As we step into the era of AI and machine learning, the question for banks really, is this:

How ready are we as banks to adopt AI and applied technologies for the various relevant use cases in our business and organization?

Let me try and draw a parallel and take you a few years back in time. Stay with me.

About half a decade ago, if any one spoke of Cloud as a technology in the banking context and scenario, most bankers would typically cringe and say, “Do they even understand banking as an industry, the restrictions and the risks? Cloud cannot be a reality in the world of banking, especially with respect to business-critical systems.”

This belief now sounds more archaic than it is. In just a period of 5 years, banks not only seem to have got past their stern reluctance but also the initial apprehensions surrounding cloud adoption. In fact, many progressive banks today prefer cloud core banking solutions. Westpac in the US is moving all its core banking applications to a cloud environment. Down under, Australian bank NAB is also in talks with leading cloud service providers to migrate its core to the cloud. With more and more challenger banks crowding the banking landscape, and most of them using cloud-native applications, banks are going beyond peripheral applications and demonstrating the willingness to migrate even mission-critical applications to the cloud. One of the reasons is also the accelerating adoption of modern technologies such as AI and machine learning, for which cloud is the underlying enabler.

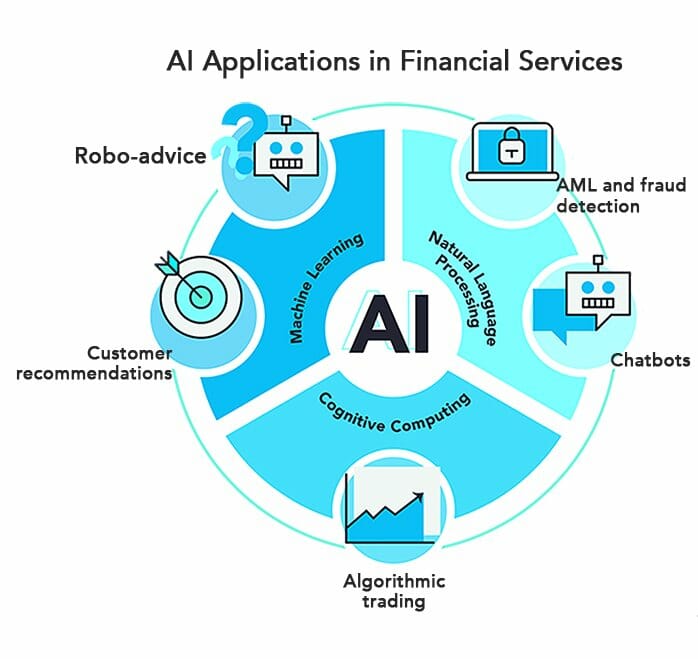

So let’s look at the adoption of AI in banking. Where are we?

The big tier 1 banks have been on this journey for a while now. They understand that data is the new oil in the digital age. And by ‘for a while’ I mean more than a decade! But the success of these tier 1 banks has been limited at best, and has been rather erratic and sporadic. Most banks have adopted a piece meal approach to AI. Due to the complexity of their systems, their data assets exist in disparate silos and data structures are extremely inconsistent and fragmented. Making sense of such data, that too huge volumes of it, in real-time, is a huge challenge even with the use of the latest data technologies. Secondly, their data is not very clean, especially the legacy data. And hence, even though they sit on huge heaps of data stacks, gleaning insights is extremely challenging. On the other hand, the challenger banks, many of which have started afresh, are not faced with the challenge of legacy IT and processes. Their fundamental design, architecture, and core are built around data, AI, and adaptability of new emerging technologies. Data-driven insights can make for extremely contextual customer experience, and also enable financial services providers and enterprises at large, make personalized recommendations to their customers. Not surprisingly, the new challenger banks and digital upstarts are showing the incumbents how it is done.

Although I’ve started the conversation in this blog post with AI, the fact is that the challenge before banks is not the adoption of AI when it is continuously evolving. Banks and financial service providers understand that AI will evolve further in the times to come. The movers and shakers are a bank’s data assets (or in the open world, an ecosystem’s data assets) – gleaning customer-insights from meaningful data, cleaning data, ensuring data integrity and most of all finding and retaining talent that understands what real data is, talent that can architect the right workflows for insights-driven and ecosystem-led banking, and talent that can design the underlying processes for maximum efficacy. Let me illustrate this with an example. In our engagements with a progressive bank, the bank candidly shared that they had gone ahead with an AI implementation some time back. They were looking to enhance customer experience, and expected customer-related metrics to notch up as a result of the implementation. However, to their shock and dismay, not only did the overall customer satisfaction index remain stagnant at pre-implementation levels, but customer complaints also shot up visibly. An investigation revealed this, among other reasons: one of the smaller business requirements as part of the implementation was “to send wishes to customers on their birthdays and other milestones and life stages”. After the new implementation, several customers were disappointed that their bank did not have the right data about them. In some cases, customers reported receiving happy and best wishes on sad occasions, and found it to be callous on the bank’s part.

Further investigation into the birth dates of the bank’s customers revealed that 1.1.1990 happened to be the birth date of an unreasonably large number of the bank’s customers. It turned out that during an earlier system migration when DoB became mandatory, the bank had decided to populate “1.1.1990” as the birthdate. Now, if the bank wanted to use AI for anything to do with age, it would be nothing but a failure as the bank’s data about age was not validated. To tell it like it is, the data was all wrong! Correcting legacy data is a tedious and painful exercise, and takes considerable effort. It includes multiple person-hours of contacting all the customers and feeding the right data into the systems, even if a bank automates part of the process.

So in my view, based on my interaction with banks, I conclude that there’s still some time before banks can make truly meaningful use of AI pervasively. Definitely some use cases like NLP, conversational banking have found application in various banks and in being used in pockets, but using it all across banking processes is not likely to be a reality very soon. The hindrance however, is not AI models, but understanding the legacy data.

Let me know your thoughts in the comments section.

This is an article provided by our partners network. It might not necessarily reflect the views or opinions of our editorial team and management.

Contributed content

Founder Dinis Guarda

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news and distribution to create an unparalleled, full digital medium and social business network spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems.