As an investor, your values and beliefs are important as a guiding principle on where to invest your money. Ethical funds are sometimes called ‘socially responsible investments’ used in place of ‘green’ or ‘ethical’, just different words for the same thing.

Ayn Rand, author of Atlas Shrugged, defender of capitalism would argue that capitalism rules, no matter what. However, not all investors wish to invest in profits gained unethically. Although, one has to remember that this is an investment, it is important that a positive return is made for the risk taken. Ethical investments are very well represented in the top quartile of performance tables.

Lisa Stonestreet, Programme Director at UKSIF (UK Sustainable Investment and Finance Association) says “Traditionally, investing ethically meant avoiding investing in companies involved in tobacco, defense, alcohol or weapons. Socially responsible investing has come a long way in recent years. It now includes investments in companies that are successfully helping to solve environmental and social problems – water conservation, living wage issues and sustainable supply chain policies”.

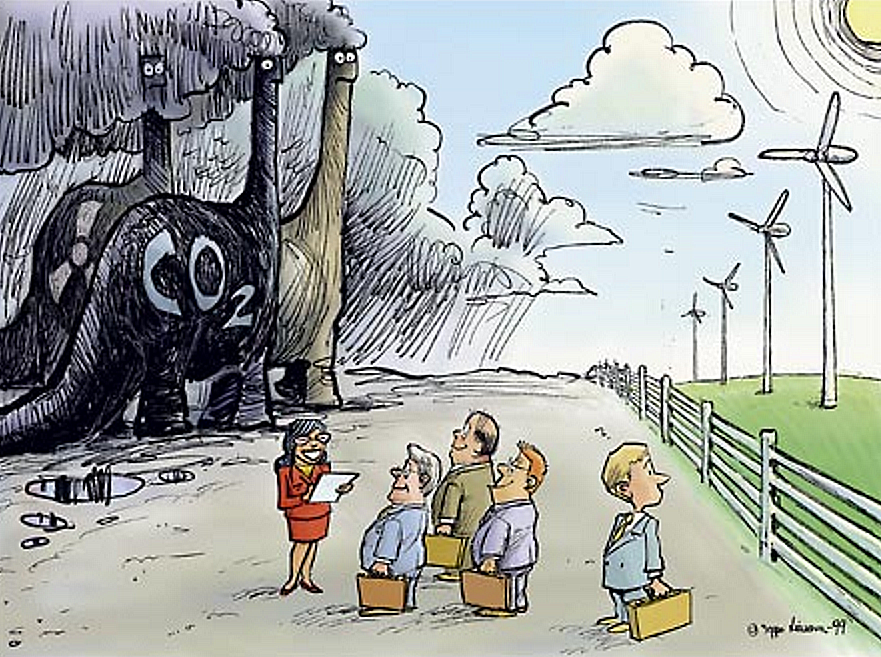

One of the biggest myths about investing in ethical funds is that they under perform; linked to this is the fact that people may have a narrow definition of ethical funds. Whilst in the past, it has been mainly about “negatively screened funds” i.e avoiding tobacco companies, investing ethically now addresses broader issues – proactively finding solutions to modern problems such as aging populations, climate change or resource scarcity. So, a water fund may not necessarily be marketed as an ethical fund but it has strong sustainability criteria embedded.

With the strength of social media, companies are having to react to the force of public opinion. Western clothing retailers faced tough questions over the link between cheap fashion and worker safety in the aftermath of the Rana Plaza disaster, which killed a large number of factory workers in Bangladesh. A business may have up to 1,000 suppliers – the businesses reputation also depends on the practices of its suppliers – its supply chain.

If more investors collectively requested better business practices, management teams would naturally shift their focus. When customers and shareholders align, powerful changes can happen. Businesses stand to benefit greatly too; some of the benefits for businesses to run in an ethical manner are public acceptance, customer loyalty, investor confidence and avoiding damaging lawsuits. Recently, I followed with great interest a blogger called Foodbabe that corralled shoppers away from spending money on sandwiches at Subway unless they removed a plastic chemical used in their bread.

So, how does one work out ethical priorities? It is important to work out what you feel most passionately about. What experiences do you hold important in defining how you would like to invest? It could be that you lost a family member to excessive cigarette smoking. Or it could be the issues of children’s rights or child education is important – perhaps you would not like to invest in a company that is careless about its supply chain and uses children to work in sweat shops. Or it could be that you feel strongly about the environment and recycling. Or pornography. An IFA would typically hand out an ethical questionnaire to help you with this process where you could add positive criteria that you want as well as negative criteria that you do not want.

It is worth noting that the stricter the ethical criteria, the more exclusions and the more volatile the portfolio could also be.

The Ethical Investment Association (EIA) is an association of financial advisers from around the UK( of which I am a member too) dedicated to the promotion of green and ethical investment. If you need financial advice on investing ethically, you could find an IFA near you by visiting their site.

If you are looking for a London Financial Adviser to assist with investing in ethical funds, please feel free to get in touch.

Cleona Lira has been working to help people with their financial goals since 2001. She writes a personal finance focussed blog at www.cleonalira.co.uk . She also runs workshops in London focused on having a conscious relationship with money- creating space to talk about core beliefs around money and connecting one’s own deeper value and sense of financial integrity to spending and investing money.

In addition to her extensive professional experience, her educational background includes a Bachelor’s degree in psychology and a Master’s degree in Business Administration. She works as an Independent financial advisor and is a chartered financial planner.

When she is not working, she enjoys spending time with her amazing husband, friends, long walks along the river and gardening. She can also talk non stop about non violent communication. Don’t try her on that last one. Follow Cleona on twitter @CLILE