabilitation and crime-based social problems. Unemployment is a very significant social problem, and Social Finance has been working with adults that are vulnerable, and in particular disabled people or those with long term health problems to help them to find solutions for employment in the future.

All of these different kinds of projects help to create change in society, for the better. In fact the organisation states that its mission is to:

“… develop and build funding models to tackle entrenched social problems and bring rigour and capital to the delivery of social change.”

It can only be hoped that Social Finance succeeds with its goals and continues to change lives for the better by addressing complex social problems with energy and vigour. The results that have been seen so far are an indicator of what might also be achieved in the future by this enterprising organisation.

Paula Newton is a business writer, editor and management consultant with extensive experience writing and consulting for both start-ups and long established companies. She has ten years management and leadership experience gained at BSkyB in London and Viva Travel Guides in Quito, Ecuador, giving her a depth of insight into innovation in international business. With an MBA from the University of Hull and many years of experience running her own business consultancy, Paula’s background allows her to connect with a diverse range of clients, including cutting edge technology and web-based start-ups but also multinationals in need of assistance. Paula has played a defining role in shaping organizational strategy for a wide range of different organizations, including for-profit, NGOs and charities. Paula has also served on the Board of Directors for the South American Explorers Club in Quito, Ecuador.